“The tax minimize was like placing fuel on the hearth when it comes to desirous to develop”

The election might assist decide the destiny of a tax break for small companies that advantages many insurance coverage brokerages, giving brokers an financial stake in the results of the vote.

The 2017 Tax Minimize and Jobs Act applied a 20% tax deduction for house owners of corporations who pay their enterprise taxes by way of their private tax returns. The tax break is one in every of a number of provisions of the legislation that’s set to expire on the finish of 2025.

The tax break for so-called pass-through companies joins a litany of different sunsetting tax insurance policies from the 2017 legislation – equivalent to decrease private charges and estate-tax limits – that Congress will wrestle with subsequent 12 months.

Renewing them might value the federal government $4.6 trillion, based on an estimate from the Congressional Price range Workplace, and will change into one of many highest-profile debates of the 12 months. Its end result will rely on who wins the White Home and controls the Home and Senate after the November elections.

The tax cuts had been a signature of the Trump administration. If former President Trump is elected once more this fall, many lobbyists and different observers anticipate him to make renewing them a precedence. If Republicans maintain on to the Home and obtain a Senate majority, it is going to make the trail towards approving a renewal a lot simpler.

The Unbiased Insurance coverage Brokers and Brokers of America, or the Massive I, is advocating that Congress make the small-business tax-deduction — identified by the shorthand “199A” for the part wherein it seems within the tax code – part of tax legislation eternally.

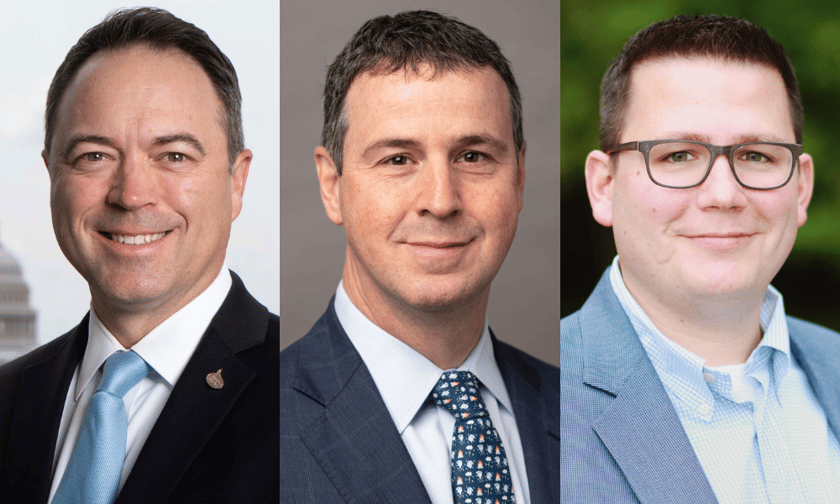

“We’re optimistic beneath a Trump administration and Republican-controlled Congress that 199A can be made everlasting,” stated Nathan Riedel (pictured above, left), Massive I senior vp for federal authorities affairs.

If he obtains a second time period, Trump is prone to put renewal of the 2017 tax cuts on a quick observe. “There’s likelihood a Trump administration would deal with tax coverage within the first 100 days,” Riedel stated.

President Biden has criticized the 2017 tax bundle as favoring the rich. His administration has promised to boost taxes on the high-earners and firms to pay for tax cuts for the center class. Biden has vowed to not elevate taxes for anybody making lower than $400,000.

It’s not clear whether or not Biden would help renewal of the pass-through tax break.

“We’re just a little extra skeptical beneath a Biden administration,” that the availability can be renewed, Riedel stated.

Lack of GOP unanimity on expiring tax breaks?

The election might be the decisive variable for the company tax deductions, such because the one for pass-throughs, stated Jimi Grande (pictured above, heart), senior vp for federal and political affairs on the Nationwide Affiliation of Mutual Insurance coverage Corporations.

“It’ll definitely be affected by who the president is and rely much more on who holds the bulk and by how a lot,” Grande stated in a press release. “President Biden has promised to let these provisions expire ought to he win in November, and whereas it’s doubtless a second Trump administration would do what it might to protect them, that won’t be unanimous throughout the GOP. The politics of immediately and throughout the GOP have modified tremendously since 2017 and a few will look to extend the company charge to assist decrease the small enterprise charges or pay for the person aspect.”

An insurance coverage dealer stated he’s paying shut consideration to how the pass-through tax break might be affected by the election end result.

“Persons are form of making ready for it,” stated Will Lemanski (pictured above, proper), proprietor of Meiers Lombardini Lemanski Insurance coverage, an eight-employee agency in East Lansing, Mich. “I do know it’s on the prime of numerous enterprise house owners’ minds.”

