The price of repairs and underwriting dangers are the largest challenges insurers are going through within the transition to electrical autos (EVs), in response to a GlobalData survey. As curiosity in EVs grows, the British Insurance coverage Brokers’ Affiliation (BIBA) has partnered with NOVO Insurance coverage to launch a brand new EV scheme to assist deal with particular challenges in coverage protection confronted by the business.

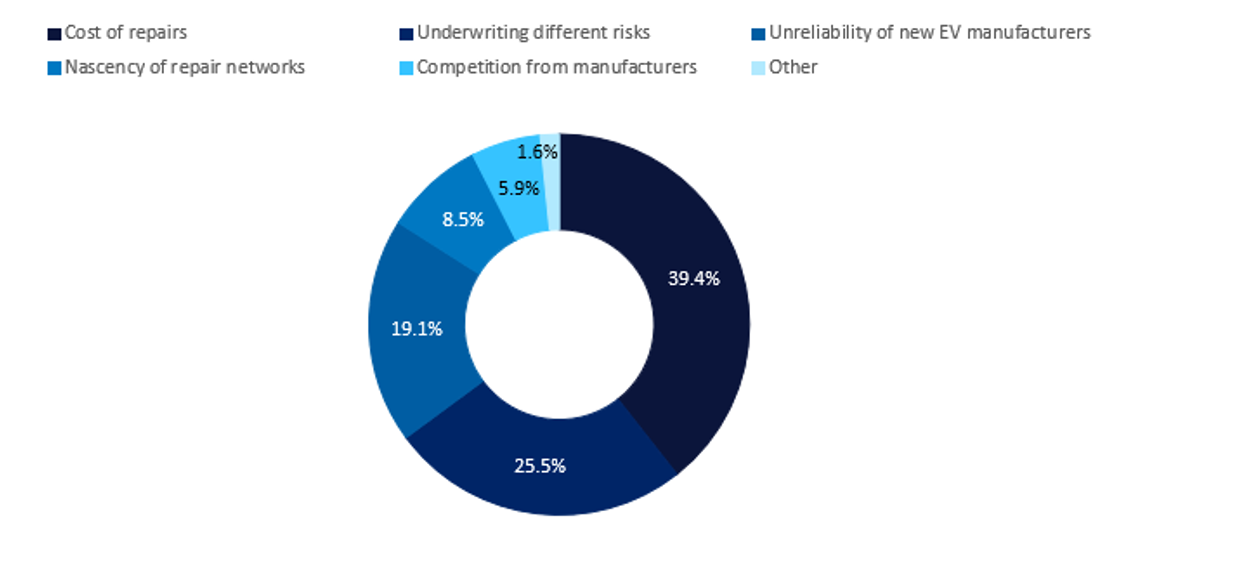

A GlobalData ballot carried out on Verdict Media websites in Q2 2023 signifies that 39.4% of insurance coverage business insiders imagine the price of repairs is the largest problem for insurers, adopted by underwriting completely different dangers (25.5%). There is no such thing as a doubt that the insurance coverage business continues to grapple with the swap to EVs as they depend on superior know-how and lithium-ion batteries, which not solely makes repairs—and premiums—very pricey but additionally modifications the character of dangers in comparison with petrol or diesel autos.

BIBA’s new scheme is a step in the proper course because it goals to deal with a few of the shortcomings in protection and enhance the claims course of by offering entry to a UK-wide EV restore community. Provide chain points when sourcing substitute parts for EVs contribute to excessive premiums as they naturally push up the price of repairs. Having a specialist manufacturer-approved EV restore community ought to hopefully enhance inventory and supply a extra dependable service to house owners. Targets for a net-zero transition are exerting extra strain on motor insurers to supply ample cowl for EVs. Nevertheless, the complexities of insuring EVs are dissuading underwriters. In October 2023, John Lewis stopped promoting insurance coverage to EV drivers following a call made by its underwriter, Covéa. In the meantime, 35.9% of automobile house owners plan to modify to a totally electric-powered car within the subsequent 5 years, as per findings from GlobalData’s 2023 UK Insurance coverage Client Survey. This proportion rises to 46% when contemplating a interval of ten years. But, as older autos break down and develop into in disuse, extra motorists could also be persuaded to buy an EV sooner than they anticipated given that every one new vehicles and vans bought within the UK have to be totally electrical by 2035. The business wants to search out methods to make EVs insurable at an affordable value in order that the transition to EVs can proceed and motorists don’t really feel discouraged. Because the EV parc grows, manufacturing parts at scale will deliver costs down. Better availability of specialised restore outlets and technicians may also scale back prices. In the meanwhile, insurers should repeatedly monitor the EV market and modify their insurance policies accordingly. On this method, they’ll have the ability to handle restore prices higher and supply complete EV cowl.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

helpful

determination for your online business, so we provide a free pattern which you could obtain by

submitting the beneath kind

By GlobalData