2. Elevating Expectations

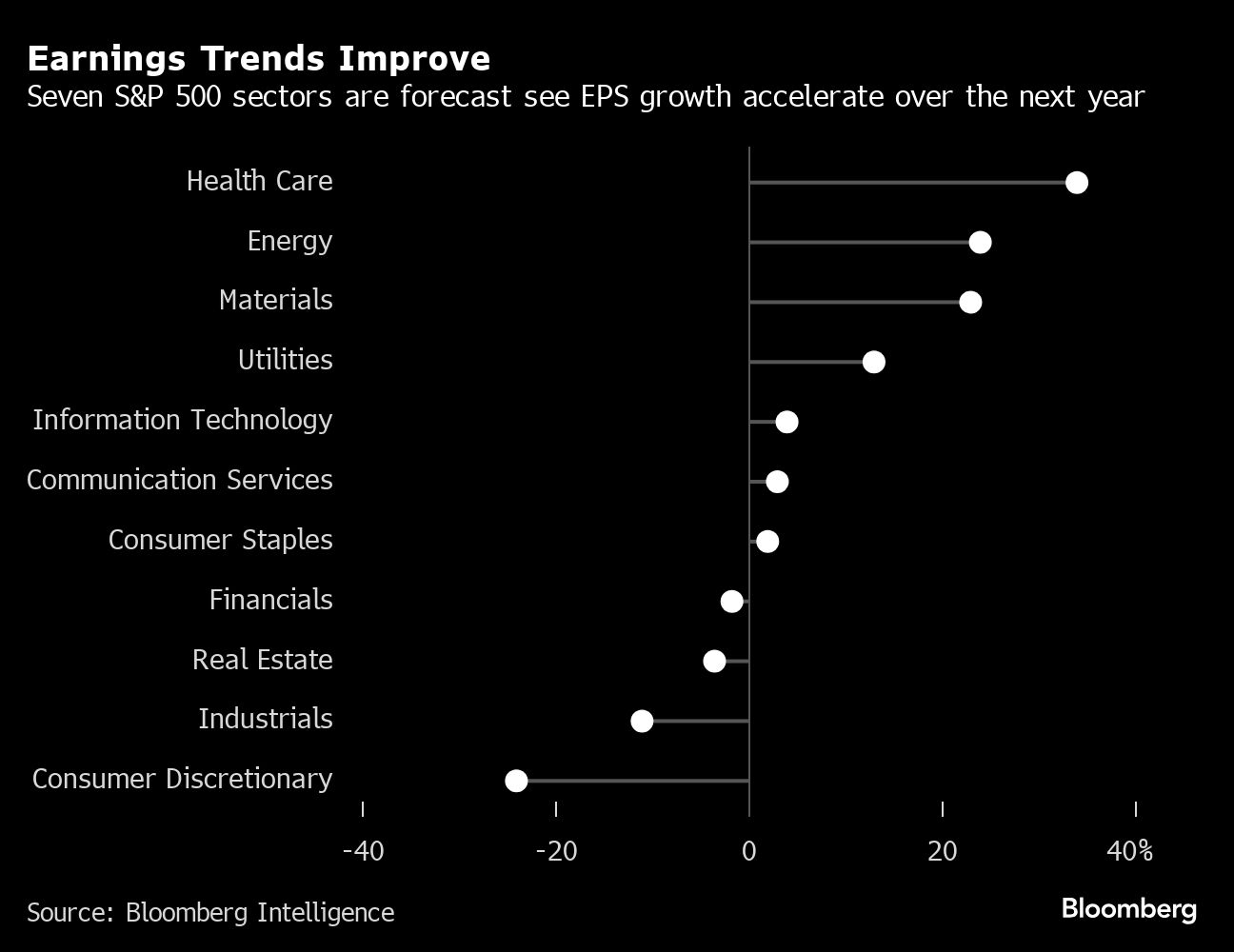

Analysts have been elevating their earnings forecasts sooner than they’re marking them down for beforehand unloved teams, from well being care to utilities.