Lemanski has structured his brokerage, which he co-owns together with his spouse, as a pass-through. The income from enterprise operations is added to the couple’s gross adjusted revenue, and so they pay their enterprise tax by way of their private return. The 20% tax break primarily lowers their enterprise tax to a degree much like the present 21% tax on conventional firms.

Tax minimize bolsters brokerage’s progress

Over the previous few years, Lemanski stated the tax deduction has bolstered his brokerage’s funds and allowed him to rent extra workers, improve its know-how and broaden worker advantages.

“The tax minimize was like placing fuel on the hearth when it comes to desirous to develop,” stated Lemanski, who’s a Massive I member. “Taking it away can be like dousing the flame.”

Riedel stated that about 70% of Massive I’s roughly 25,000 members construction their companies as pass-throughs. Lemanski attended Massive I’s legislative convention in April, the place the group despatched greater than 600 members to Capitol Hill to speak to lawmakers and congressional workers about its legislative priorities, together with a invoice – The Foremost Road Tax Certainty Act – that may make the pass-through tax deduction everlasting.

A Senate model of the invoice has 32 co-sponsors, all Republicans, whereas a Home model has 177 co-sponsors, 175 of whom are Republicans. With so little Democratic help, the invoice will not be prone to advance within the present session of Congress, the place Republicans and Democrats management the Home and Senate, respectively, by slim margins.

‘Massive negotiation’ subsequent 12 months in Congress

Meaning renewal of the tax breaks should be taken up by the brand new Congress that’s seated in January after the election.

“There’s going to be an enormous negotiation that goes on,” Rep. Josh Gottheimer, D-N.J. and a co-sponsor of the pass-through-deduction invoice, stated on the Massive I convention. “There are loads provisions which can be sunsetting that I feel are actually necessary, like [the small-business deduction]. We’re going to have to determine how we do away with the dangerous stuff and maintain the good things that’s essential to financial progress.”

If the election end result sends lawmakers to Washington who are usually not inclined to resume the pass-through tax break, his agency would “decelerate in 2026” when it comes to enlargement, Lemanski stated. However it could adapt to a brand new tax code.

“As a enterprise proprietor, you need to modify to the surroundings you reside in,” Lemanski stated.

Abstract: Cross-By Tax Provision beneath the TCJA

-

- The Tax Cuts and Jobs Act (TCJA) launched a 20% deduction for certified enterprise revenue (QBI) for pass-through entities.

- This provision is efficient from 2018 to 2025.

-

- Cross-through entities embrace sole proprietorships, partnerships, S firms, LLCs, and LLPs.

- These companies don’t pay taxes themselves; earnings are handed by way of to house owners who report them on particular person tax returns.

- Certified Enterprise Revenue (QBI)

-

- QBI is the online revenue from a pass-through enterprise after common deductions.

- Contains rental revenue (if it qualifies as a enterprise), revenue from publicly traded partnerships, REITs, and certified cooperatives.

- Excludes capital positive factors, dividends, curiosity revenue, wages to S company shareholders, assured funds to companions or LLC members, and revenue earned exterior the U.S.

- Calculation of the Deduction

-

- Homeowners can deduct as much as 20% of their QBI from their taxable revenue.

- Deduction can’t exceed 20% of whole taxable revenue, excluding the deduction itself.

- Deduction phases out for high-income earners and is topic to particular limitations.

- Thresholds and Limitations

-

- For 2023, the taxable revenue threshold is $364,200 for joint filers and $182,100 for single filers.

- Revenue exceeding these thresholds includes complicated calculations and extra limitations.

- Specified service companies (well being, legislation, accounting, and so forth.) face stricter phase-outs and potential elimination of the deduction at larger revenue ranges.

- Non-Service Companies Over Threshold

-

- Deduction restricted to the larger of fifty% of W-2 wages paid or 25% of wages plus 2.5% of depreciable property’s unadjusted foundation.

- Instance: A pair with $500,000 taxable revenue and $400,000 in QBI might have a deduction restricted to $75,000 primarily based on wages and property.

- Service Enterprise Section-Out

-

- Deduction phases out utterly at $464,200 for joint filers and $232,100 for single filers.

- Instance: A marketing consultant with $394,200 taxable revenue would have a phased-out deduction of $35,000 primarily based on wages paid.

-

- The QBI deduction is a private deduction on Type 1040.

- It doesn’t cut back adjusted gross revenue (AGI) and solely impacts revenue tax, not Social Safety or Medicare taxes.

Sustain with the newest information and occasions

Be part of our mailing checklist, it’s free!