Flock has entered a partnership with NIG, which is able to enable them to focus on bigger fleets extra successfully. In the meantime, GlobalData surveying signifies that amongst bigger fleets, enhanced security measures rank as probably the most essential side of usage-based insurance coverage (UBI) insurance policies.

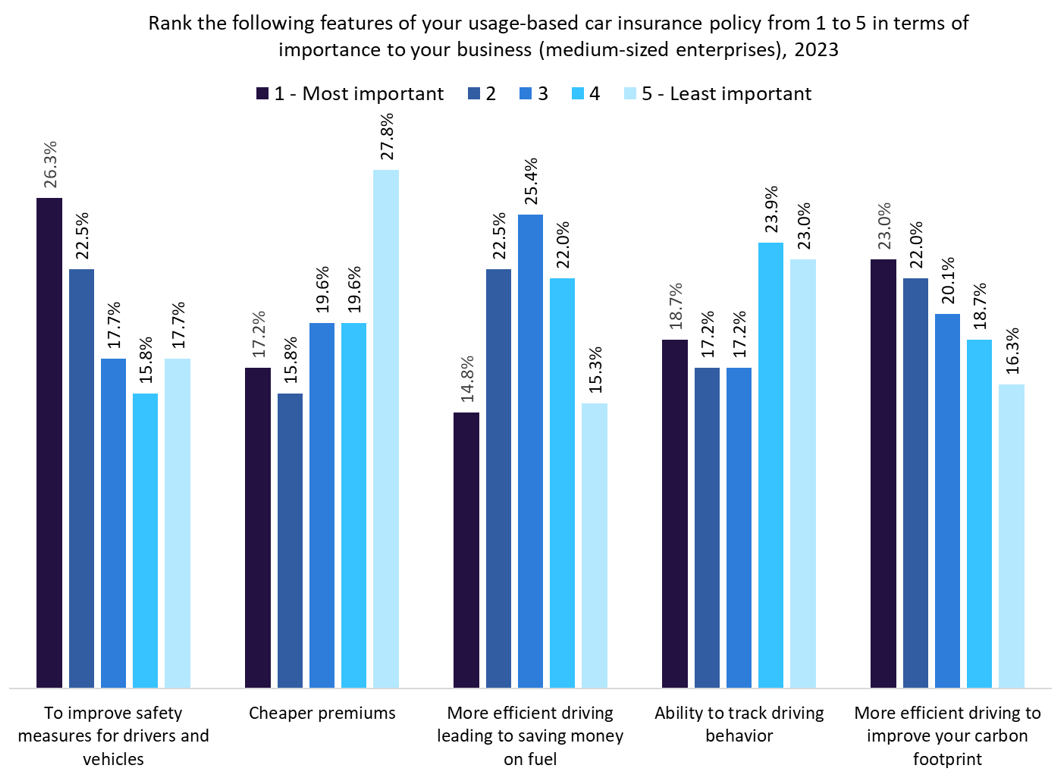

In line with GlobalData’s 2023 UK SME Insurance coverage Survey, 26.3% of medium-sized enterprises (with 50–249 staff) prioritise enhanced security measures as the important thing function of a UBI coverage. Compared, this desire is shared by 24.1% of small-sized enterprises, 9.5% of micro-enterprises, and 10.5% of sole merchants. Notably, medium-sized corporations place a better worth on improved security options than on decrease premiums, with 17.2% rating cheaper premiums as their most necessary function. In distinction, 57.9% of sole merchants, 30.2% of micro-businesses, and 18.8% of small corporations contemplate cheaper premiums as a very powerful side of a UBI coverage. Furthermore, 27.8% of medium-sized enterprises rank cheaper premiums because the least necessary function of a UBI coverage.

Financial pressures are inclined to amplify the significance of cost-related concerns, resembling searching for cheaper insurance coverage choices. Nonetheless, GlobalData’s survey outcomes point out a shift in priorities, showcasing a heightened emphasis on security for medium-sized companies. This variation may very well be attributed to the rising recognition amongst bigger SMEs of the broader dangers and uncertainties related to their operations. The fee-of-living disaster, marked by inflationary pressures and financial challenges, might have prompted SMEs to re-evaluate their danger administration methods.

On this context, prioritising improved security measures displays a proactive stance in direction of mitigating potential dangers and disruptions, even on the expense of decrease premiums. Furthermore, GlobalData’s 2023 UK SME Insurance coverage Survey discovered that medium-sized enterprises worth danger administration providers greater than their smaller counterparts when switching suppliers. 13.1% of medium corporations acknowledged that the primary purpose they switched was due to the brand new supplier’s added danger administration providers. This compares with 11.1% of small enterprises, 5.1% of micro-enterprises, and three.8% of sole merchants.

In opposition to this backdrop, the Flock-NIG partnership’s deal with driver security ought to discover a receptive target market. Flock specialises in utilising superior applied sciences and information analytics in motor fleet insurance coverage. By way of its platform, Flock leverages real-time information and synthetic intelligence-driven algorithms to assemble insights from linked units, resembling telematics techniques. This information permits Flock to supply personalised danger assessments for motor fleets, tailoring insurance coverage protection based mostly on components resembling driving habits, mileage, and highway circumstances. Flock has fashioned a partnership with NIG to focus on bigger fleets within the industrial motor insurance coverage market. The collaboration entails a digital, data-driven method to motor fleet insurance coverage, providing a totally digital insurance coverage administration portal, rebates for safer driving, and security and claims workshops. Flock will leverage NIG’s capability to supply real-time security insights and interventions for fleet managers. The partnership goals to deliver a contemporary, data-driven perspective to the motor fleet market, significantly specializing in security and danger administration. Total, bigger companies prioritise enhanced security options, indicating a strategic dedication to proactive danger administration. Insurers can profit by offering customised options that prioritise security, utilise data-driven insights, and foster collaborative danger administration. Aligning with these security preferences locations insurers in a beneficial place throughout the altering panorama of economic motor insurance coverage for bigger companies.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

useful

resolution for what you are promoting, so we provide a free pattern that you may obtain by

submitting the beneath kind

By GlobalData