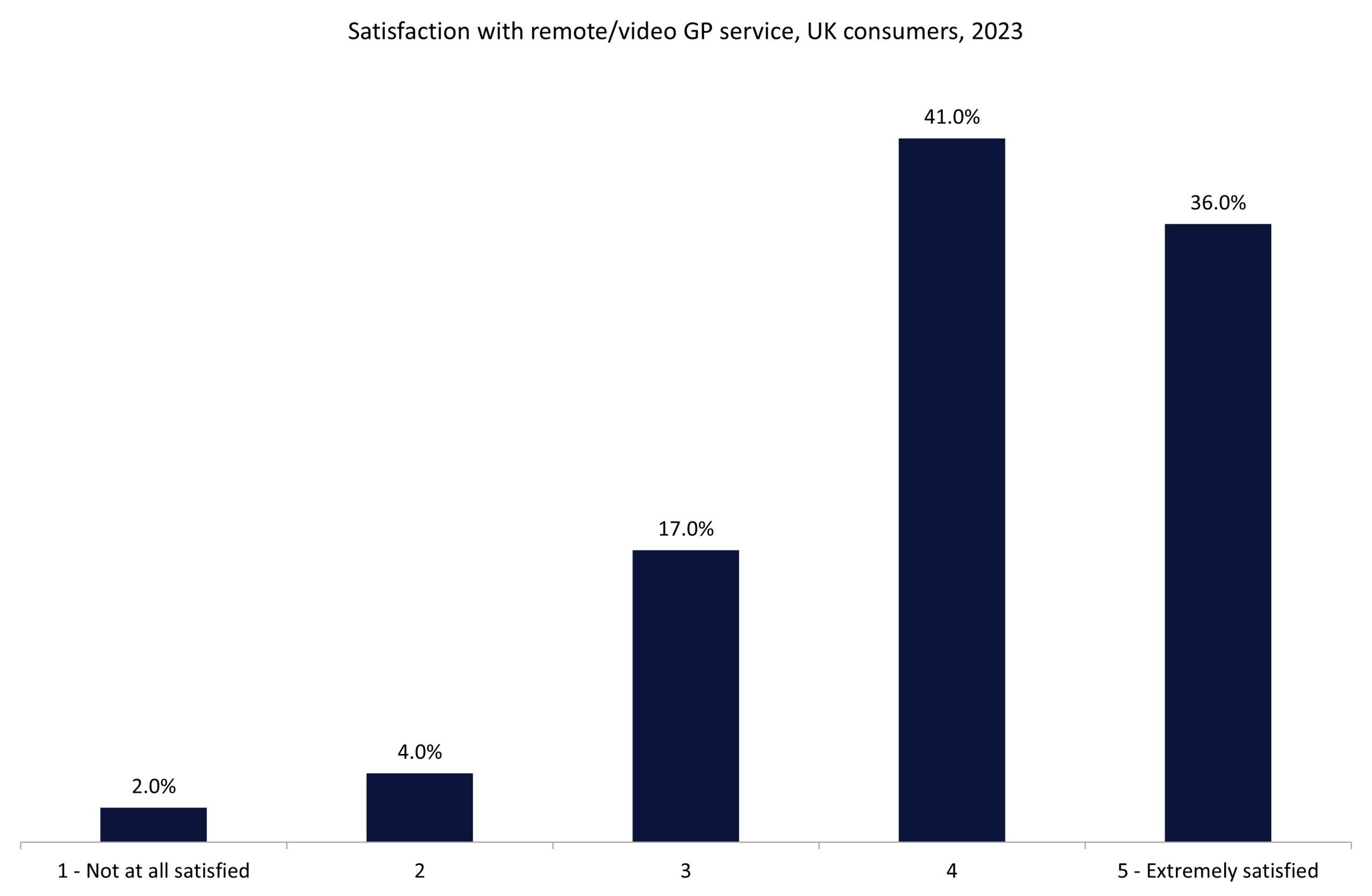

Scottish Widows just lately reported a 62% improve in the usage of its well-being app in 2023 in comparison with the yr earlier than. GlobalData surveying means that encouraging insurance coverage policyholders to utilise such instruments can improve buyer satisfaction. GlobalData’s UK Insurance coverage Shopper Survey signifies that 77% of shoppers who use a distant GP service are glad with the service they obtain.

Properly-being apps have gotten more and more prevalent all through UK well being and life insurance coverage. Better digital consciousness and proficiency amongst insurers’ buyer bases, in addition to rising stress on the NHS within the UK, is driving this uptick in utilization. Particularly, insurers are tapping into the prevalence of smartwatches and different gadgets to assist shoppers preserve wholesome existence, supply advisory providers, and supply easy medical help. Within the personal medical insurance coverage area, 25.2% of shoppers indicated to GlobalData’s 2023 UK Insurance coverage Shopper Survey that they bought the product as a result of considerations over NHS ready occasions or providers. Distant providers are sometimes seen as a great way of serving to docs see extra sufferers, in addition to permitting for distant monitoring (liberating up hospital mattress area) and growing accessibility for much less cellular sufferers. GlobalData’s survey additional finds that, of the 35% of policyholders who used a distant/video GP service, 77% of them had been glad with it.

Scottish Widows’ breakdown of shoppers who used their well-being app, Clinic in a Pocket, reveals that 58% of customers had been aged between 26 and 45. This supplies additional credence to the suggestion that digitally savvy (youthful) policyholders are extra inclined to make use of such providers. Scottish Widows is a top-ten supplier of whole-of-life assurance within the UK (4.8% market share), based on GlobalData’s 2023 UK Insurance coverage Shopper Survey. Making continued use of such instruments, in addition to its collaboration with RedArc, the nursing service supplier, will assist to take care of renewals over the approaching interval in addition to present a key level of distinction in attracting new enterprise. Insurers and clients are beginning to see the advantages of integrating expertise into well being and life insurance coverage providers. As expertise continues to enhance and additional capabilities (presumably pushed by synthetic intelligence) emerge, gamers ought to proceed to implement such capabilities into their choices. Prospects evidently use and revel in such providers, serving to insurers to enhance policyholders’ well being and existence whereas additionally creating efficiencies throughout prognosis, triage, and declare evaluation.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

helpful

determination for what you are promoting, so we provide a free pattern which you can obtain by

submitting the under kind

By GlobalData