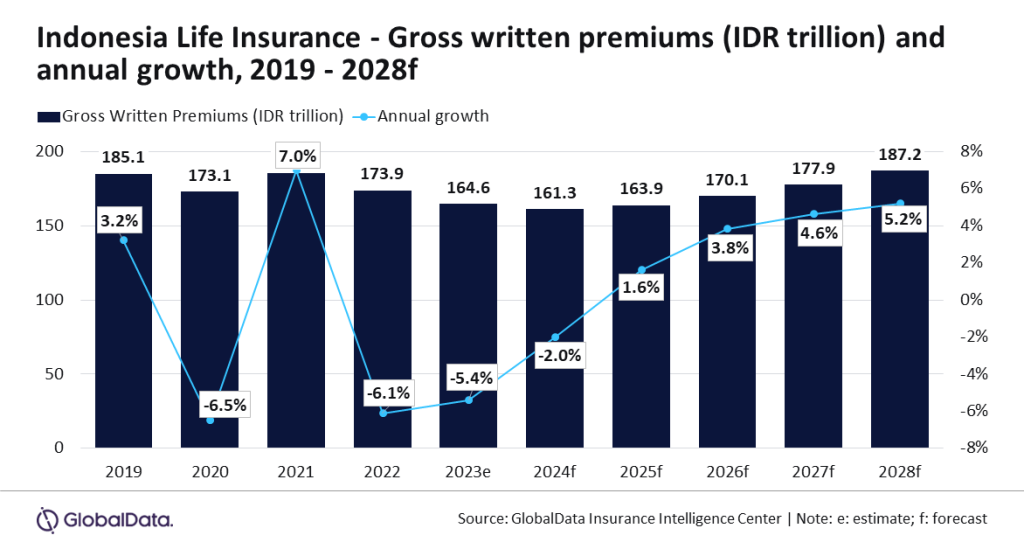

The life insurance coverage sector in Indonesia is predicted to develop at a CAGR of three.8% between 2024 and 2028. This implies it would develop from IDR161.3trn ($10.5bn) in 204 to $12.1bn in 2028 when it comes to GWP.

Nonetheless, there shall be declines in line with GlobalData and its Insurance coverage Database. It expects the shrinking of the life insurance coverage sector in Indonesia that started in 2022 will proceed in 2023 and 2024. This shall be pushed by a drop within the gross sales of endowment insurance coverage insurance policies, that are anticipated to account for practically 70% of life insurance coverage premiums in 2024.

Manogna Vangari, insurance coverage analyst at GlobalData, stated: “The Indonesian life insurance coverage business is predicted to say no by 2% in 2024, after witnessing a 5.4% decline in 2023. The decline might be attributed to a lower within the gross sales of investment-linked insurance coverage merchandise as a result of heightened volatility in world monetary markets, in addition to a decline in new premiums as a result of altering client preferences.

“Nonetheless, the business is about to make a turnaround in 2025, pushed by a rise within the demand for conventional life insurance coverage insurance policies and modifications within the nation’s demographic elements.”

Moreover, endowment insurance coverage is the most important product within the Indonesian life insurance coverage business, accounting for 69.3% of the GWP in 2024. It’s anticipated to say no by 7% in 2024 as a result of excessive market volatility that has resulted in decrease returns over an prolonged interval.

Vangari added: “Optimistic regulatory developments are anticipated to assist endowment insurance coverage progress. In January 2024, the Monetary Providers Authority of Indonesia (OJK) issued a regulation that gives pointers on the supervision of the advertising of investment-linked insurance coverage merchandise. These embody client knowledge safety rules, rights and obligations of potential shoppers, the inclusion of charges and commissions/rewards to advertising brokers/intermediaries, and dealing with complaints and dispute decision.”

Entry essentially the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

useful

determination for your small business, so we provide a free pattern you can obtain by

submitting the under kind

By GlobalData