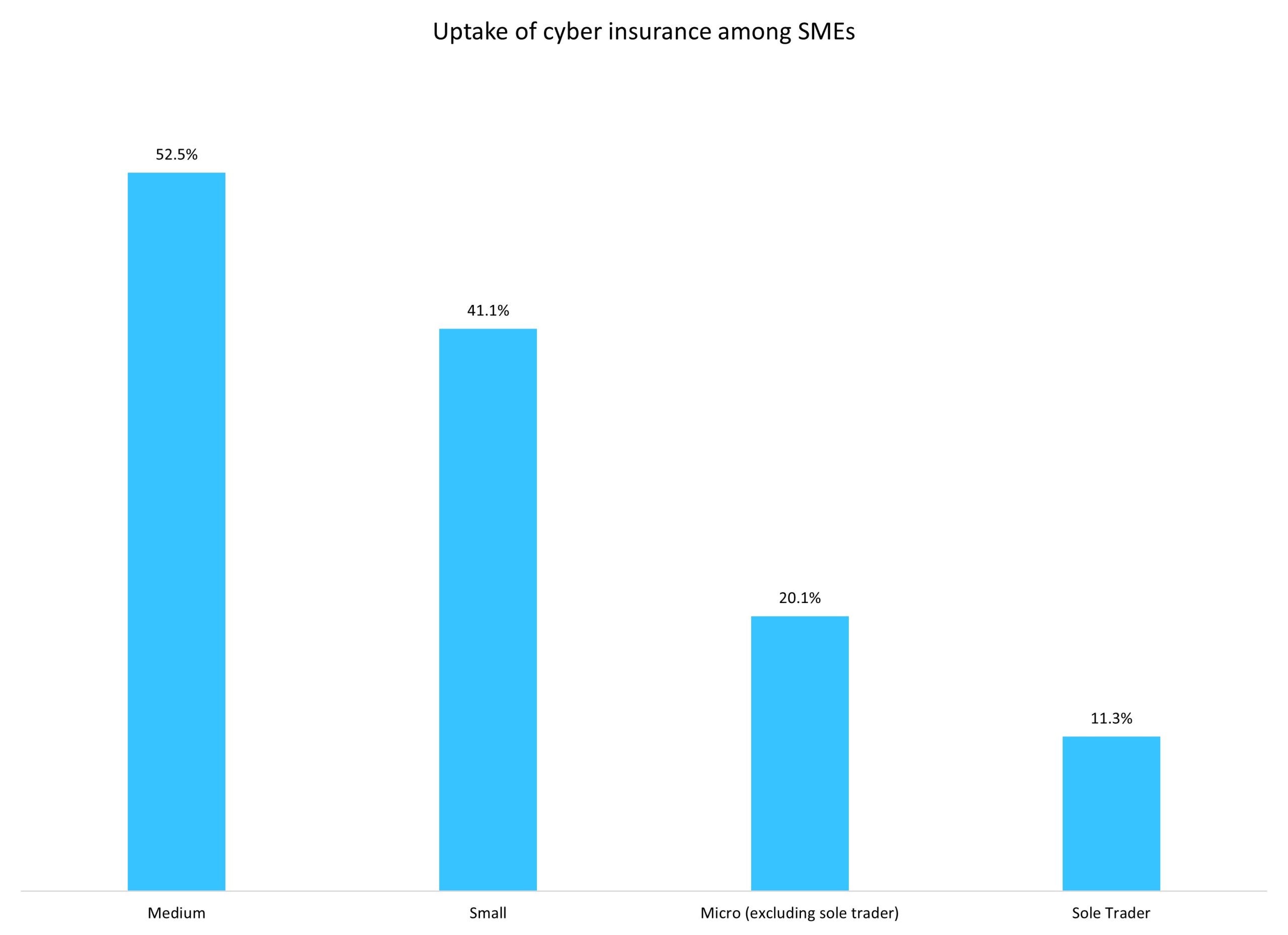

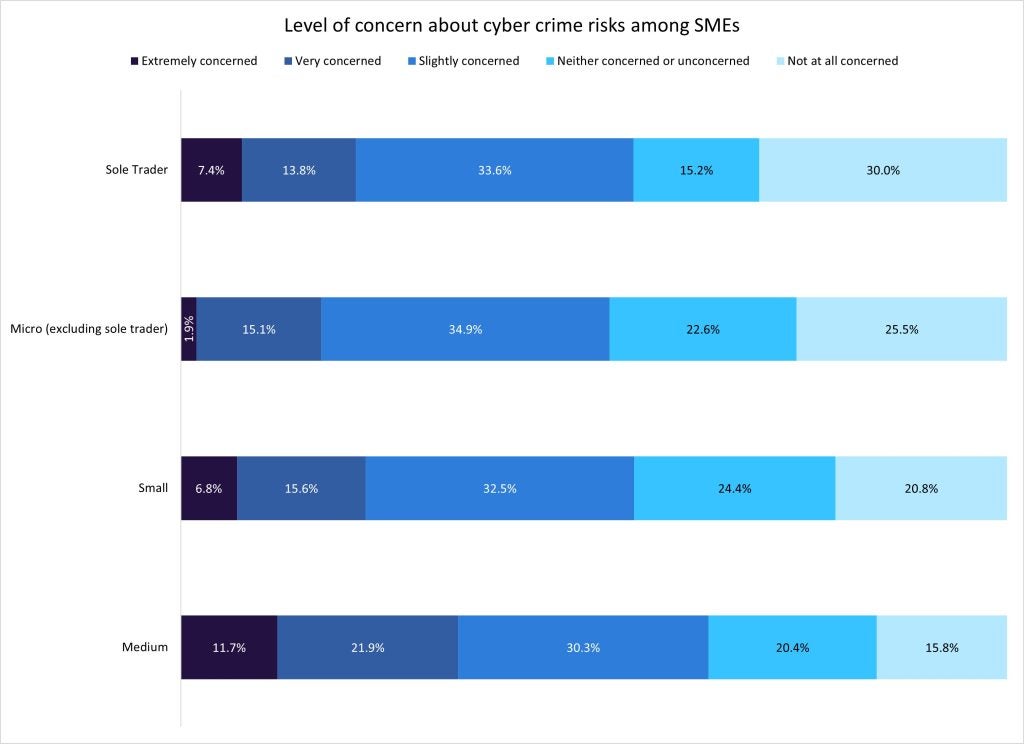

A disparity might be seen within the adoption of cyber insurance coverage amongst SMEs. Whereas medium-sized companies boast a strong 52.5% uptake and small-sized companies comply with with 41.4% penetration, micro-enterprises and sole merchants lag behind at simply 20.1% and 11.3%, respectively. But it’s evident that there’s a sturdy want for cyber insurance coverage, as considerations about cybercrime stay prevalent amongst SMEs of all sizes, with over 50% involved to some extent.

With 63.9% of medium-sized companies expressing some stage of concern about cybercrime in 2023 (up from 62.7% in 2022), GlobalData’s survey emphasises the excessive stage of fear amongst these companies. This elevated sense of concern is in step with their greater adoption charges of cyber insurance coverage, as medium corporations are conscious of the attainable results on their day-to-day operations. But it’s attention-grabbing to notice that even corporations with decrease cyber insurance coverage adoption charges, like sole merchants and micro companies, nonetheless specific a substantial amount of concern at 54.8% and 51.9%, respectively.

Companies of all sizes are in danger from the evolving nature of cybercrime. As such, insurers ought to try to supply protection choices that meet the wants of all forms of companies. Cowbell is an instance of an insurer that has utilised its cyber providing to achieve all sizes of the SME market; it’s now increasing into the mid-market.

