LifeTrends, a life insurance coverage knowledge firm, posted a spreadsheet displaying that the rules decreased most illustrated returns for some insurance policies by greater than 1 proportion level however led to small will increase in illustrated returns for another insurance policies.

The NAIC Life Insurance coverage Annuities Committee got here near shutting down a panel that was engaged on IUL illustration rule updates, the Listed Common Life Illustration Subgroup, due to considerations a few lack of regulator settlement on the best way to transfer ahead, however the committee ended up retaining the subgroup in operation.

The brand new presentation: Birnbaum and Cude’s new presentation depends partly on factors about reengineering life and annuity illustrations and different disclosures that Birnbaum made throughout a discuss in November 2020.

In addition they draw on an article about funding index design by Bobby Samuelson and a paper in regards to the weaknesses of disclosure-based client safety efforts that was created by the Australian Securities and Investments Fee and the Dutch Authority for the Monetary Markets.

Samuelson urged that index designers have created indexes that look unusually good in 10- and 20-year historic illustrations however appear unlikely to carry out particularly properly sooner or later.

The Australian and Dutch crew argued, primarily based on analysis on customers’ use of many varieties of advisors and disclosures, together with mortgage mortgage advisors, that disclosure necessities might backfire, by inflicting high-risk advisors who present the disclosures to look extra reliable.

“Re-engineer illustrations laws for a constant method for listed annuities and life insurance coverage,” Birnbaum and Cude inform regulators of their new presentation, which is included in a gathering doc packet. “Eradicate hypothetical historic outcomes and projections of non-guaranteed outcomes.”

Eliminating each outcomes will enhance the illustrations and cut back the chances that insurance coverage brokers and brokers will find yourself appearing as monetary planners with out having the coaching to take action, the reps say.

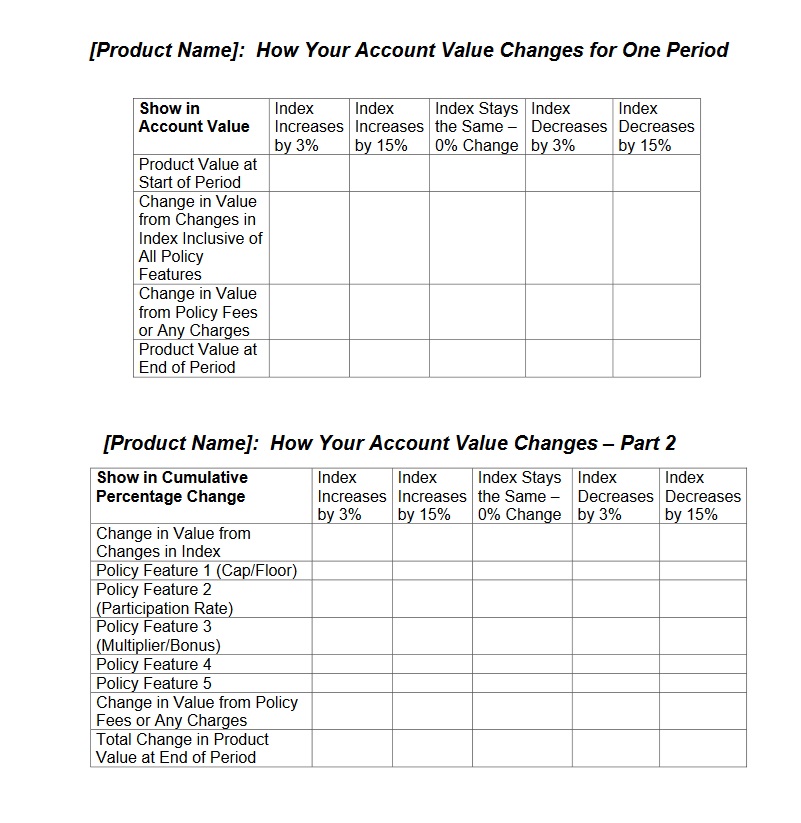

Birnbaum and Cude have included what they hope might be an easier, extra full instrument for displaying how merchandise will work: A set of two tables that will present how 12 product variables would carry out in very unhealthy markets, superb markets and markets the place funding indexes modifications just a bit or keep the identical.

Credit score: Middle for Financial Justice

Credit score: Middle for Financial JusticeIf an annuity or life insurance coverage coverage issuer can change an vital performance-related parameter, similar to return caps or participation charges — the proportion of index positive aspects that move right into a consumer’s personal product returns — the issuer must also present how the way it has dealt with these varieties of parameters for all of its merchandise previously, the reps say.

They notice that the product efficiency tables, which have been developed by Birnbaum, haven’t but been consumer-tested and would have to be to see if they’d work.

The ferment: Larry Rybka, the chairman and CEO of Valmark Monetary Group, who has been writing about issues with unrealistic listed life and annuity product illustrations for years, is getting enthusiastic responses from life and annuity professionals for his LinkedIn posts in regards to the subject.

In October, for instance, Rybka argued in a put up that the utmost fee included in listed common life coverage illustrations must be 5%, relatively than the 5.5% default illustrated fee included in Actuarial Guideline 49, as a result of alternations of excellent years, when charges are capped, with down years, when investment-linked additions to the crediting fee are zero, imply that the precise fee will have an effect on precise returns and maintain precise returns under the default fee.

Many life and annuity professionals replied with feedback about their very own considerations in regards to the excessive charges they see in illustrations.

However different members within the dialog, together with regulators on the NAIC, have questioned whether or not the critics’ proposals would work higher than the principles and disclosures now in use.

Credit score: vetta/iStock