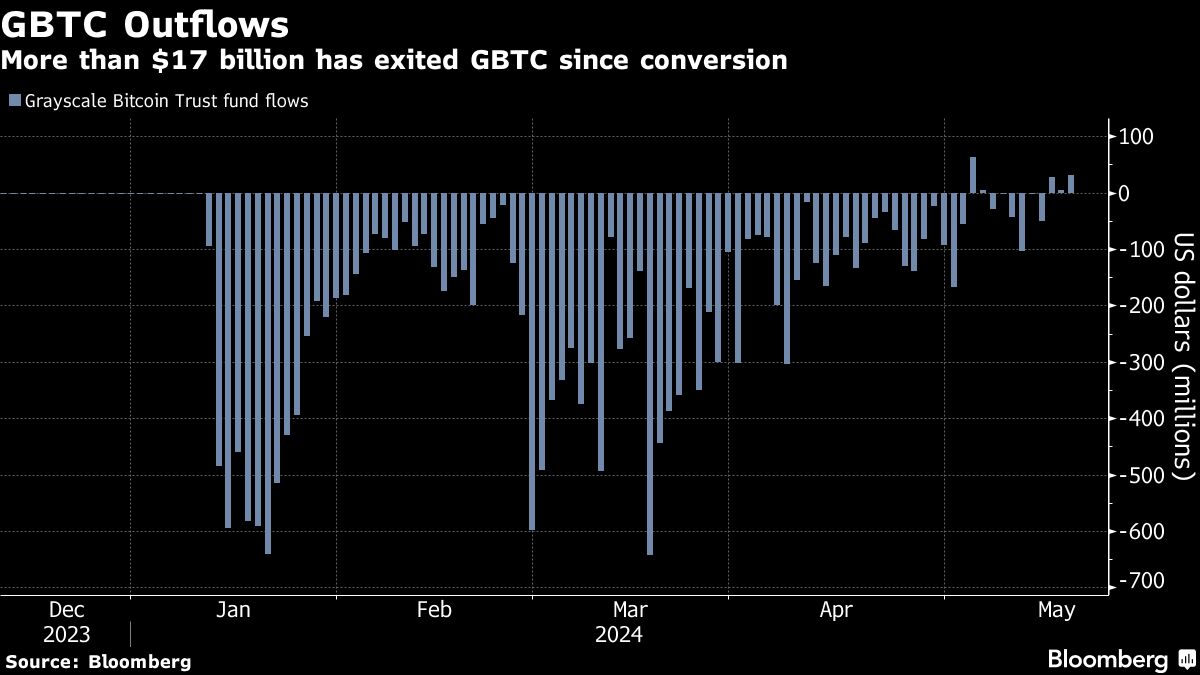

Since changing into an ETF in January, GBTC has bled greater than $17.6 billion.

The opposite ten U.S. spot-Bitcoin funds have all had optimistic inflows this 12 months, with BlackRock’s $15.6 billion haul main the way in which. GBTC fees a 1.5% expense ratio, whereas different funds cost a fraction of that.

Sonnenshein stated in an interview with Bloomberg TV in January that GBTC’s comparatively excessive price is justified by “the dimensions, the liquidity, and the monitor report” of the corporate.

“As an investor, when you find yourself selecting amongst these merchandise, charges are a consideration, the asset supervisor, the issuer behind it are a consideration, however so needs to be dimension, liquidity and that monitor report,” Sonnenshein stated on the time.

The SEC rejected Grayscale’s proposal to transform GBTC in 2022, arguing that an ETF based mostly on Bitcoin lacked enough oversight to detect fraud. Grayscale sued to overturn the choice, accusing the SEC of discriminating in opposition to its product, whereas approving comparable Bitcoin-futures ETFs.

Grayscale’s board and dad or mum firm, Digital Forex Group, started trying to find a brand new CEO in late 2023, based on the Wall Road Journal, which cited individuals aware of the matter. The search was not associated to GBTC’s efficiency or outflows, the report stated.

“The crypto asset class is at an essential inflection level and that is the appropriate second for a easy transition,” Sonnenshein stated in a press launch.

(Credit score: Adobe Inventory)