Getting your Texas insurance coverage license is not any easy feat. There are specific steps you should take. Discover out how one can ace every one on this information

Getting a Texas insurance coverage license is usually step one if you wish to pursue a profession as an insurance coverage skilled within the Lone Star State. Identical to in different states, the method isn’t all the time simple and requires you to satisfy stringent standards.

To information you thru your journey, Insurance coverage Enterprise provides you a walkthrough on the right way to get an insurance coverage license in Texas. We’ll go over the completely different roles that require one, the licensing necessities, and what it takes to retain your license.

If you wish to observe as an insurance coverage producer or adjuster in Texas, this information can show helpful. Learn on and discover out the steps you should take to acquire your Texas insurance coverage license.

All insurance coverage producers and claims adjusters who want to observe in Texas are required to get the corresponding licenses. Earlier than you are able to do so, the Texas Division of Insurance coverage (TDI) has laid down the next eligibility standards:

- you have to be at the least 18 years outdated

- you have to be a resident of Texas

- it’s essential to cross the state licensure examination for the insurance coverage traces you propose on specializing in

- it’s essential to not have dedicated any offense that might be grounds for denial, suspension, or revocation of your license

Right here’s a step-by-step information on the right way to safe your insurance coverage license if you wish to change into an agent, dealer, or adjuster within the state.

Step 1: Work out which sort of insurance coverage license you want.

You may have a number of choices if you wish to pursue an insurance coverage profession within the state. In accordance with the TDI, three of the most typical licenses that insurance coverage professionals apply for in Texas are for:

- Basic traces – life, accident, and well being (LA&H): this license lets you promote life insurance coverage, together with annuities, in addition to medical health insurance.

- Basic traces – property and casualty (P&C): this license provides you the authority to promote residence, auto, industrial, legal responsibility, and different private traces protection.

- All traces adjuster: the most typical license for adjusters, this license lets you assess and examine a broad vary of claims, together with property and casualty, and employees’ compensation.

When you’ve selected a profession path, you’ll be able to proceed to the following step. Should you want extra details about these roles, these guides on the right way to change into an insurance coverage producer and what it takes to change into a claims adjuster may also help.

Step 2: Put together for the state licensure examination.

Not like in different states, Texas doesn’t all the time require aspiring insurance coverage brokers and brokers to finish a pre-licensing course. Which means that making ready and learning for the state licensure examination is completely as much as you.

These assessments, nonetheless, aren’t straightforward. The newest knowledge from Pearson VUE – TDI’s examination administrator accomplice – exhibits that for the three most typical licensure exams, the passing charges are:

- Basic traces – life, accident, and well being: 49%

- Basic traces – property and casualty: 54%

- All traces – adjuster: 57%

These figures present how necessary ample preparation is to cross the take a look at.

Aspiring insurance coverage brokers also can apply for a brief license previous to taking the state examination if their sponsoring firm or company requests it. Candidates, nonetheless, should full 40 hours of pre-licensing training inside 14 days of their utility for a 90-day short-term license and inside 30 days for a 180-day license.

Claims adjusters, in the meantime, should end 40 hours of pre-licensing coursework previous to taking the licensure take a look at.

Pearson VUE has ready this insurance coverage content material define to information aspiring insurance coverage professionals on what subjects to check for the state examination.

Step 3: Ebook your take a look at schedule.

Probably the most environment friendly manner so that you can schedule your examination is to guide it on-line on Pearson VUE’s web site. You should achieve this at the least 24 hours earlier than your most popular take a look at date. The identical goes if you wish to make a cellphone reservation. You’ll be able to contact the examination administrator at (888) 754-7667 to guide a slot.

You’ll be requested to supply the next data:

- Authorized identify

- Handle

- Date of start

- Social Safety quantity

- Telephone quantity

- Kind of examination

- Most well-liked examination date

- Most well-liked testing location, which you could find in the back of this TDI handbook

Additionally, you will be charged a testing charge, which varies relying on the kind of examination. The charge for the three sorts of licenses talked about above – LA&H, P&C, and all traces adjuster – prices $43.

