GlobalData findings reveal that e-scooter insurance coverage penetration charges are low, regardless of the elevated development of motorbike and e-scooter sharing and possession in city areas. Nevertheless, the quickly altering mobility ecosystem will push insurers to rethink their merchandise, together with exploring new advertising and marketing avenues to serve potential clients.

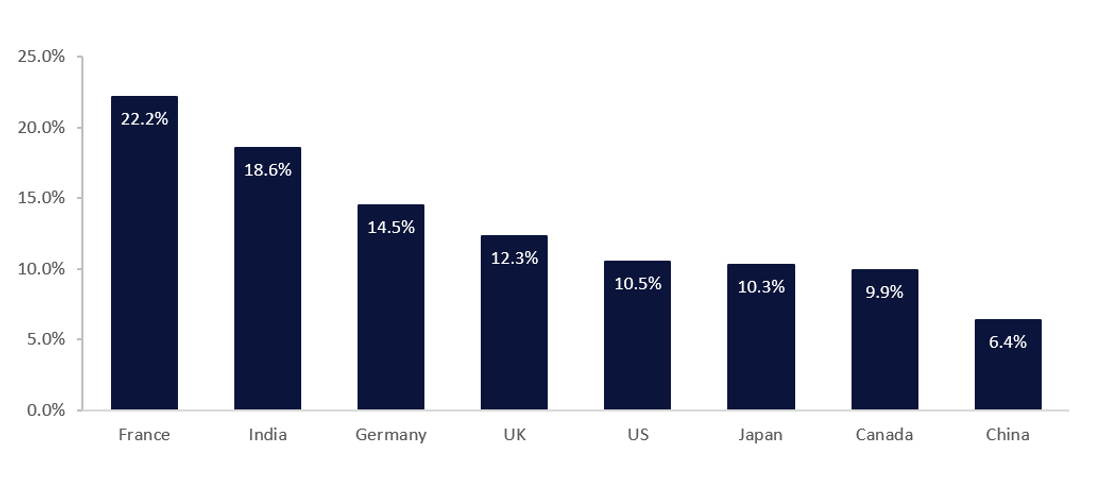

Leases are generally related to micromobility, however privately owned micromobility autos can supply insurers recent avenues for brand new enterprise. In response to GlobalData’s 2023 Monetary Companies Shopper Survey, e-scooter insurance coverage penetration charges differ considerably by nation however stay worryingly low even in nations the place there’s a authorized requirement to carry insurance coverage. France has one of many highest e-scooter insurance coverage penetration charges globally, standing at 22.2%. Nevertheless, contemplating that riders are legally required to carry insurance coverage, this charge is disappointing. In Germany, insurance coverage holding can be a should to make use of e-scooters, however the charge is even decrease.

Regulators haven’t been capable of sustain with the fast development of the e-scooter market, however laws surrounding the usage of e-scooters will immediate extra insurers to develop new merchandise. There are additionally discrepancies on the place people can experience e-scooters. In some nations, e-scooters needs to be used on pavements reasonably than roads, rising the chance of a rider injuring a pedestrian—notably as riders can navigate a lot quicker than pedestrians. On this respect, motor and fleet insurer AND-E has launched a brand new tagline, “Each Journey Protected,” because it focuses on related mobility safety. The insurer goals to offer merchandise that guarantee each journey—no matter its form or objective—is secure and safe. It presents safety for journeys with e-scooters, e-bikes, and e-cargo bikes, in addition to car-sharing and car-pooling companies. AND-E goals to offer a robust buyer expertise by way of easy insurance policies and simple claims processes. As governments globally implement measures to lower the variety of autos on roads with a view to cut back CO₂ emissions, and the price of automobile possession soars, the mobility ecosystem will proceed evolving. On the identical time, extra shoppers will embrace greener and extra handy modes of transport. These developments will create important development alternatives for insurers, with rising laws additionally driving development. Insurers that may cater for the rising micromobility house early usually tend to seize a bigger share of the market.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

useful

choice for your corporation, so we provide a free pattern you can obtain by

submitting the under type

By GlobalData