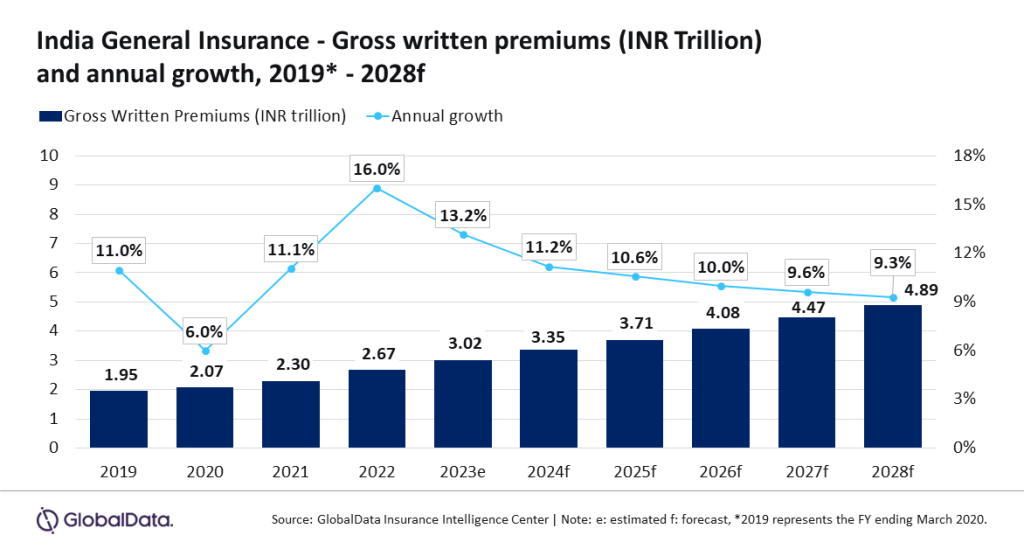

The final insurance coverage trade in India is about to develop at a CAGR of 9.9% from INR3.35trn ($40.36bn) in 2024 to INR4.89trn ($57.3bn) in 2028, when it comes to gross written premiums (GWP).

That is in response to GlobalData, which additionally predicted that normal insurance coverage in India will develop by 11.2% in 2024. The rise shall be pushed by private accident and well being (PA&H), motor, and property insurance coverage traces which totalled 93% of normal insurance coverage premiums in 2023.

Swetansha Chauhan, insurance coverage analyst at GlobalData, mentioned: “The final insurance coverage trade in India continued its excessive progress development and grew by 13.2% in 2023, pushed by financial progress and rising disposable earnings. Rising client consciousness of well being and different normal insurance coverage merchandise and sturdy regulatory reforms additionally supported India’s normal insurance coverage trade progress. The development is anticipated to proceed in 2024 and 2025.”

PA&H insurance coverage is big in India, accounting for 39.5% of the sector in 2024. It is usually anticipated to develop by 14.5% in 2024, pushed by elevated well being consciousness following the Covid-19 pandemic and rising medical inflation.

Motor insurance coverage is the second largest line typically insurance coverage as GlobalData estimates it takes 31.1% of the trade.

Moreover, it’s anticipated to develop by 10.4% in 2024 as a result of rising automobile gross sales.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

helpful

resolution for your corporation, so we provide a free pattern that you could obtain by

submitting the beneath kind

By GlobalData

Chauhan added: “The expansion in automobile gross sales was additionally fueled by the federal government’s automobile scrapping coverage, which got here into impact on April 1, 2023. The coverage requires non-public automobiles older than 20 years and industrial automobiles older than fifteen years to be scrapped. Motor insurance coverage is anticipated to develop at a CAGR of seven.9% throughout 2024-28.”

Chauhan continued: “Restoration within the economic system and rising disposable earnings will proceed to assist the expansion of India’s normal insurance coverage trade throughout the subsequent 5 years. Initiatives from the federal government and favorable regulatory reforms will assist in rising the insurance coverage penetration fee in India (0.98%), which was decrease as in comparison with different Asian markets resembling Japan (1.75%), South Korea (1.46%), Hong Kong (1.65%) and China (1.26%) in 2023.”