‘Lacking Out’

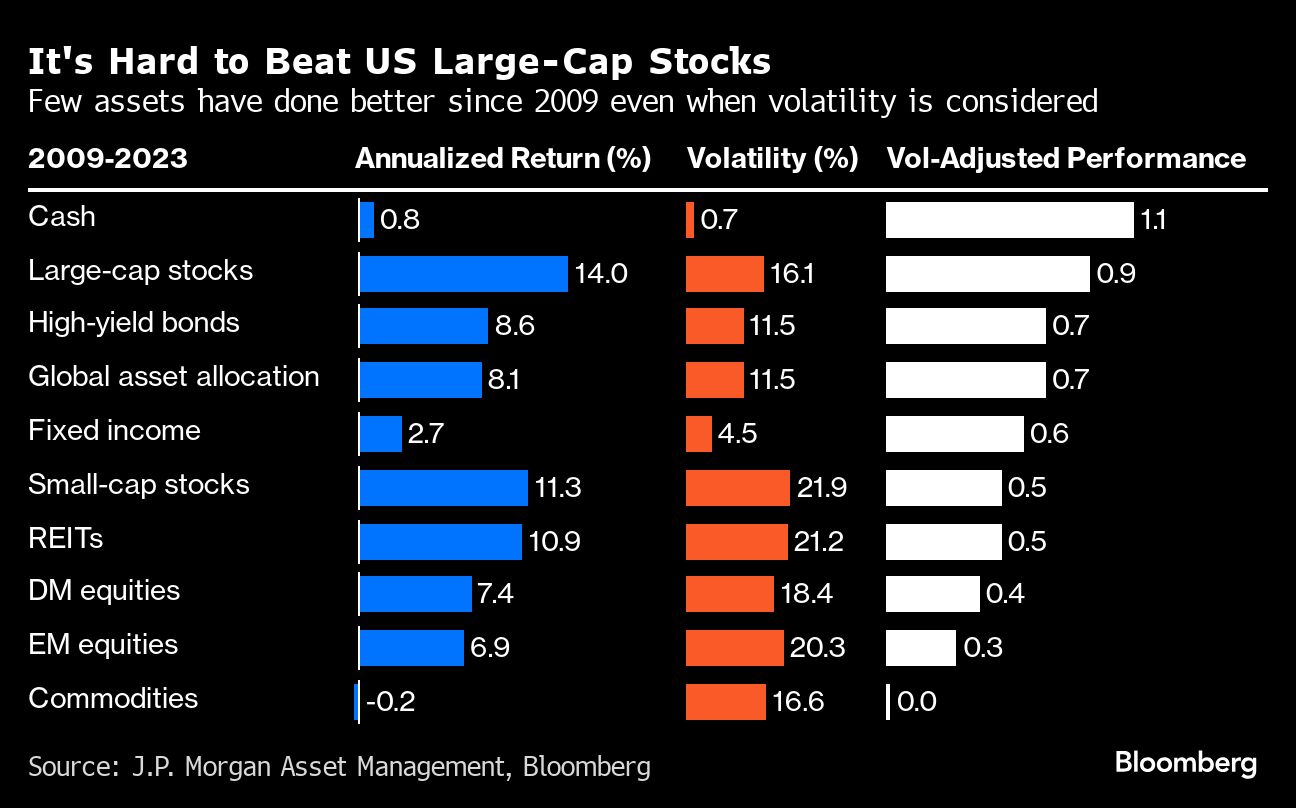

In opposition to this backdrop, practically everybody straying from U.S. equities is topic to a way of lacking out. During the last 15 years, the PIMCO StocksPLUS Lengthy Length Fund (PSLDX) is the one and solely among the many 372 asset allocation portfolios tracked by Morningstar that’s forward of the S&P 500.

The info has emboldened those that say diversification — nevertheless sound in idea — is costing buyers over the long term, by holding underperforming investments. The revolt bought an airing final yr when teachers printed a research saying retirees can be higher off eschewing bonds fully.

Proponents of modern-day allocations pushed again, saying belongings like fastened revenue enable particular person buyers to raised match monetary features with future obligations. Furthermore, diversified portfolios gained out from 2000 to 2008, a interval when shares noticed their values minimize in half on two separate events.

“Diversification is your finest pal in your worst day,” mentioned David Kelly, chief international strategist at J.P. Morgan Asset Administration. “The correct asset allocation is a bit bit like dwelling insurance coverage. You by no means know while you’re going to want it, however you must by no means really feel snug not having it.”

That logic is partly what’s behind the choice by many big-money execs, who periodically shuffle holdings to be able to return to a desired degree of asset allocation.

In fact, pure returns are usually not the one factor that issues. One other consideration is how a lot turbulence have to be endured to be able to earn the revenue. Primarily based on a measure of risk-adjusted returns often known as the Sharpe ratio, Cambria’s international asset allocation mannequin has certainly performed higher than the S&P 500 since 1927.