The truth is, seven of 11 sectors within the S&P 500 are poised to see revenue development speed up over the subsequent 12 months. Utilities, financials and well being care are the lead sectors when ranked by Twenty fifth-percentile earnings revisions, with power, supplies and communication providers on the backside, BI information present.

3. Money Hordes

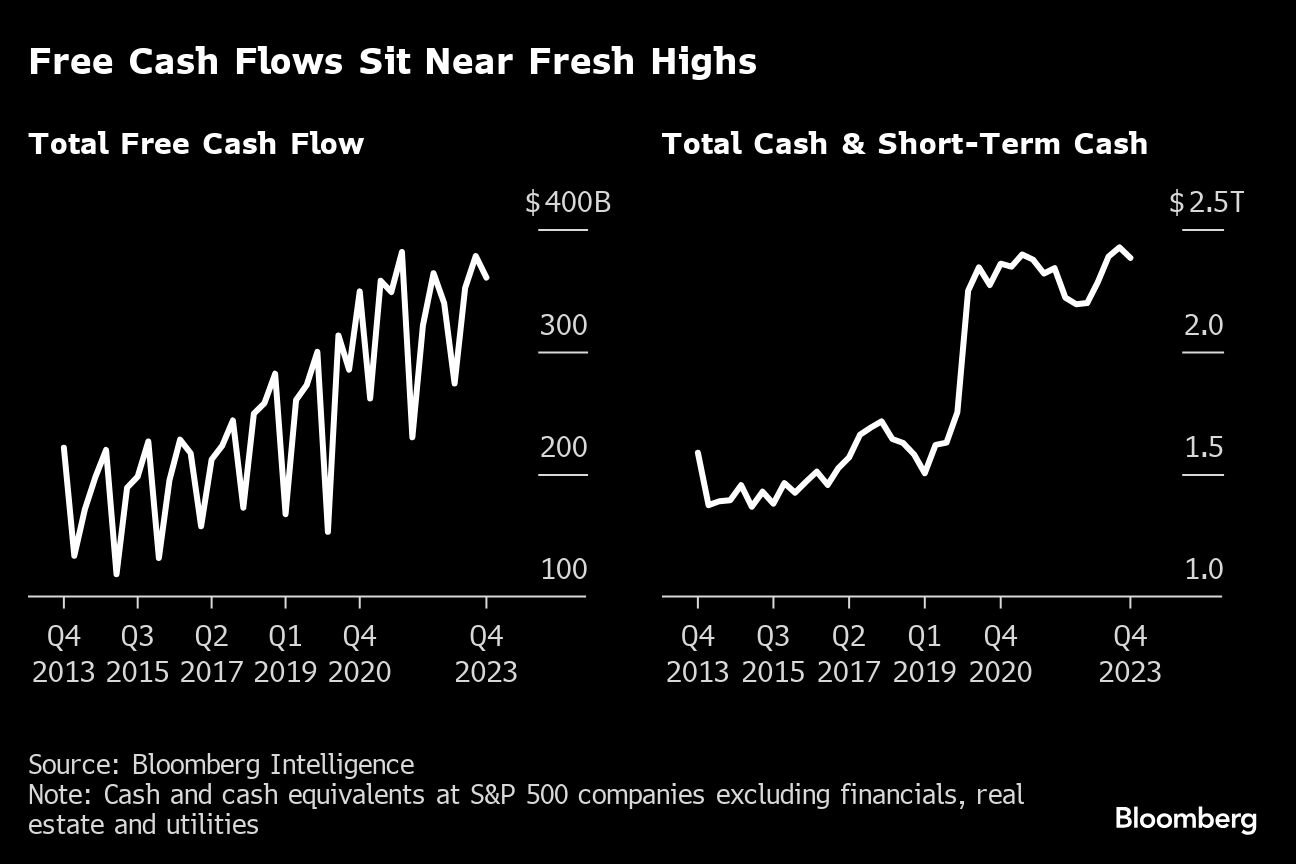

Company money and free money circulation are at report excessive ranges, setting the stage for a restoration in how the most important U.S. firms deploy their capital, whether or not via payouts to stockholders or investing in increasing their companies.

