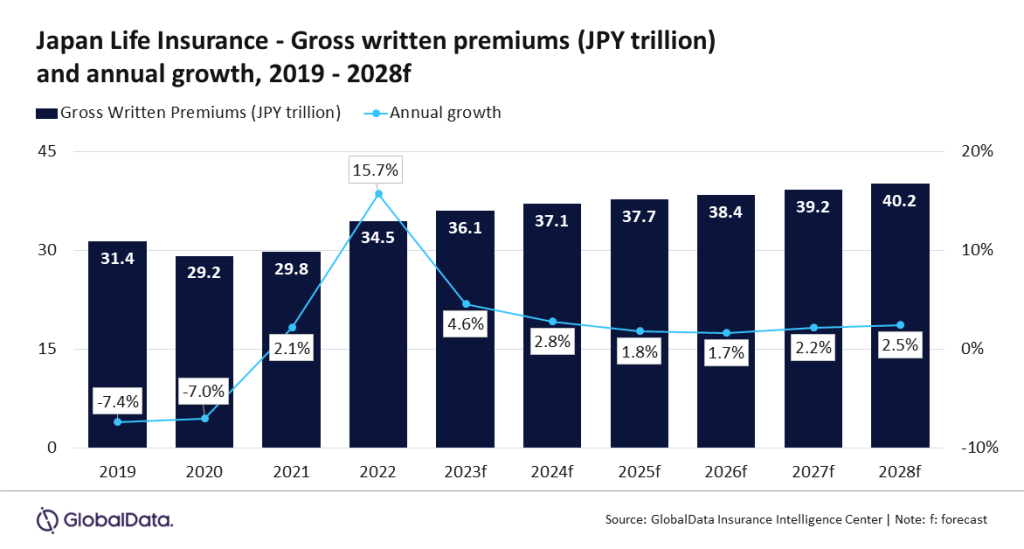

The life insurance coverage business in Japan is forecast to develop at a compound annual development price (CAGR) of two.0% from JPY37.1trn ($289bn) in 2024 to JPY40.2trn ($359.5bn) in 2028, when it comes to gross written premiums (GWP).

As well as, life insurance coverage in Japan is anticipated to row by 4.6% in 2023.

That is attributed to the revival of company distribution channels and protracted demand for single premium overseas currency-denominated insurance coverage merchandise.

In response to GlobalData, regulatory intervention in enhancing company requirements and growing competitors for higher market share in short-term insurance coverage may even assist development over 2024 to 2028.

Deblina Mitra, senior insurance coverage analyst at GlobalData, commented: “In Japan, companies are a outstanding distribution channel for all times insurance coverage merchandise. The channel witnessed a dip in income in 2020 and 2021 as a result of COVID-19 outbreak that restricted face-to-face interplay, resulting in slower business development.

“The business GWP recovered with double-digit development in 2022, primarily after the regulator reclassified COVID-19 underneath the much less extreme Class 5 infectious illness, resulting in a revival in company gross sales. The development is anticipated to proceed in 2023 and past, supporting business development.”

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

helpful

determination for your enterprise, so we provide a free pattern which you could obtain by

submitting the under type

By GlobalData

Moreover, the introduction of a brand new evaluate system in early 2023 for companies by the Life Insurance coverage Affiliation (LIAJ) will enhance buyer confidence and enhance transparency, thereby positively influencing the channel’s development over the subsequent 5 years.

Mitra added: “Nevertheless, the Financial institution of Japan‘s (BoJ) anticipated tightening financial determination in 2024, the place it’s projected to finish detrimental rates of interest, could trigger volatility in international capital markets. Any repercussions from this determination on overseas authorities bond yields or rates of interest can affect foreign-currency insurance coverage demand over 2024.”