The Fed’s Impression

However issues began to shift after the Federal Reserve rushed to the market’s rescue throughout the 2008 disaster. Since then, the S&P 500 has staged an virtually uninterrupted rally with largely subdued volatility, scoring the next Sharpe ratio.

“The query everybody has is, does it make sense to diversify?” mentioned Mayukh Poddar, senior portfolio supervisor at Altfest Private Wealth Administration. “Lots of people have develop into extra targeted on fairness market returns within the post-Covid period.”

Inside diversified portfolios, many purchasers are rising skeptical over the good thing about investing in small-cap and non-U.S. shares, in accordance with Que Nguyen, chief funding officer of fairness methods at Analysis Associates.

“What we’ve seen during the last 15 years is that the large will get greater,” she mentioned. “You don’t need all your eggs in a single basket, nevertheless it’s exhausting to maintain the religion.”

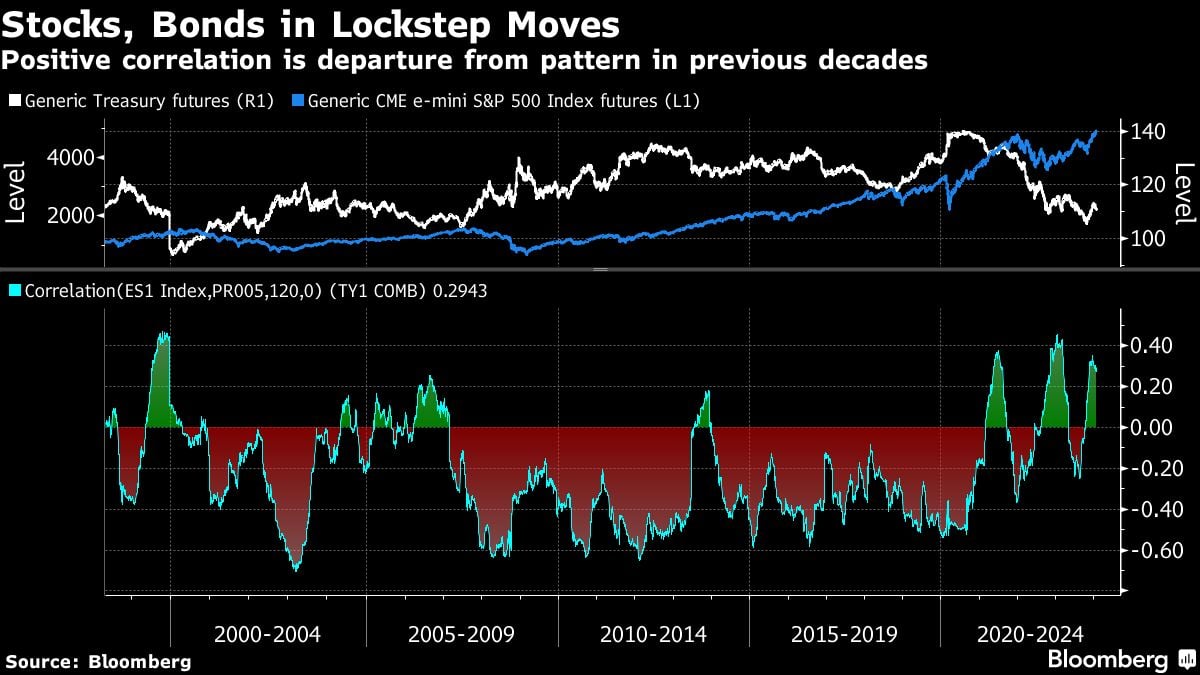

In some circles, fastened revenue’s haven standing is questioned too, after the asset class sank along with shares throughout 2022’s inflation-induced selloff.

Inflation is more likely to keep sticky, making bonds uncovered at a time when the federal government ramps up Treasury provide to fulfill fiscal wants, in accordance with David Rogal, a portfolio supervisor at BlackRock Inc.

“It’s very clear that the bond market has develop into much less dependable as a hedge in a portfolio,” Rogal mentioned in a latest panel dialogue hosted by MacroMinds Basis.

It’s tempting to name an finish to the fairness rally, given the prospect of stretched valuations and restrictive financial coverage. But the S&P 500 has saved its management this yr, delivering a acquire that’s once more forward of the remainder of the world and contrasts with losses in Treasuries.

There are indicators that American buyers are adapting to the brand new regime, together with a deepening dwelling bias and a willingness to let fairness holdings swell to data, in accordance with Cambria’s Faber. In the meantime, big-money managers are shifting to different belongings akin to privately held companies as a technique to juice up efficiency.

“There’s no end-expiration date on this” fairness increase, Faber mentioned. “Establishments have been leaning exhausting into this, however the savior that they’re on the lookout for is non-public fairness, which is basically U.S. shares.”

(Picture of Meb Faber; credit score: Bloomberg)