What You Have to Know

- Traders are getting ready for a inventory transfer that might be the most important since March 2023, says Citigroup’s head of U.S. fairness buying and selling.

- The potential for a big swing across the CPI report and Fed resolution comes as volatility throughout markets has been traditionally restrained.

Wall Avenue’s most outstanding buying and selling desks from JPMorgan Chase & Co. to Citigroup Inc. are urging traders put together for a inventory market jolt this week after the newest inflation print and the Federal Reserve’s interest-rate resolution, each of which arrive on Wednesday.

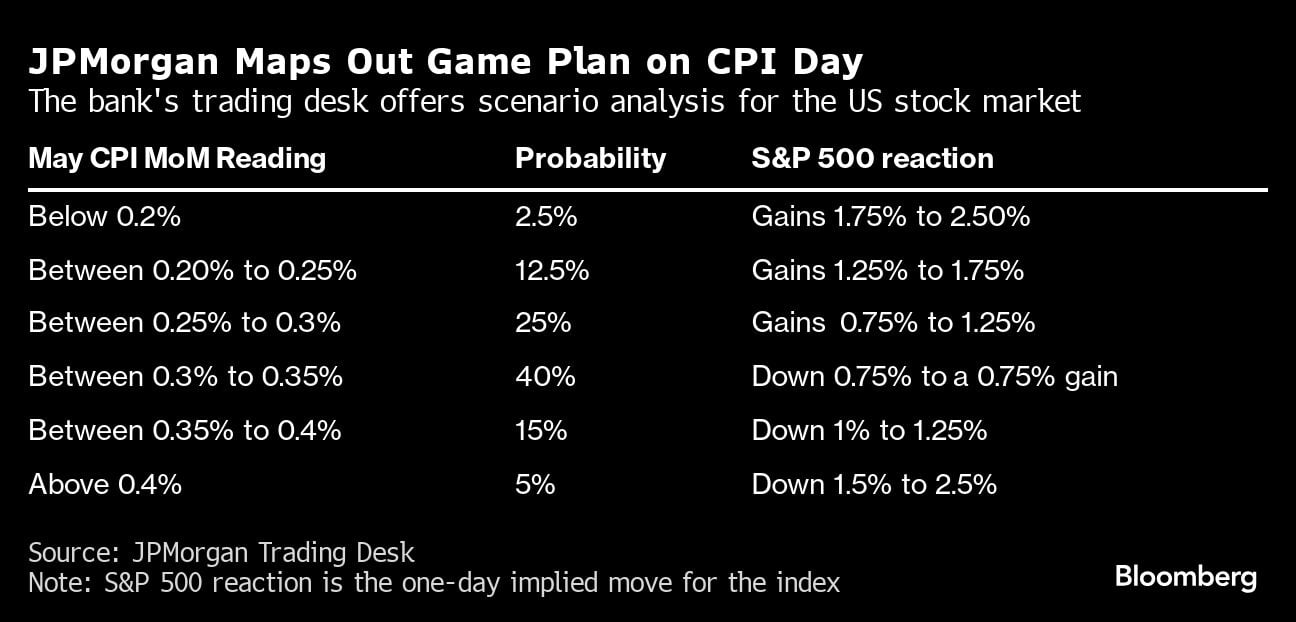

The choices market is betting the S&P 500 Index will transfer 1.3% to 1.4% in both course by Friday, primarily based on the worth of at-the-money straddles that expire that day, in line with Andrew Tyler, head of U.S. market Intelligence on JPMorgan Chase’s buying and selling desk.

This may come within the wake of the buyer value index report Wednesday and the Federal Reserve’s interest-rate resolution that afternoon.

“With CPI and Ate up the identical day there’s a chance of a CPI end result being reversed by Powell’s press convention,” Tyler and his staff wrote in a word to purchasers on Monday.

In the meantime, traders are getting ready for a Fed day stock-market transfer that will be the largest since March 2023, in line with Stuart Kaiser, Citigroup’s head of U.S. fairness buying and selling technique.

If month-over-month core CPI tops 0.4%, that will doubtless spur a selloff throughout all danger belongings, with the S&P 500 falling between 1.5% to 2.5%, in line with Tyler. However he sees only a 5% likelihood of that occuring.

The forecast for Could’s core CPI, which strips out the unstable meals and vitality parts and is seen as a greater underlying indicator than the headline measure, is projected to rise 0.3% from a month earlier.