Whereas alternate options at present account for roughly 3% of BlackRock’s property below administration, they bring about in about 10% of charges.

The agency’s property in illiquid alternate options jumped about 65% within the three years by September, and in 2023 it acquired Kreos Capital to gasoline its development in non-public debt.

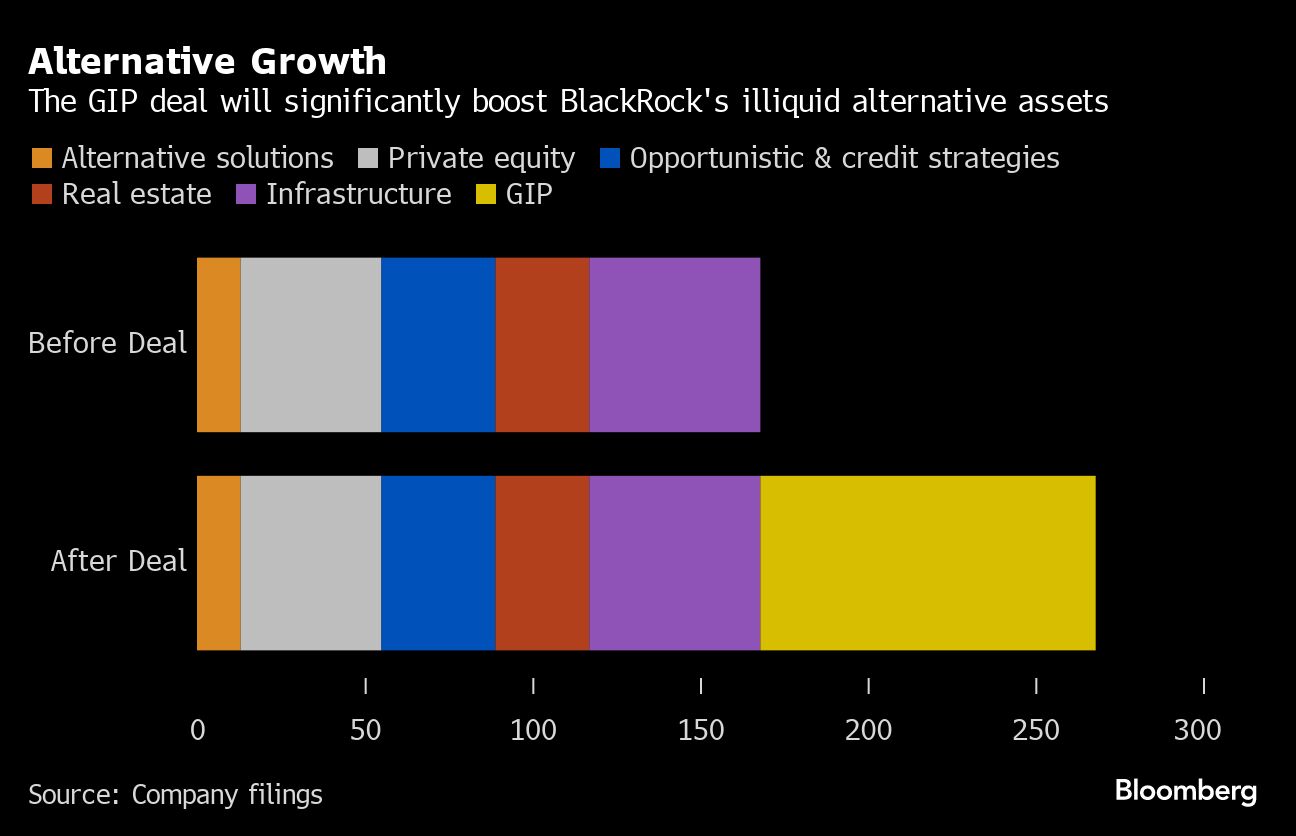

Combining GIP with the roughly $50 billion of infrastructure property that BlackRock managed on the finish of September will create a unit to rival the business’s largest gamers, together with Macquarie Asset Administration and Brookfield Asset Administration.

Lately, BlackRock participated in multibillion-dollar investments in pipelines within the Center East, a carbon-capture mission in Texas and a fiber community enterprise with AT&T Inc.

Infrastructure has been a rising nook of the alternate options market as buyers see alternatives to revenue from serving to to fill what consultants at McKinsey mission will likely be a $15 trillion spending hole on world infrastructure by the top of the last decade.

That demand held up even throughout current dips in different non-public merchandise, as fundraising within the space rose in 2022 whereas non-public fairness and actual property’s totals slumped.

GIP’s Focus

GIP has been among the many greatest gamers in that world, taking notable stakes in among the busiest airports, together with London’s Gatwick.

Whereas infrastructure bets can embrace extra mundane tasks akin to toll roads and bridges, investing giants have additionally more and more seen alternatives in energy-transition tasks and knowledge facilities. They’re drawn by the sometimes steady, recurring returns these property can generate.

Ogunlesi, 70, launched the agency in 2006 with backing from Basic Electrical Co. and Credit score Suisse, and its portfolio firms have mixed annual revenues of greater than $80 billion, in line with its web site. Ogunlesi at present serves as Goldman Sachs Group Inc.’s lead director.

In 2019, GIP raised a then-record $22 billion for a flagship fund, International Infrastructure Companions IV, and lately has been elevating a fifth fund.

5 of GIP’s founding companions will be a part of BlackRock. About 30% of the shares will likely be deferred for about 5 years, and BlackRock mentioned it can subject debt to cowl the money portion. Perella Weinberg Companions suggested BlackRock, whereas Evercore Inc. was lead adviser for GIP.

Credit score: Bloomberg