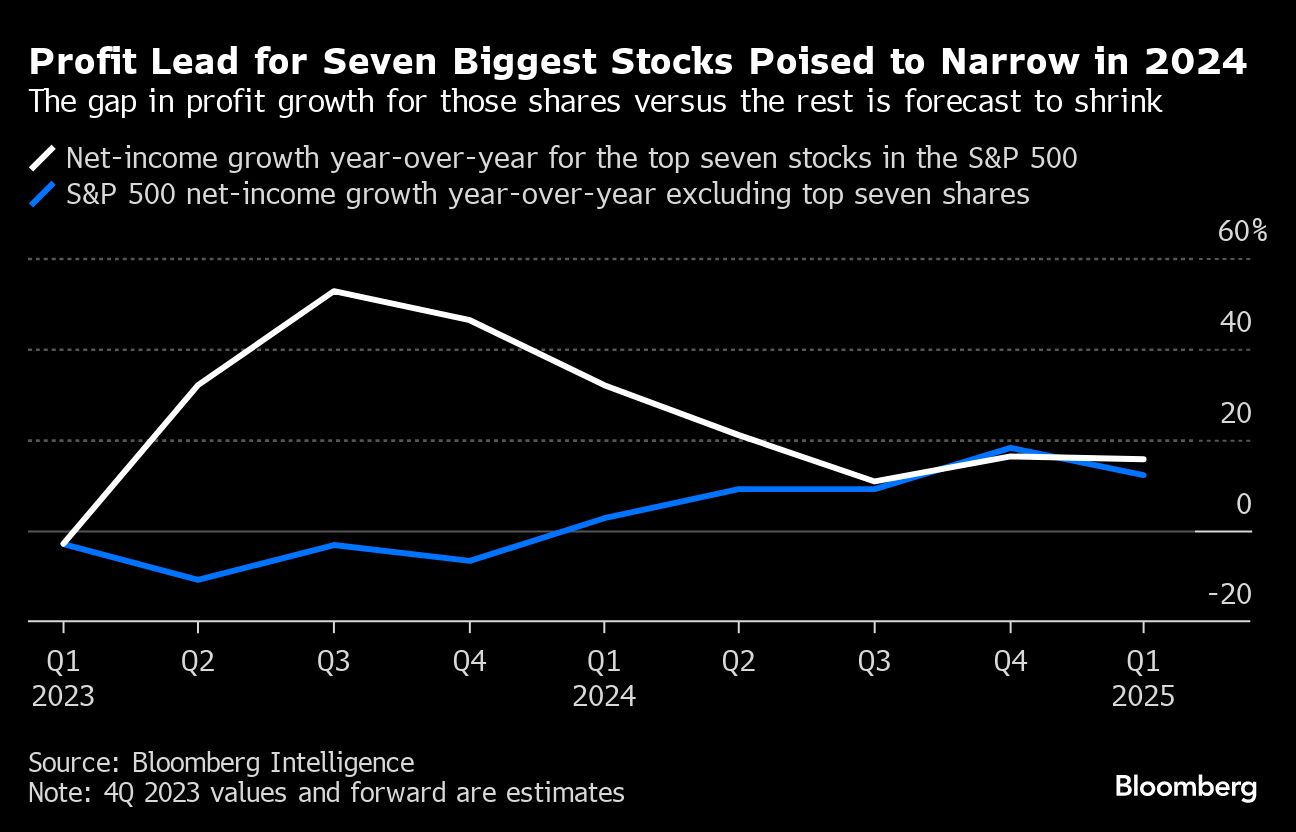

The bottom line is how a lot of that’s already baked into share costs, particularly with expectations for a comfortable touchdown constructing.

As Louis Navellier of Navellier & Associates sees it, six of the seven shares are trying good heading into 2024. Solely Apple might be sitting on the sidelines absent a cutting-edge product — or know-how — to spice up its bottom-line, he wrote in a report.

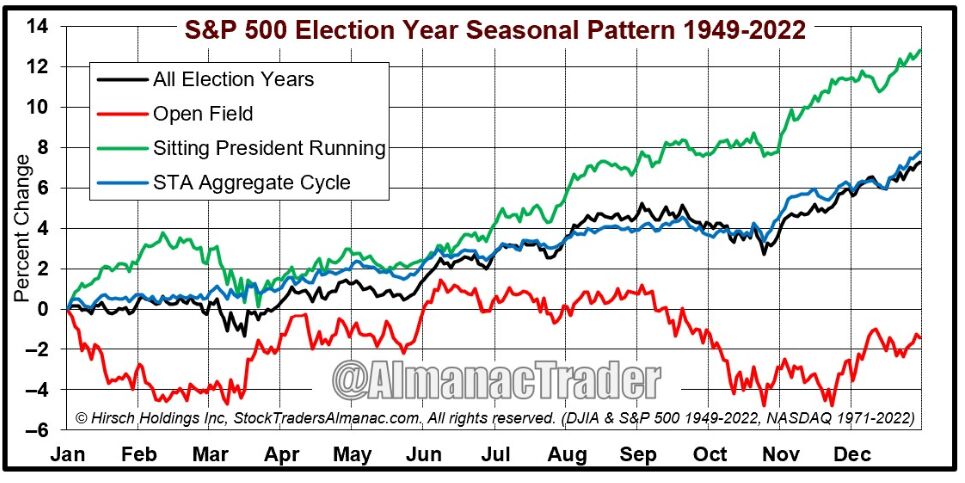

3. Presidential Vote

An election yr with a sitting president working is traditionally a bullish state of affairs for US shares. Since 1949, the S&P 500 is averaging a acquire of practically 13% in these election years, per the Inventory Dealer’s Almanac. When there’s an open discipline with out an incumbent president, the index averages a 1.5% loss for the yr.