The examination administrator reminds all candidates that walk-in slots aren’t accessible. There are additionally no examinations scheduled throughout these holidays:

- New 12 months’s Day

- Martin Luther King, Jr. Day

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving

- Christmas

Holders of short-term licenses should take the examination earlier than their insurance coverage licenses expire.

Step 4: Cross the Texas insurance coverage license examination.

The Texas insurance coverage licensure examination covers a variety of subjects, making it among the many most tough assessments to take. Relying on the insurance coverage line, the examination could include 50 to 200 objects that you should reply inside one to a few hours. The passing rating is 70%.

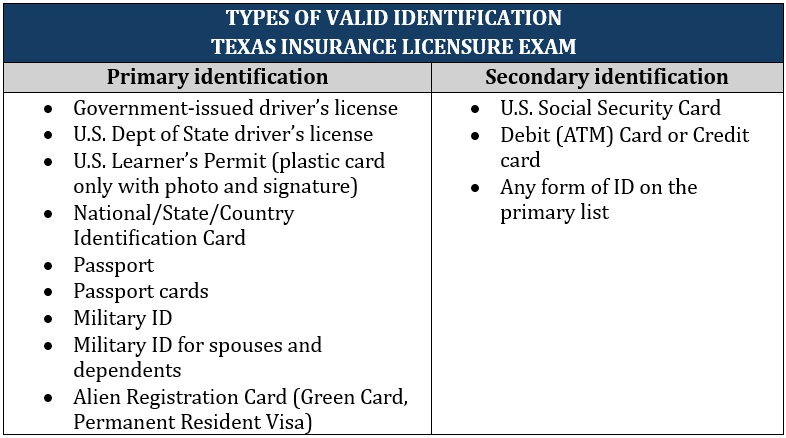

Be on the testing web site half-hour earlier than your scheduled take a look at to provide time for check-in procedures. You’ll be requested to supply two legitimate IDs, with at the least one which’s government-issued and bearing your photograph and signature. All IDs have to be in English.

Right here’s an inventory of the sorts of identification you’ll be able to current:

Latecomers and people who fail to current the required identification paperwork won’t be allowed to take the take a look at. Their testing charges will probably be forfeited.

The examination administrator permits latecomers and absentees to request for a change of schedule inside 14 days for the next causes:

- sickness, both of the examinee or their rapid member of the family

- loss of life of their rapid household

- disabling site visitors accident

- courtroom look or jury responsibility

- navy responsibility

- climate emergency

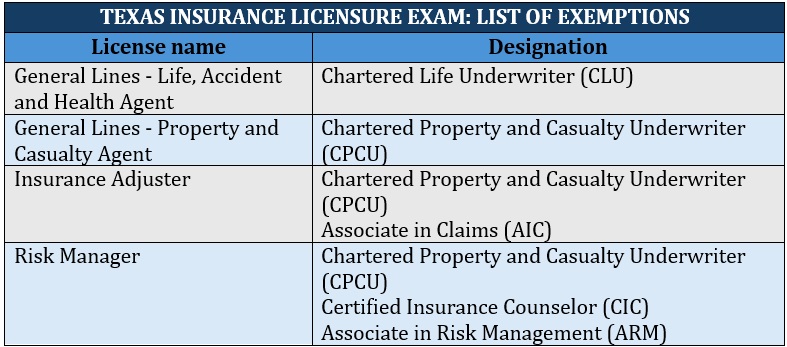

There are additionally insurance coverage professionals with sure designations who can skip the state examination:

Non-resident insurance coverage license holders from states that Texas has reciprocal agreements with are additionally not required to take the state licensure examination.

Step 5: Submit an digital fingerprint and full background examine.

All insurance coverage license candidates in Texas should present fingerprints previous to licensing to start out a background examine. You’ll be able to arrange a fingerprinting appointment by way of the IdentoGo web site or by calling the identification options supplier at (888) 467-2080.

