Greater than 15 execs moved in management shuffle

After enterprise a complete overview of its organisational construction and administration groups, multinational insurer MAPFRE has introduced that it’s ushering in adjustments to higher adapt to the evolving and complicated enterprise panorama amid a mixture of financial, social, and geostrategic uncertainties.

Regardless of a enterprise mannequin that has confirmed efficient quarter by quarter, the corporate stated that it seeks to protect its management positions throughout numerous markets. To navigate the present world scenario, characterised by higher instability and unpredictability, the corporate is transferring in direction of less complicated and extra versatile constructions that prioritise its core operations, enhancing consumer relations and sustaining service excellence.

The reorganisation of the administration group entails a strategic mix of expertise and rising expertise, aiming to harness the total spectrum of administration capabilities and seize quite a few alternatives on the horizon.

Exec strikes for MAPFRE

The company appointments embody José Manuel Inchausti succeeding Ignacio Baeza as the primary vice chairman, and Fernando Mata taking up the function of third vice chairman whereas persevering with because the group’s CFO. Moreover, Raúl Costilla has been appointed because the group’s chief enterprise officer, answerable for directing the group’s gross sales and technical technique globally.

In an effort to simplify the company construction, Folks, Technique, and Sustainability have been built-in right into a single space led by Alfredo Castelo. The Company Inside Audit Space will see José Luis Gurtubay taking up from March 31, 2024.

Key appointments in Iberia embody Elena Sanz Isla as CEO of MAPFRE Iberia and Jesús Martínez Castellanos as deputy CEO and CEO of MAPFRE Vida.

The enterprise models bear adjustments as properly, with geographical areas like LATAM and EMEA built-in into a brand new unit referred to as Worldwide Insurance coverage, led by Eduardo Pérez de Lema. Miguel Ángel Rosa has been appointed CEO of MAPFRE RE, whereas Mónica García Cristóbal turns into CEO of Verti Germany.

The reorganisation extends to a number of group nations, with new CEOs appointed in Mexico, Brazil, the Dominican Republic, Chile, and Panama and Central America.

- Alberto Berges, MAPFRE Mexico CEO

- Óscar Celada, MAPFRE Seguros enterprise CEO

- Nelson Alves, MAPFRE Seguros deputy CEO of finance and enterprise assist

- Andrés Mejía, MAPFRE Dominican Republic CEO

- Eva Tamayo, MAPFRE Chile CEO

- Óscar Ortega, MAPFRE Panama and Central America CEO

These adjustments will take impact on Jan. 1, 2024, apart from the inner audit appointment.

“We’re laying the foundations of the corporate for the following 10 years,” stated Antonio Huertas, chairman and CEO of MAPFRE. “All the pieces we have now achieved to date, particularly monetary power, service excellence and proximity to the consumer, the give attention to folks and the reinforcement of our moral dedication and values, will likely be maintained as important and differentiating components of MAPFRE. However the atmosphere has modified, and we’re going to transfer ahead with a brand new, less complicated street map that offers us the pliability and talent we have to proceed holding management positions within the group’s important markets.”

MAPFRE Q3 2023 outcomes

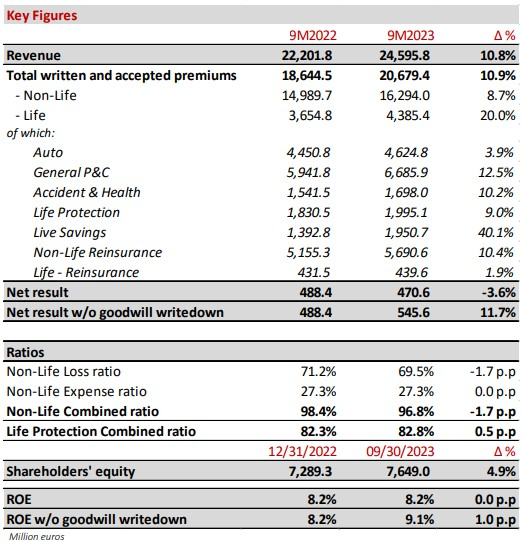

Moreover the most important administration shakeup, the corporate additionally revealed its financials for the third quarter of the 12 months. MAPFRE touted sturdy monetary efficiency for the primary 9 months of 2023 – a development persevering with from its final monetary report – showcasing vital development in each income and outcomes.

The ten.8% surge in income underscores the continuation of constructive developments witnessed in latest quarters, pushed by a considerable improve in enterprise quantity and enhanced monetary efficiency. Notably, premiums registered a ten.9% upswing, with minimal impression from alternate charge fluctuations (at fixed charges, premiums elevated by 12%).

This development mirrors a broad enchancment in enterprise, with non-life premiums rising by 8.7% and life premiums hovering by 20%. Key contributing elements to this development embody the areas of IBERIA and LATAM, in addition to the constructive efficiency of the Reinsurance enterprise.

Throughout the non-Life section, premiums skilled an increase of over €1.3 billion through the first 9 months of the 12 months. This development was significantly pronounced normally property & casualty (P&C) with a development charge of 12.5%, whereas accident & well being premiums elevated by 10.2%, and auto insurance coverage noticed a 3.9% rise.

Regardless of the financial state of affairs’s volatility and dispersion noticed in earlier quarters, the mixed ratio for non-life improved to 96.8%, marking a discount of 1.7 share factors. Basic P&C exhibited a commendable mixed ratio of 87.1%, which was 2.8% higher than the earlier interval. This helped compensate for ongoing challenges within the auto insurance coverage section, which had a mixed ratio of 105.9%, a slight enchancment of 0.3% in comparison with June.

Within the life enterprise, premiums surged by greater than €730 million, primarily pushed by life financial savings in Spain. The constructive efficiency on this line could be attributed to sturdy technical proficiency and sturdy monetary revenue, significantly in Latin America. The life safety mixed ratio remained wonderful at 82.8%. Consequently, the life technical-financial outcome witnessed a 7% enchancment.

Important occasions impacting monetary outcomes included the earthquake in Turkey within the first quarter, with a €105 million impression on the web outcome. This occasion primarily affected MAPFRE RE (€100 million) and had a minor impression on the native insurer (€5 million). In 2022, essentially the most related catastrophic occasion was the drought in Brazil, which had a web impression of €106 million on the Group. In 2023, a beneficial reinsurance market atmosphere and a milder hurricane season contributed to MAPFRE RE attaining a results of €190 million, doubling the earlier 12 months’s efficiency.

The third quarter additionally noticed two noteworthy financial occasions: a constructive web impression of €46.5 million ensuing from arbitration relating to the conclusion of the alliance with Bankia and a prudent €75 million provisional impression for a goodwill write-down for the corporate’s insurance coverage operations in the USA. This write-down, accounting for 11% of its e book worth, was made in response to rising rates of interest and difficult situations within the auto insurance coverage sector on account of inflation. The estimate for this goodwill write-down will likely be up to date at year-end based mostly on rates of interest and enterprise plans.

Concerning the funding portfolio, there have been no vital adjustments within the asset class construction through the third quarter. Realised positive aspects web of impairments had a €22.3 million impression on the web outcome for the interval, in comparison with €70.8 million in the identical interval in 2022.

“Our enterprise continues to point out robustness, each in income and premium development in addition to within the outcome, based mostly on a excessive stage of diversification and talent to adapt to the context. MAPFRE is overcoming the difficulties offered by inflation, due to steady enchancment based mostly on our technical administration,” Huertas stated.

What are your ideas on this story? Please be happy to share your feedback under.

Sustain with the newest information and occasions

Be a part of our mailing record, it’s free!