Shareholder payouts rebounded within the fourth quarter for S&P 500 firms, and buybacks revived after 4 consecutive quarters of declines, BI information present.

A rise in capital expenditures will rely upon a rebound exterior the heavy-spending expertise sector, BI’s Soong mentioned.

4. Margins Bettering

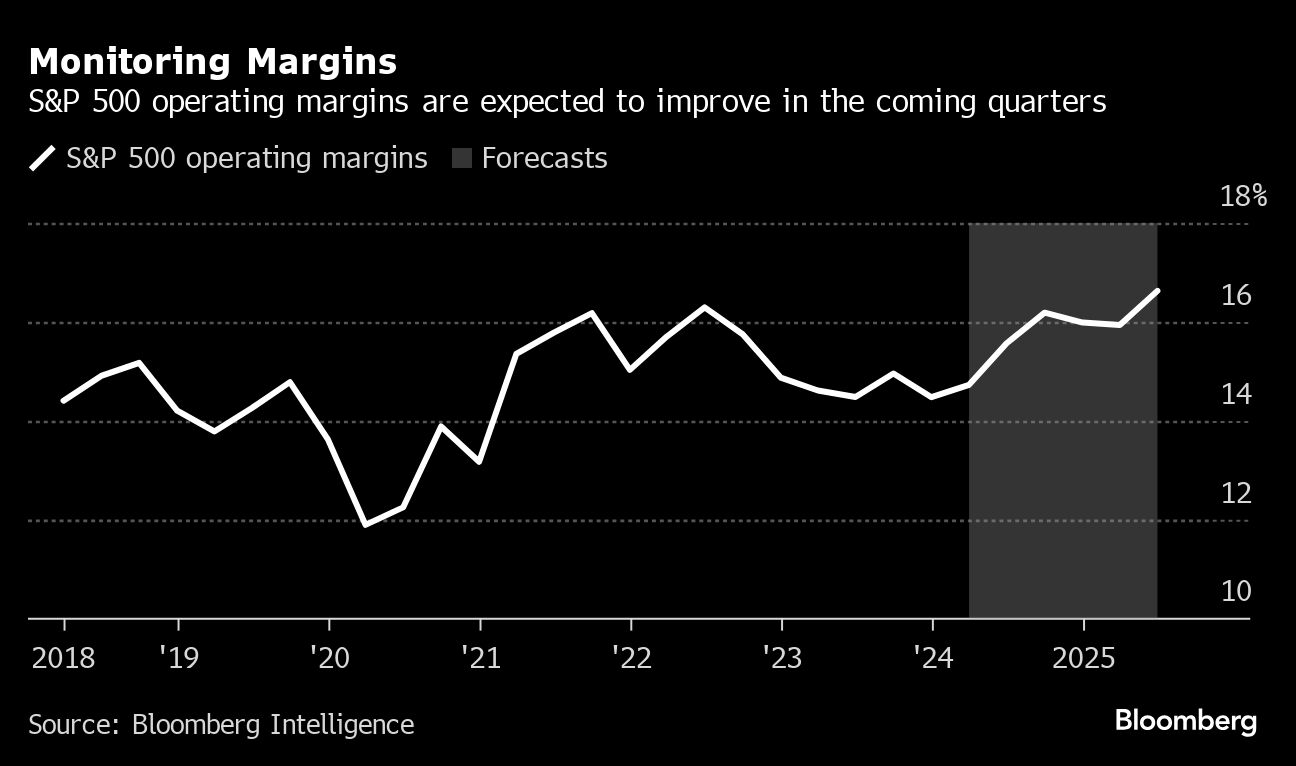

Merchants will probably be maintaining an in depth eye on working margins, a key gauge of profitability that traditionally affords a sign on the place an organization’s inventory worth is headed.

