A research from Entry PaySuite has discovered that youthful customers contemplate various cost choices a significant component in selecting an insurance coverage supplier. In the meantime, GlobalData surveying suggests customers throughout numerous age teams exhibit diverse preferences relating to insurance coverage cost strategies.

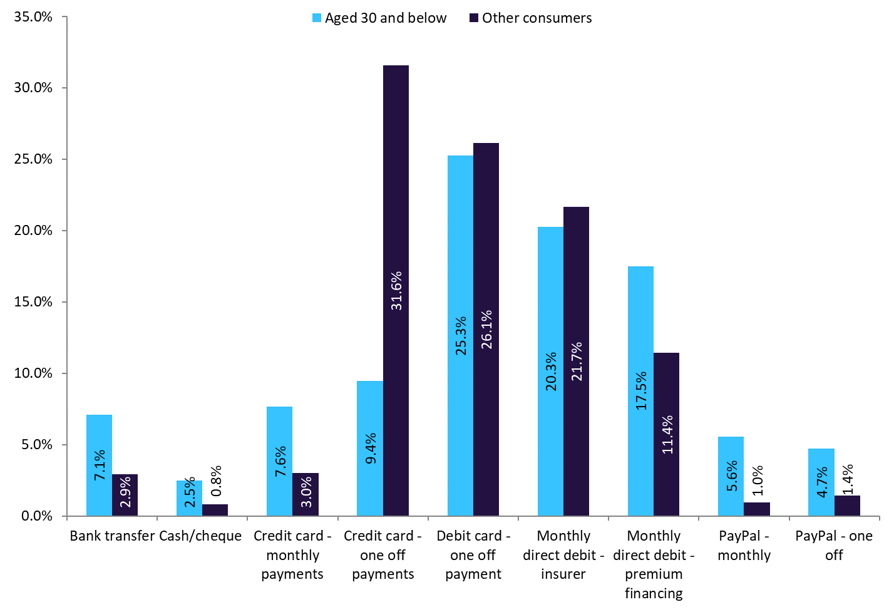

As per GlobalData’s 2023 UK Insurance coverage Client Survey, customers aged 30 and under exhibit a broader spectrum of selections in comparison with these aged over 30. Whereas the youthful demographic exhibits a relatively greater inclination in direction of various choices resembling month-to-month bank card funds (7.6%), month-to-month PayPal funds (5.6%), and financial institution transfers (7.1%), customers aged over 30 show a extra concentrated choice for one-off bank card funds (31.6%). This means that youthful customers are likely to embrace a wider array of cost strategies when managing their insurance coverage transactions, reflecting better flexibility and flexibility of their monetary preferences.

Most well-liked cost choices for automobile and residential insurance coverage, 2023

In the meantime, the analysis section of Entry PaySuite’s newest report, titled, “Future-Proofing Funds within the Insurance coverage Sector,” signifies that 80% of Gen Z respondents and 77% of millennials contemplate quite a lot of cost choices as a major consider deciding on an insurance coverage supplier. The report additionally underscores the importance of safety and suppleness for customers of their insurance coverage cost processes, with 42% of contributors emphasizing the significance of safe knowledge dealing with. Nonetheless, the research additionally sheds mild on notable considerations inside the sector. Greater than a 3rd of customers report adverse experiences associated to paying their insurance coverage premiums. These points embody situations the place funds have been made with out full buyer consciousness (39%), difficulties in cancelling funds (35%), and situations of being overcharged (33%).

The emphasis on various cost choices displays a broader pattern within the monetary providers business, whereby flexibility and comfort are more and more changing into non-negotiable features of shopper engagement. Insurance coverage suppliers that efficiently adapt to those altering dynamics stand to not solely meet the present calls for of their buyer base but additionally place themselves favourably in attracting new prospects, significantly from youthful age teams who prioritise trendy and adaptable cost strategies.

General, insurers poised to succeed are these able to agile adaption to evolving buyer wants, particularly in response to the rising demand for various and revolutionary cost options. Because the panorama of shopper preferences continues to rework, insurance coverage suppliers that proactively regulate their choices stand to not solely retain their present buyer base but additionally entice a broader and extra various viewers.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

useful

choice for your online business, so we provide a free pattern that you would be able to obtain by

submitting the under type

By GlobalData