“We proceed to work intently with asset managers, as we’ve at all times carried out, to interact in constructive dialog and attain outcomes that mirror a extra constant strategy throughout mutual funds and ETFs,” mentioned a Constancy spokesperson.

With the negotiations, Constancy is asking ETF issuers to decide on between making a gift of a portion of their already-thin income — the typical expense ratio for U.S. ETFs is 0.55% — or hit their finish buyers with a brand new buying and selling cost.

Opponents say the plan will stifle innovation within the ETF area because it makes it tougher for upstart corporations to function.

‘Pay-to-Play’ Points

The funding agency’s proposed revenue-sharing agreements have sparked broad trade backlash. To make sure, the preliminary checklist topic to the potential $100 servicing cost represented lower than 0.5% of mutual funds and ETFs accessible to funding advisers on the Constancy platform.

“We’ve at all times recognized that there’s a pay-to-play in place for shelf area within the middleman area, and Constancy reminded us that’s the case, however nobody was joyful about it,” mentioned Cinthia Murphy, funding strategist at knowledge supplier VettaFi.

Whereas Constancy and Charles Schwab maintain a lot of the market share for RIA custody belongings, a brand new startup custodian is looking for to seize market share from smaller advisory corporations, particularly, and just lately achieved a valuation of greater than $1.5 billion.

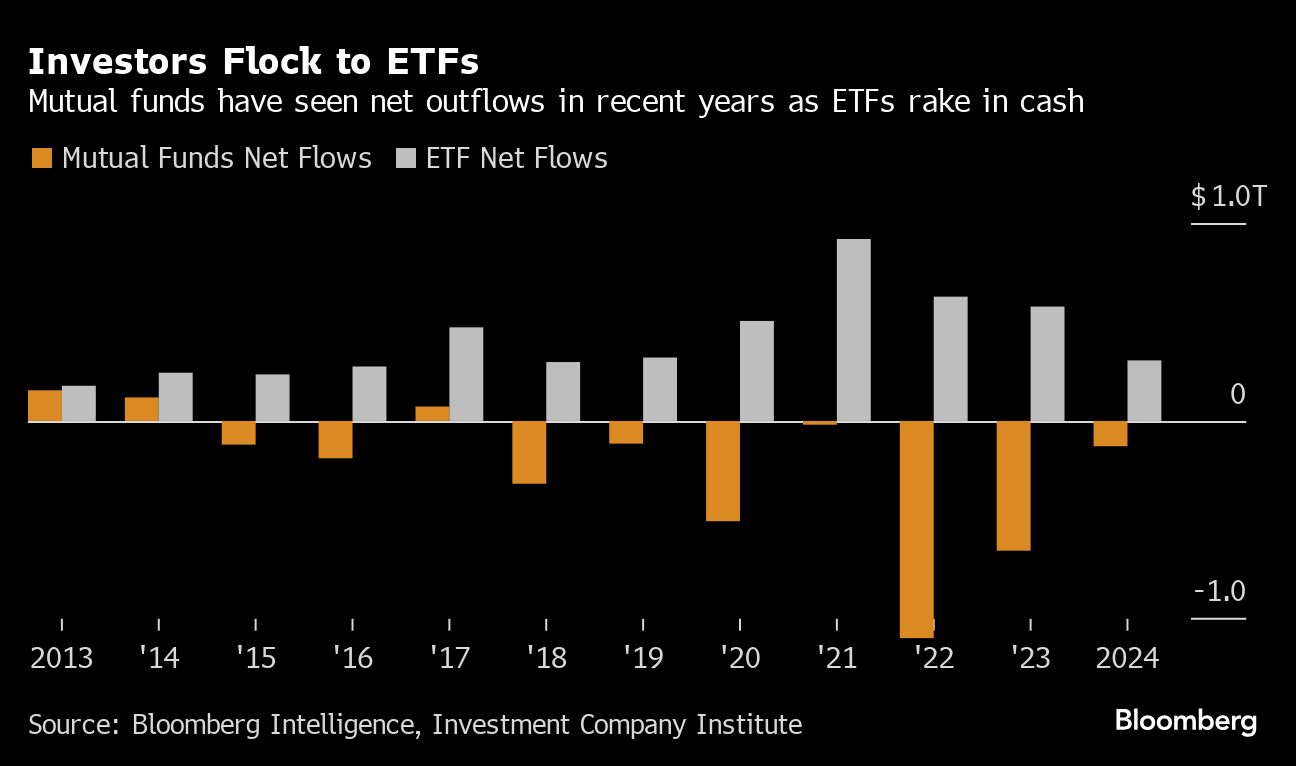

Custodians used to extract plenty of straightforward cash from mutual funds earlier than the ETF disruption, mentioned Jason Wenk, founder and CEO of Altruist.

“That every one obtained like an enormous wrench thrown in it as a result of when ETFs took place, these are exchange-traded merchandise, there’s no promoting agreements. So long as your fund is on an trade, anyone should buy it,” Wenk mentioned. “

All the sudden, the brokerage corporations couldn’t go to the issuers and inform them, ‘Hey, it’s important to pay us all this cash to have your funds on our platform.’ That’s now form of occurring once more,” he added.

(Credit score: Adobe Inventory)