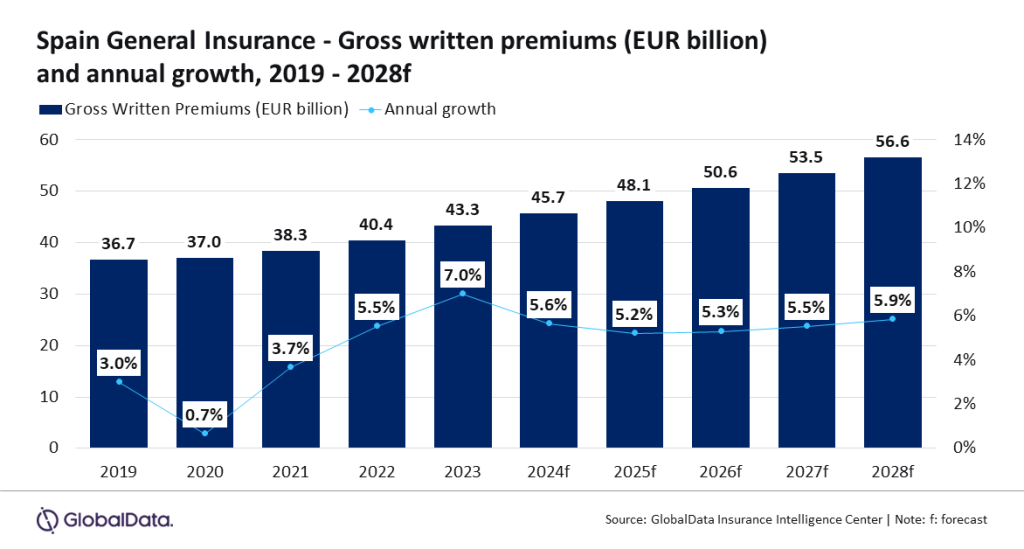

The final insurance coverage trade in Spain is about to develop at a CAGR of 5.3% from EUR45.7bn ($48.5bn) to EUR56.6bn ($60.4bn) in 2028, by way of GWP.

That is based on GlobalData, which additionally predicts that normal insurance coverage in Spain will develop by 5.6% in 2024 and 5.2% in 2025.

Progress shall be primarily backed by private accident and well being (PA&H), motor and property insurance coverage segments, which make up round 78.4% of complete normal insurance coverage GWP in Spain.

Anurag Baliarsingh, insurance coverage analyst at GlobalData, defined: “The final insurance coverage trade in Spain continued its development development for the third consecutive yr and grew by 7% in 2023, its highest development over the past 5 years. The expansion was pushed by rising demand for personal medical health insurance, prompted by insufficient public healthcare, a restoration in car gross sales, and rising investments in infrastructure.

“Nevertheless, with the Spanish financial system anticipated to develop at a slower tempo of 1.4% in 2024 and 1.6% in 2025, the final insurance coverage trade will witness slower development over the subsequent two years.”

PA&H insurance coverage is the main line of enterprise within the Spanish normal insurance coverage sector. It’s anticipated to have a 29.8% share of normal insurance coverage GWP in 2024 and anticipated to develop by 5.3% in the identical yr. That is attributed to a rise in demand for personal medical health insurance.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nevertheless, we would like you to take advantage of

helpful

choice for what you are promoting, so we provide a free pattern you could obtain by

submitting the beneath kind

By GlobalData

In accordance with the Spanish Union of Insurance coverage and Reinsurance Entities (UNESPA), round 2.3 million individuals opted for personal medical health insurance in 2023.

Because of this, the share of the inhabitants choosing non-public medical health insurance elevated from 19.2% in 2022 to 30% in 2023. Elements resembling physician on demand and protection of psychological well being have performed a pivotal function within the demand of personal medical health insurance. PA&H insurance coverage is anticipated to develop at a CAGR of 4.9% between 2024 and 2028.

Moreover, motor insurance coverage is the second largest line of enterprise, anticipated to account for 28.4% share of normal insurance coverage GWP in 2024. Motor insurance coverage GWP is anticipated to develop by 5.2% in 2024, pushed by rising car gross sales.

In accordance with the Spanish Affiliation of Car and Truck Producers (ANFAC), passenger automobile gross sales grew by 7.8% throughout January-April 2024 as in comparison with the identical interval over the earlier yr.

Baliarsingh added: “The final insurance coverage trade in Spain is anticipated to witness an upward development development from 2025 onwards, propelled by financial restoration and elevated demand of personal medical health insurance. Rising prices as a result of inflation will immediate insurers to reassess their threat publicity and enhance premium costs within the quick time period.”