The charge for fingerprinting companies is $39.70.

Make a reservation 24 hours upfront. Word that you’ll not obtain a printed fingerprint card. Your fingerprints and photograph will probably be despatched on to the Division of Public Security (DPS) and the Federal Bureau of Investigation (FBI) for background checks. Any misdemeanor or felony costs could influence your eligibility for a Texas insurance coverage license.

Step 6: Apply in your Texas insurance coverage license.

When you’ve handed the examination and efficiently accomplished a background examine, now you can apply in your license. You may have 12 months after the discharge of the take a look at outcomes to use for a license. If you wish to get a license in several traces of authority, it’s essential to submit the functions individually. Every submission prices $50.

The TDI will assessment your license utility and your background examine. The method can take between three and 5 weeks. If one thing comes up from the background examine, the division could contact you for an evidence. This could decelerate the method.

The TDI will inform you of the standing of your utility by way of e-mail. If authorised, your Texas insurance coverage license is legitimate for 2 years. As soon as it expires, you will have to have it renewed.

Some licenses require 24 hours of continuous training (CE) to be eligible for renewal. This consists of three hours of ethics-related coaching. At the least half of the CE credit have to be taken in a classroom.

How will you get a Texas insurance coverage license?

Should you want to pursue an insurance coverage profession in Texas, whether or not as a producer or an adjuster, there are particular steps you should take. Right here’s a abstract of your complete course of:

- Step 1: Resolve on which line of authority to specialise in. This may decide what licenses you will have.

- Step 2: Put together for the state licensure examination. Not like in most states, you’re not all the time required to finish pre-licensing training to take the Texas insurance coverage licensure examination. Which means that learning and making ready for the take a look at is all as much as you.

- Step 3: Ebook your take a look at schedule. Do that at the least 24 hours earlier than your most popular date. Stroll-ins aren’t allowed to take the examination.

- Step 4: Cross the Texas insurance coverage license examination. The assessments consist of fifty to 200 objects that have to be accomplished inside one to a few hours. The passing rating is 70%.

- Step 5: Submit an digital fingerprint to start out your background examine. Any fraud or felony costs can influence your eligibility for an insurance coverage license.

- Step 6: Apply in your Texas insurance coverage license. The TDI will assessment your utility. The method lasts about three to 5 weeks however could take longer if points come up in your background examine.

As soon as authorised, you should renew your license and full sure hours of continuous training each two years.

How a lot does it value to get your insurance coverage license in Texas?

Testing charges for the Texas insurance coverage licensure examination value between $23 and $43, relying on the kind of license you’re taking the take a look at for. Fingerprinting companies value round $40, whereas the license utility charge is $50.

These three processes collectively can value you round $113 to $133. This quantity doesn’t embrace charges for taking pre-licensing coursework, which is required for adjusters and brokers with short-term licenses. It additionally excludes charges for persevering with training.

How lengthy is a Texas insurance coverage license good for?

Your Texas insurance coverage license is legitimate for 2 years. You should renew your license after this era. Sometimes, you’re required to take 24 hours of continuous training to qualify for license renewal. You should additionally settle any fines or charges which can be due.

What disqualifies you from getting an insurance coverage license in Texas?

The TDI bars anybody who has been convicted of a felony or has engaged in fraudulent or dishonest actions from getting an insurance coverage license.

How a lot are you able to make with a Texas insurance coverage license?

One of many causes that makes a profession in insurance coverage engaging is the sturdy incomes potential that comes with it. Insurance coverage brokers and adjusters can earn earnings in a wide range of methods, together with commissions, salaries, and revenue sharing.

How a lot they make, nonetheless, is determined by how profitable they’re in establishing relationships with shoppers. Their dedication and laborious work even have a significant influence on their earnings.

What do you consider the method of getting a Texas insurance coverage license? Is getting an insurance coverage license in Texas value it? Chat us up within the feedback part beneath.

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!