The hole between rising shopper and producer costs has narrowed considerably over the previous 12 months due to company cost-cutting that drove earnings greater, in addition to an sudden synthetic intelligence increase.

Analysts now see working margins for the primary quarter at 15%, with the worst of the ache within the rear-view mirror as forecasts enhance within the coming quarters, information compiled by BI present.

5. Sector Choosing

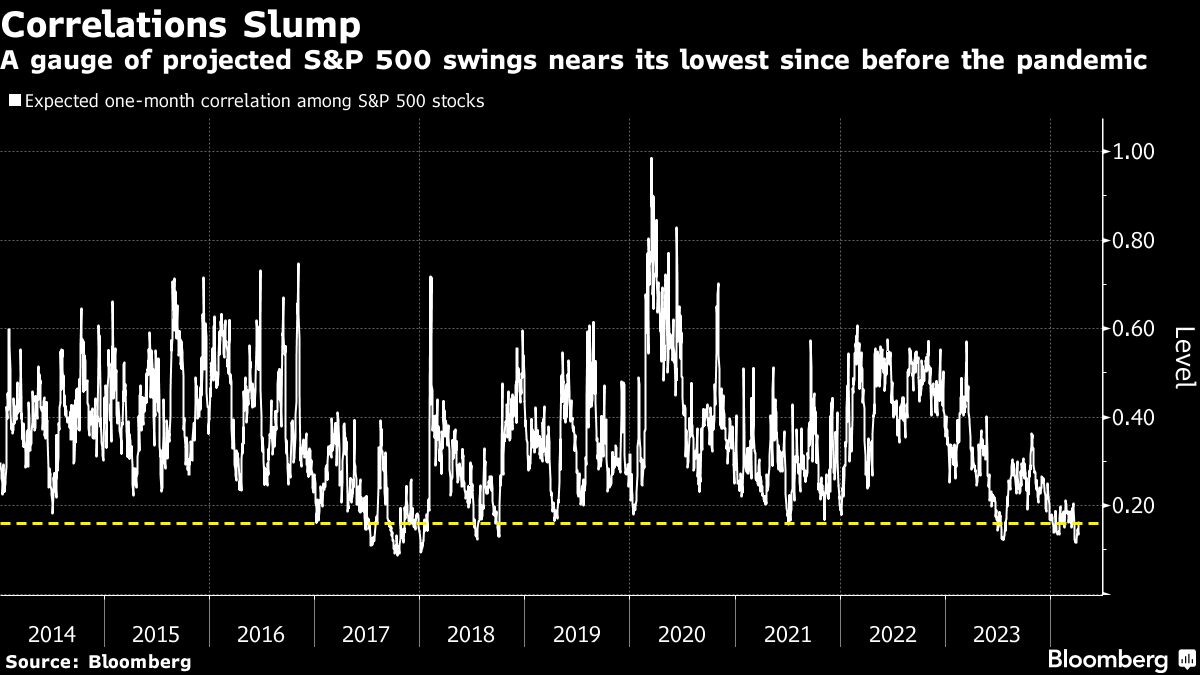

Merchants aren’t anticipating share costs to maneuver in unison this earnings season. Differing inflation outlooks for S&P 500 sectors has left a gauge of anticipated one-month correlation within the index’s shares hovering close to its lowest since 2018, Bloomberg information present. A studying of 1 means securities will transfer in lockstep, it’s at the moment at 0.16.

This comes as three of the 11 teams — communication providers, expertise and utilities — are anticipated to put up revenue expansions of greater than 20%, whereas power, supplies and health-care firms will seemingly see earnings shrinking.

Opposite to fashionable perception, average inflation traditionally has been good for earnings broadly as a result of it promotes development, lending and borrowing, in response to Dan Eye, chief funding officer at Fort Pitt Capital Group.

“Earnings are in nominal phrases, so having a little bit inflation within the system isn’t a nasty factor for company earnings,” Eye mentioned. “The inventory market clearly sniffed that out within the first quarter, given the massive rally.”

(Credit score: Adobe Inventory)