Supply: The Inventory Dealer’s Almanac

Supply: The Inventory Dealer’s AlmanacA part of the explanation for fairness positive aspects is incumbents usually implement new insurance policies or push for decrease taxes to spice up the financial system and sentiment forward of the vote.

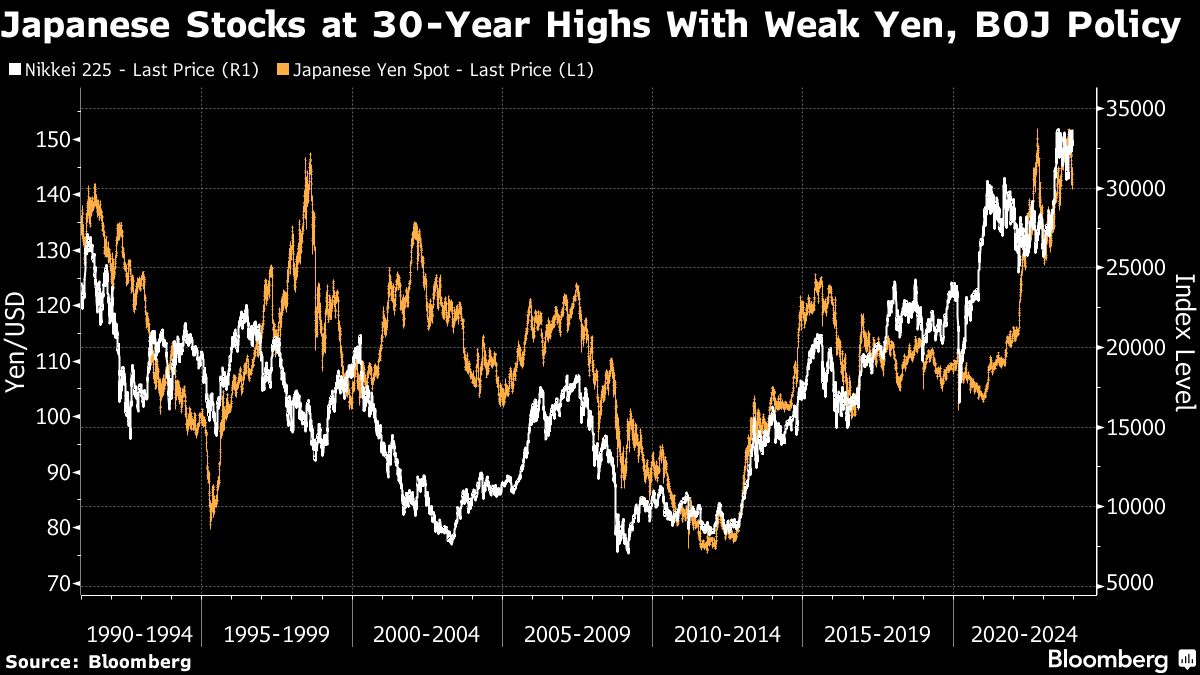

4. Asia Danger: BoJ, China and India Elections

Whereas the Nikkei 225 Inventory Common climbed to a three-decade excessive in 2023 on the again of the Financial institution of Japan’s ultra-loose coverage and a weak yen, Japanese shares face a hurdle in early 2024. The central financial institution is sustaining the world’s final adverse price, however two-thirds of economists forecast it would ship its first price hike since 2007 by April.

In the meantime, after one other disappointing yr for China bulls, buyers will watch conferences of the Nationwide Individuals’s Congress and the third plenum for Beijing’s progress goal in 2024 and clues on fiscal stimulus.

India is an enormous bullish vibrant spot, because the nation luggage high-profile manufacturing contracts, ramps up infrastructure spending and emerges as a substitute for China.

5. ECB, BOE Coverage

With the Stoxx Europe 600 Index close to its highest degree in two years, cyclical shares which might be closely uncovered to Asia could maintain the important thing to additional positive aspects given China’s potential fiscal enhance.

Whereas a comfortable financial system will probably weigh on European earnings, analysts’ consensus estimates are for roughly 4% revenue progress in 2024, largely counting on rising margins, BI knowledge present.

Bond markets count on the European Central Financial institution to chop charges by April, which might present a further enhance to the area’s shares.

The Financial institution of England is anticipated to path each the Fed and ECB in easing because the UK has one of many highest inflation charges amongst Group of Seven nations.