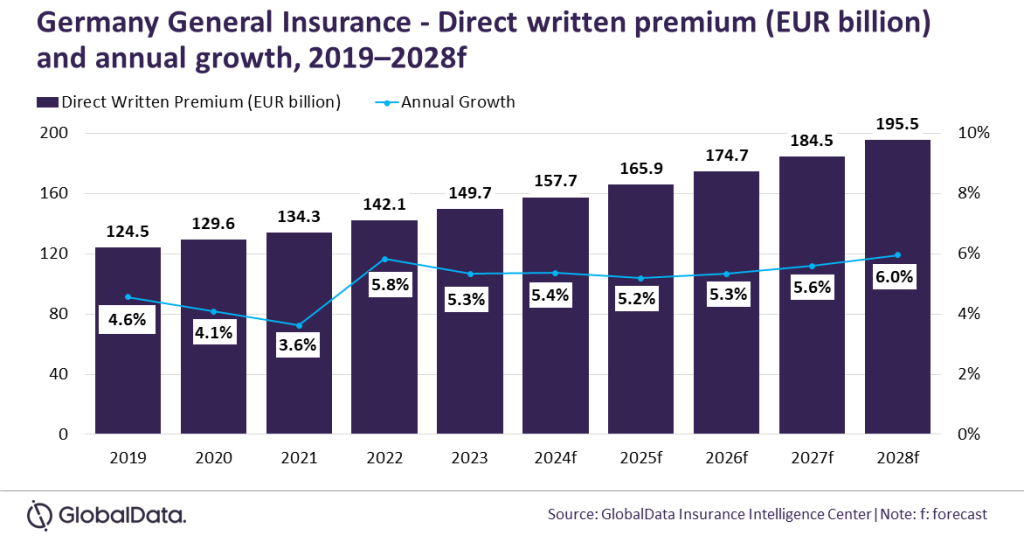

The final insurance coverage business in Germany is about to develop at a CAGR of 5.5% from EUR149.7bn ($152.8bn) in 2023 to EUR195.5bn ($205.2bn) in 2028.

That is in accordance with GlobalData and its insurance coverage database which additionally revealed that Germany normal insurance coverage is anticipated to develop by 5.4% in 2024. The expansion is supported by a rise in motorcar gross sales, rising demand for pure catastrophic (nat-cat) insurance coverage insurance policies and an inflation-led rise in premium charges throughout most normal insurance coverage strains.

Sneha Verma, insurance coverage analyst at GlobalData, commented: “The expansion price of Germany’s normal insurance coverage business is anticipated to stay constant between 5-6% throughout 2023-28. Will probably be primarily supported by well being and property insurance coverage, pushed by the post-COVID-19 pandemic improve in well being consciousness and growing demand for nat-cat insurance coverage insurance policies.”

As well as, private accident and medical insurance (PA&H) is the main line of enterprise, accounting of 37.7% of the final insurance coverage market in 2023. It is usually anticipated to develop by 3.8% in 2024 and 4.2% in 2025, boosted by a rise in well being consciousness after Covid-19.

Based on the German Insurance coverage Affiliation, non-public medical insurance premium is anticipated to extend by 4% to five.5% in 2024. PA&H insurance coverage is projected to develop at a CAGR of 4.4% throughout 2023-28.

Moreover, motor insurance coverage is the second largest line of enterprise, accounting for a 21% share of the Germany normal insurance coverage DWP in 2023.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we would like you to take advantage of

helpful

resolution for your online business, so we provide a free pattern you could obtain by

submitting the under kind

By GlobalData

Motor insurance coverage DWP grew by 1.8% in 2023, supported by a rise in whole car gross sales. Based on the Federal Motor Transport Authority, car gross sales elevated by 7.2% to 2.84 million in 2023 from 2.65 million in 2022. The pattern is anticipated to proceed in 2024.

Verma added: “Along with car gross sales, a rise in premium costs as a result of inflation may even assist motor insurance coverage progress. An prolonged interval of excessive inflation has resulted in an above-average improve in spare elements and restore prices, resulting in the next value of claims. This has impacted insurers’ profitability, resulting in the mixed ratio for the motor insurance coverage business surpassing 100% in 2022 for the primary time within the final 10 years. Motor insurance coverage is anticipated to develop at a CAGR of two.2% throughout 2023-2028.”