Can Footage Assist?

To higher illustrate how visible aids may also help simplify advanced info, let’s talk about an property planning technique that has risen in recognition given the present excessive rate of interest atmosphere and potential discount of federal reward and property tax exemptions topic to tax legal guidelines sunsetting in 2026.

For prime-net-worth and charitably inclined people, the usage of a charitable the rest annuity belief has turn out to be interesting. The belief may be funded and set as much as present an instantaneous revenue profit for both the donor or beneficiaries of the donor over both a set time frame or the lifetime of the beneficiaries, and the belief will go by the rest belongings to a qualifying charity on the finish of the belief time period.

There are shifting items concerned for which a visible instance can be utilized to raised join them to kind a whole image, comparable to:

- How a lot of a charitable deduction the donor would probably be entitled to say for the switch made to the belief ($192,776 primarily based on a present of $500,000 made to a 15-year belief utilizing the April 2024 Part 7520 rate of interest of 5.2%)

- How a lot the donor or revenue beneficiaries would anticipate to obtain on an annual foundation ($30,000 annuity funds primarily based on a 6% cost charge and a $500,000 reward)

- How investing belongings prudently throughout the belief may end in a good larger quantity than was initially gifted being transferred to a qualifying charity to assist fulfill the consumer’s future philanthropic wants ($771,521 being transferred to a qualifying charity in 2039 assuming an 8% charge of return).

The Influence of Visuals on Confidence

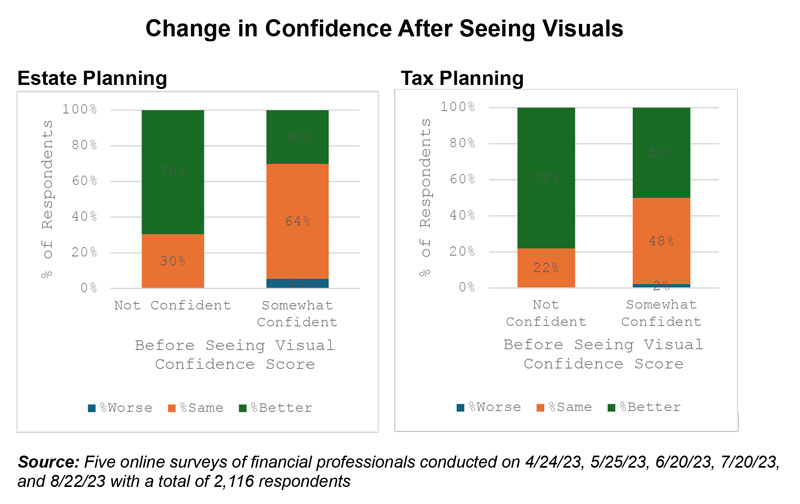

Within the unique surveys, we offer context on a given tax or property planning technique to gauge how the monetary professionals’ confidence on the respective matter modifications after being guided with visible components.

Even excluding those that indicated they had been assured or very assured — as a result of the usage of visible aids is unlikely to have an effect on confidence ranges as their perceived or precise want for these instruments can be low — we will see an enchancment in confidence, particularly amongst monetary professionals who weren’t assured, as nicely those that had been solely considerably assured.

Conclusions

Using sensible examples of planning eventualities is nothing new — most textbooks and information articles are full of them — however they’re delivered primarily by the written phrase. Provided that many individuals have a desire for visible studying, and are in a position to higher recall info that was consumed visually over longer durations of time, it’s not stunning that the usage of visuals can improve confidence ranges amongst monetary professionals as nicely.

If the usage of visible aids can improve confidence within the information of a specific planning idea, advisors could be extra more likely to deliver up mentioned technique in response to a prospect inquiry. They may even be extra proactive of their recommendation supply and search alternatives to create instructional moments that can resonate with the purchasers they serve.

David Blanchett, pictured at left, is managing director and head of retirement analysis for PGIM DC Options, the worldwide funding administration enterprise of Prudential Monetary Inc. Ross Riskin is the chief studying officer at Investments & Wealth Institute.