On the spending aspect, curiosity prices rose quicker this time as a result of Individuals now have a bigger share of their money owed in client credit score, which is faster to reprice and saddles debtors with greater payments when charges go up. Mortgages, against this, are principally locked-in past the Fed’s attain.

As for curiosity revenue, one purpose it’s lagged is that banks have been gradual to move on greater charges to depositors — they’ve come underneath fireplace for that everywhere in the world. And after about 15 years during which charges have been close to zero a lot of the time, savers might have gotten out of the behavior of transferring money between accounts in the hunt for higher returns.

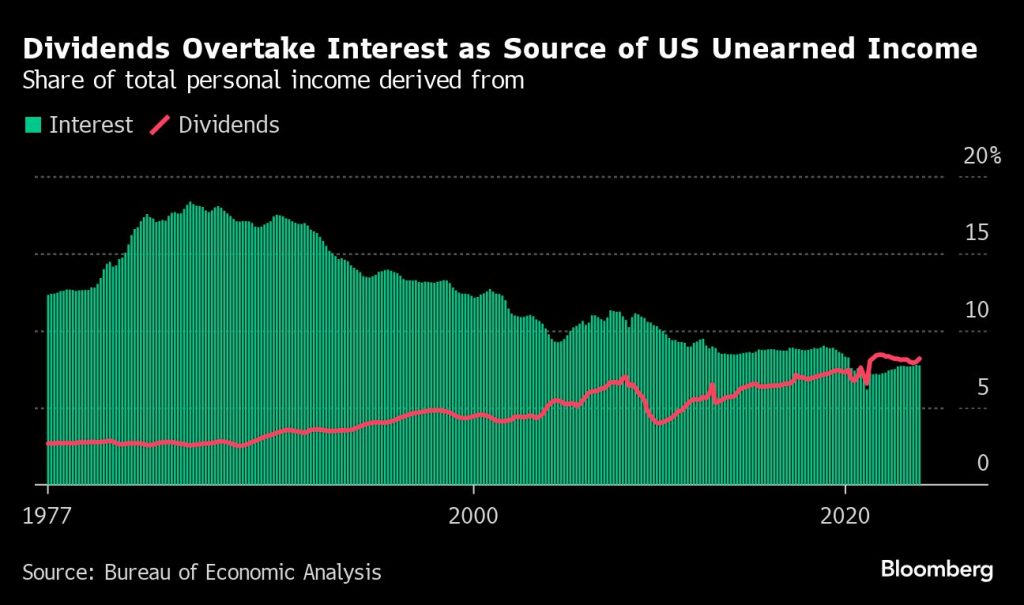

One other is that wealth has shifted out of the form of holdings that pay curiosity, and into shares. Through the pandemic, for the primary time on document, dividends overtook curiosity funds as a supply of unearned revenue for Individuals.

To make certain, mixture numbers hardly ever inform the entire story, and within the case of curiosity revenue and funds they inform even much less of it than typical.

That’s as a result of the individuals who earn extra when charges go up are typically not the identical individuals who face greater payments. Possession of interest-earning belongings skews towards the wealthiest, whereas Individuals with the most costly sorts of debt usually tend to be decrease earners.

In addition to widening inequality, that distribution has penalties for the financial influence of fee will increase.

Put merely, the payouts are likely to go to savers who’re much less probably to offer the economic system a lift by spending every further greenback on items and companies. In contrast, the payments land on the doorsteps of households who in all probability would’ve used these {dollars} to purchase stuff — in the event that they didn’t now should spend them on servicing debt as a substitute.

Photograph: Adobe Inventory; Charts: Bloomberg