SMEs had been additionally requested how cyber threat has modified in comparison with earlier than the COVID-19 pandemic. GlobalData’s survey outcomes present that perceived cyber threat for SMEs has elevated, rising from 32.7% in 2022 to 34.3% in 2023. In response to this pattern, 26.5% of SMEs stated they might be extra seemingly to purchase protection in 2023, up from 22.7% in 2022. The information signifies the rising want for cyber insurance coverage available in the market—a pattern that innovators like Cowbell are capitalizing on.

Having first targeted on the SME sector, Cowbell has established itself as a progressive participant within the cyber insurance coverage area. As of January 2024, Cowbell is providing protection to mid-market corporations (these with an annual turnover of as much as £1bn). With a big threat pool consisting of 4.5 million SMEs within the UK, its method permits for data-driven evaluations of cyber dangers. This info is then handed on to brokers to strengthen bonds and broaden their understanding of cyber threat, demonstrating a complete method to threat administration.

Insurance coverage corporations should modify their merchandise to satisfy the wants of each small and huge companies in mild of the cyber insurance coverage hole. Regardless of their decrease adoption fee, micro and sole merchants proceed to be involved about cyber threats, which presents a large market alternative. Insurance coverage corporations also needs to work with brokers to construct partnerships and educate corporations about how cyber dangers are altering. Doing so will allow them to benefit from the cyber insurance coverage hole to enhance their insurance coverage books.

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we would like you to take advantage of

useful

resolution for your enterprise, so we provide a free pattern which you can obtain by

submitting the beneath kind

By GlobalData