What You Have to Know

- Sinead Colton Grant expects the rally to broaden based mostly on sturdy earnings progress and financial momentum.

- BNY Mellon Wealth is obese U.S. large-cap shares, preferring them to worldwide and emerging-market equities.

- Earnings are the important thing for shares to rise from right here, and the group sees 11% revenue progress in 2024.

The U.S. inventory market’s retreat from all-time highs set late final month is giving buyers parked in money a gap to purchase in, in keeping with Sinead Colton Grant, chief funding officer of BNY Mellon’s wealth administration arm.

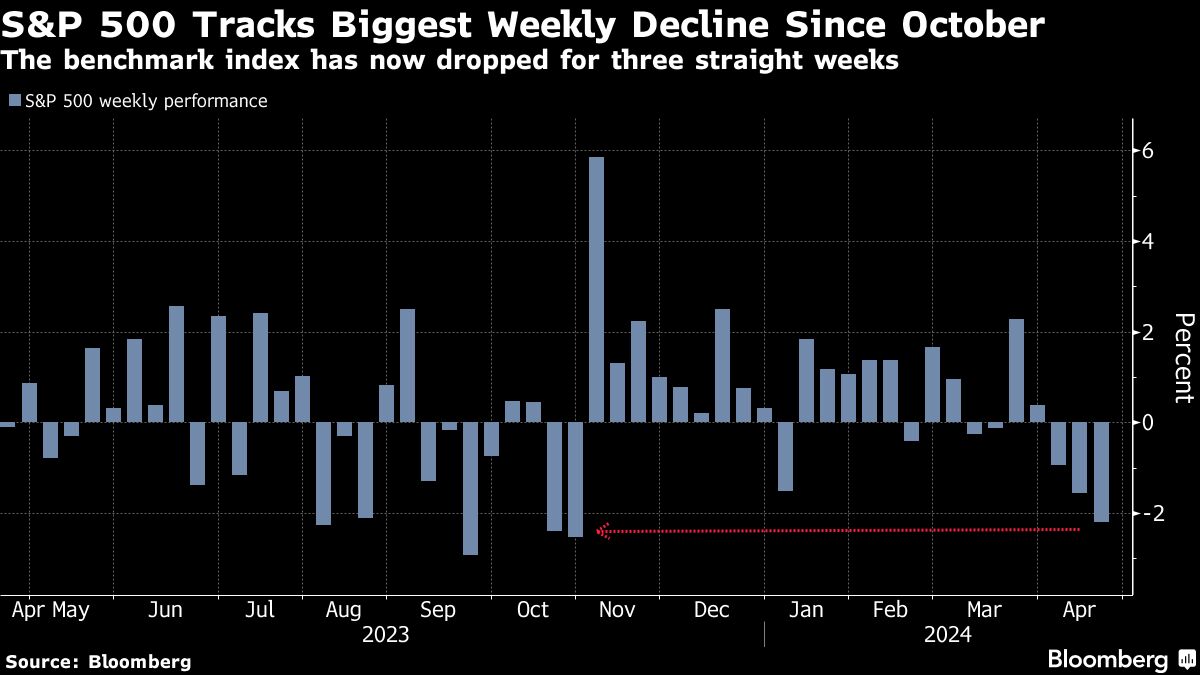

The three-week droop within the S&P 500 Index is a wholesome consolidation by merchants after it soared 10% within the first quarter, its greatest begin to a yr since 2019, on high of a 24% acquire in 2023, she stated.

From right here, Colton Grant expects the rally to not solely resume however broaden based mostly on sturdy earnings progress and persevering with financial momentum, doubtlessly pushing the S&P 500 past the upper finish of her 5,000-5,400 goal vary earlier than 2024 closes out.

“Historical past has so many examples wherein buyers waited to seek out absolutely the low they usually missed their second, so in case you have capital to deploy, it is a good level to begin including publicity,” she stated in an interview. “It’s an enchanting market, and the worst factor for buyers is to be fully in money.”

BNY Mellon Wealth Administration is obese U.S. large-cap shares, preferring them to worldwide and emerging-market equities.

Whereas American shares commerce at greater multiples than the remainder of the market, Colton Grant likes the free money stream larger firms generate. Specifically, she favors the know-how, well being care and industrial sectors.

The S&P 500 is on observe for a third-straight week of declines as buyers dial again their expectations for the Federal Reserve to scale back rates of interest after a sequence of sizzling inflation experiences.

Atlanta Fed President Raphael Bostic reiterated on Thursday that he doesn’t suppose cuts will probably be acceptable till the top of the yr.