What You Must Know

- Constancy, Morgan Stanley and Dimensional Fund Advisors need to use the multi share-class construction as a result of its tax benefits.

- Vanguard’s patent that prevented copycat funds expired in Might. Now, the one barrier is SEC approval.

Outdoors the Fontainebleau Resort in Miami, Florida final week, dozens of drones moved slowly by means of the night time sky, projecting the Bitcoin image far and vast above one of many largest ETF gatherings of the 12 months.

However contained in the annual Change convention, trade insiders had been obsessing over an occasion that would show a far greater deal for the $8.4 trillion enterprise than the long-awaited launch of spot Bitcoin ETFs: Regulatory approval of latest share-class buildings.

It’s arcane stuff in comparison with the boom-crash-boom of crypto — nobody ever launched drones to rejoice totally different investor lessons, as Grayscale Investments did for its $23 billion Bitcoin fund.

However the query of whether or not the U.S. Securities and Change Fee would enable companies to duplicate the fund mannequin used solely by Vanguard Group for greater than two many years was the new subject among the many trade professionals in attendance.

For good cause. That construction would allow an ETF to be listed as a share class of a broader mutual fund — successfully bringing the well-known tax effectivity of the exchange-traded fund to the entire automobile.

Vanguard’s patent that prevented copycat funds expired in Might. Now, the one barrier is SEC approval.

Grayscale makes use of drones to create the Bitcoin image on the Change convention in Miami, Florida.

“Whereas spot Bitcoin ETFs are at the moment dominating the headlines, these merchandise are merely a sideshow in comparison with the potential affect of the multi-share class construction,” mentioned Nate Geraci, president of The ETF Retailer, an advisory agency.

Heavyweights together with Constancy, Morgan Stanley and Dimensional Fund Advisors have all requested the regulator for permission to make use of the mannequin, which might port the tax benefits of ETFs onto trillions of {dollars} of mutual fund property.

It’s a tantalizing prospect for an trade on the lookout for the subsequent wave of progress after quadrupling in dimension over the previous decade. There are already greater than 3,300 U.S.-listed ETFs, and SEC approval might open the floodgates to hundreds extra.

“If the SEC permits for share lessons, particularly for energetic mutual funds, I believe it’s large for the ETF trade,” mentioned Michael Venuto, chief funding officer at Tidal Monetary Group. “There’s 10,000 mutual funds. The concept 20% of them would add an ETF share class doesn’t appear insane to me.”

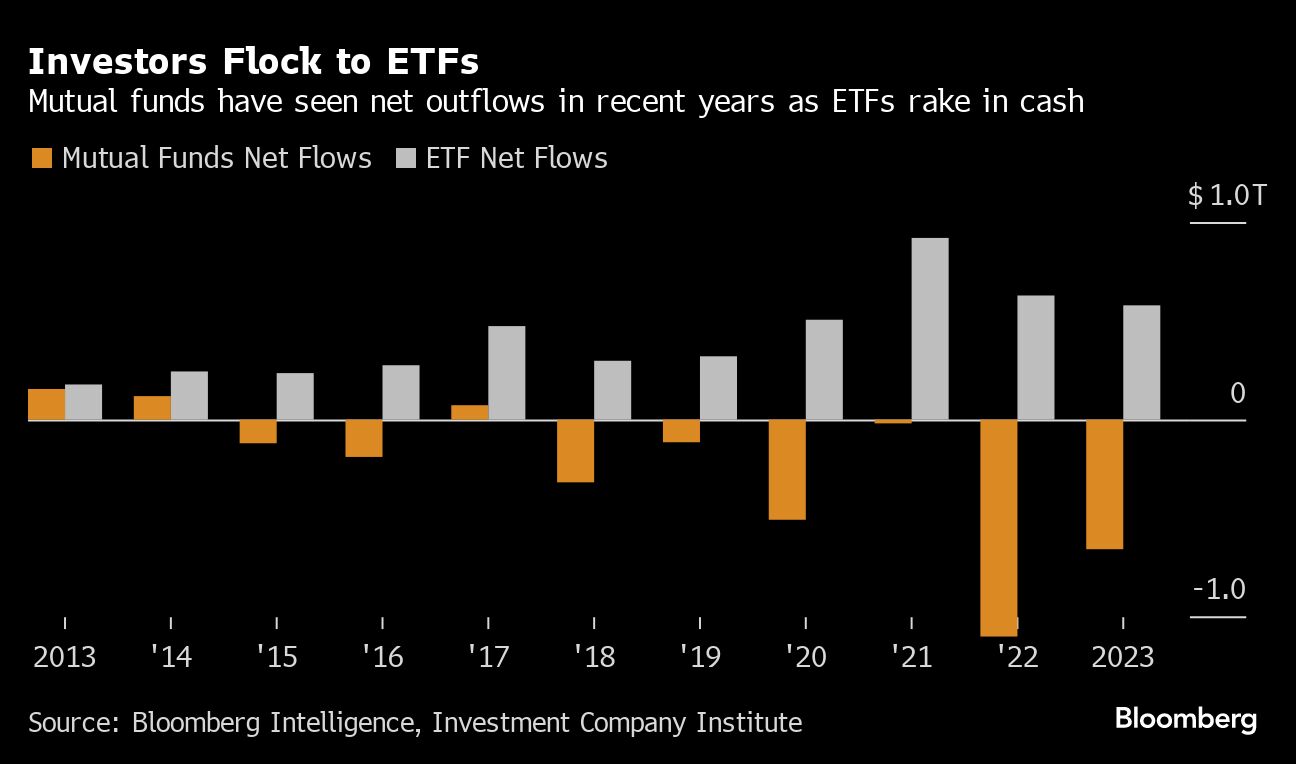

Mutual funds have largely bled property lately as ETFs have grown in reputation. Consequently, legacy asset managers have discovered themselves battling for a slice of the more and more saturated ETF market.