What You Must Know

- Traders aren’t seeking to hit the promote button simply but, however half count on a correction of a minimum of 10% this yr.

- The survey’s median projection is for the S&P 500 to complete 2024 at 5,606, virtually 3% above Friday’s shut.

- The lop-sided rally in shares has additionally created huge distortions available in the market.

The S&P 500 Index has doubtless logged a lot of the positive aspects it is going to see this yr as buyers are rising more and more nervous in regards to the inventory market’s wealthy valuations, in keeping with the newest Bloomberg Markets Dwell Pulse survey.

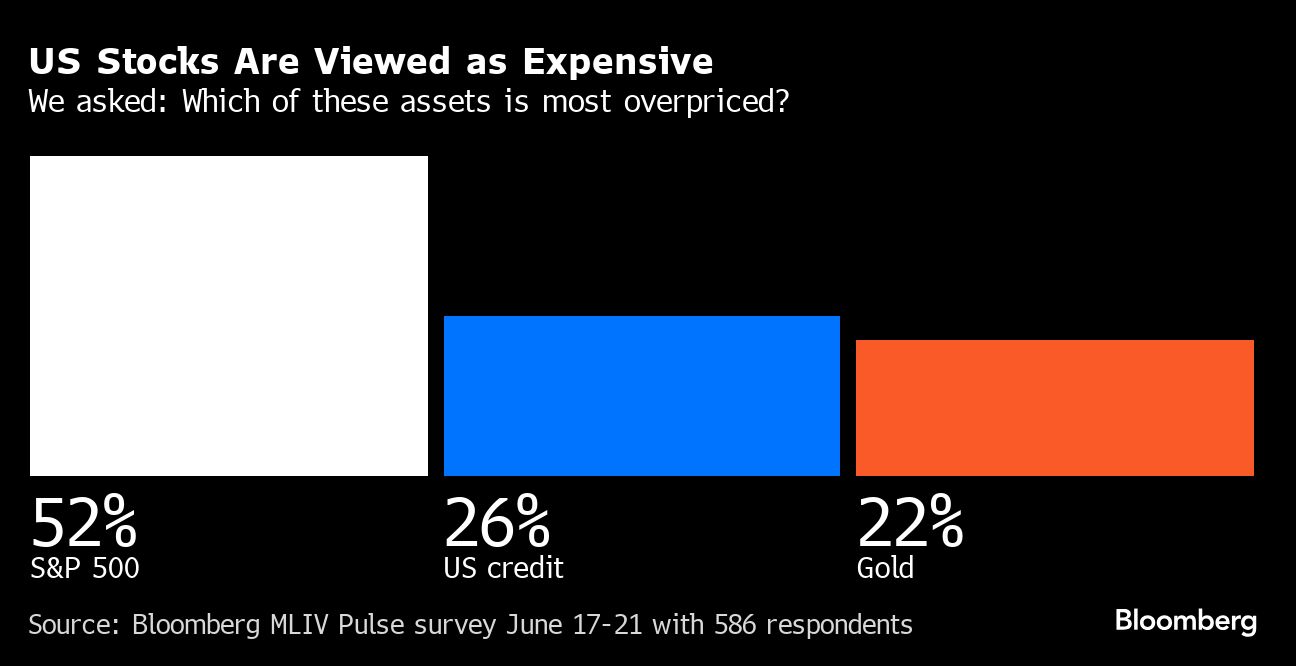

The 2024 rally, which has pushed the U.S. fairness benchmark to 31 document closing highs, has left the asset class extra overpriced than U.S. credit score or gold, a majority of the 586 respondents stated.

After hovering roughly 50% since October 2022, pushed by know-how shares, the bull market has delivered a better advance than the median of its predecessors going again to 1957.

Traders aren’t seeking to hit the promote button simply but, however indicators of skittishness are evident as about half of survey takers say shares will see the start of a correction of a minimum of 10% this yr, with 35% saying that can occur in 2025.

That overarching sense of warning can be obvious within the choices market, the place merchants have been constructing hedges in opposition to potential losses in tech shares.

With the economic system and earnings nonetheless rising, and ample liquidity sloshing round within the monetary system, most ballot members see scope for added positive aspects this yr, however solely a modest quantity.

The survey’s median projection is for the S&P 500 to complete 2024 at 5,606, virtually 3% above Friday’s shut. That’s a cheerier view than Wall Road strategists’ median goal, which is for the index to be little modified from present ranges at year-end.

About three quarters of members say they’ll keep or enhance their publicity to the S&P 500 over the subsequent month. It is sensible to journey the bullish wave in the intervening time, Ned Davis Analysis’s Ed Clissold and Thanh Nguyen wrote in a June 20 observe.

They’ve doubts, nevertheless, because the yr goes on, given all of the questions buyers face within the second half, round all-important areas such Federal Reserve coverage and the U.S. elections.

“Keep an obese place in equities for now,” they wrote. “However put together for extra defensive positioning, doubtlessly within the third quarter.”

As a measure of equities’ lofty valuation, Michael O’Rourke at JonesTrading factors to the S&P 500’s market capitalization relative to the scale of the economic system. Since round 1990, that ratio has solely been greater when shares have been surging in 2021.

“We’re in a bubble and there may be an outsized danger that the economic system lastly slows down within the second half of the yr and multiples ought to contract,” stated O’Rourke, the agency’s chief market strategist. “These are very harmful ranges for long-term buyers to be shopping for shares.”

Synthetic intelligence, a key driver of the market’s virtually 15% advance this yr, is seen because the most certainly set off for a selloff, with 31% of survey respondents on alert for a adverse shock on that entrance.

Tech shares within the so-called Magnificent Seven basket — led by AI darling Nvidia Corp. — have dominated revenue progress, though within the evaluation of Bloomberg Intelligence their affect is more likely to wane within the months forward.