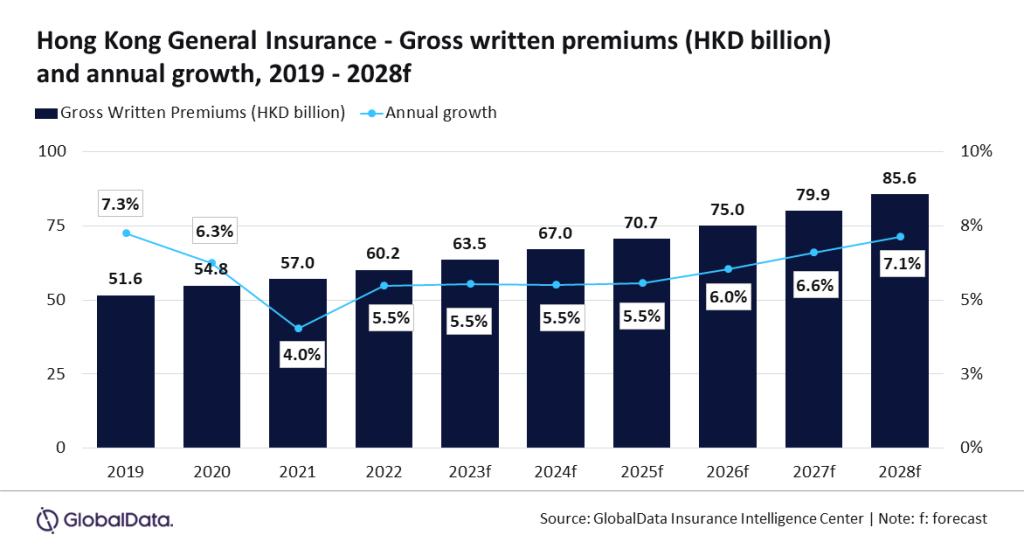

The final insurance coverage market in Hong Kong is ready to develop at a CAGR of 6.3% from HKD67bn ($8.6bn) in 2024 to $10.9bn in 2028.

That is when it comes to gross written premiums, in response to GlobalData.

As well as, the overall insurance coverage business in Hong Kong is predicted to develop by 5.5% in 2024 and 2025, in response to the GlobalData Insurance coverage Database.

This progress might be supported by main insurance coverage traces, corresponding to private accident and well being (PA&H), legal responsibility, and property, which altogether account for 75% of the overall insurance coverage GWP in 2023.

PA&H insurance coverage is the main line of enterprise in Hong Kong common insurance coverage, accounting for 31.4% of the market in 2023. It’s projected to develop by 7.2% in 2024, primarily pushed by a rise in well being consciousness and a a restoration within the demand for medical insurance insurance policies from mainland China after the removing of prolonged journey restrictions.

Legal responsibility insurance coverage is the second largest line, accounting for a 24.1% share of the overall insurance coverage GWP in 2023. Hong Kong was the fourth-largest legal responsibility insurance coverage market within the APAC area in 2023.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

choice for what you are promoting, so we provide a free pattern that you may obtain by

submitting the beneath kind

By GlobalData

Anurag Baliarsingh, insurance coverage analyst at GlobalData, commented: “Hong Kong common insurance coverage business witnessed a constant progress of 5.5% in 2022 and 2023. The expansion was supported by a restoration within the demand for well being and journey insurance coverage insurance policies from mainland Chinese language prospects, necessary insurance coverage lessons, and rising medical inflation that resulted in a rise within the premiums for medical insurance insurance policies. The development is predicted to proceed in 2024 and 2025.

“Chinese language prospects are largely attracted by the superior care, high-quality medical services, and shorter ready instances supplied in Hong Kong. The medical insurance insurance policies supplied in Hong Kong embody choices for added protection for members of the family, larger protection for particular sorts of sickness, and severity-based safety that aren’t out there within the insurance policies supplied in Mainland China.”