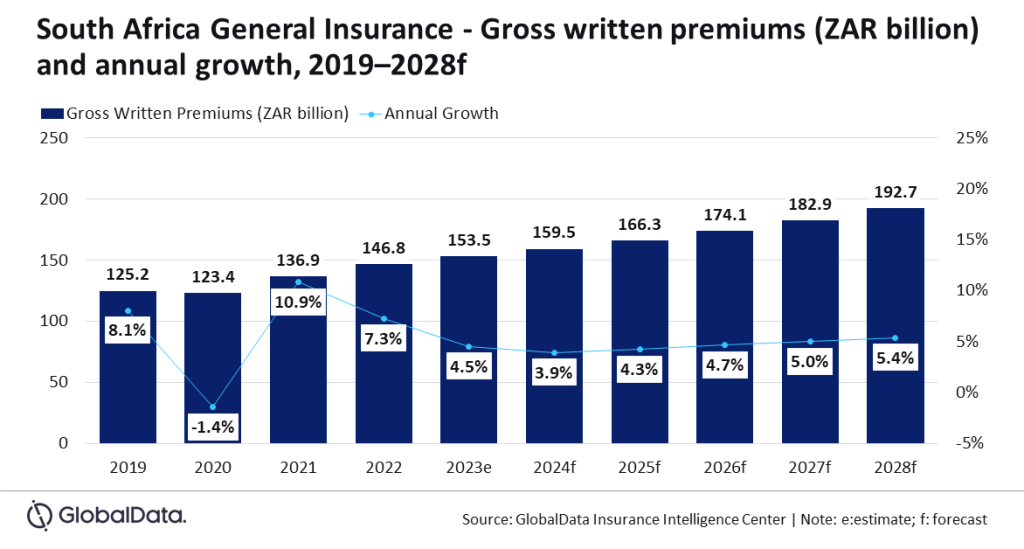

The final insurance coverage sector in South Africa is predicted to develop at a CAGR of 4.8% from ZAR159.5bn ($9.4bn) in 2024 to $10.4bn in 2028 when it comes to GWP.

That is in response to GlobalData, which additionally expects basic insurance coverage in South Africa to develop by 3.9% in 2024. The expansion is due to motor and property insurance coverage strains, which accounted for round 83.6% of the market in 2023.

Sravani Ampabathina, insurance coverage analyst at GlobalData, mentioned: “The South African basic insurance coverage trade’s development price slowed down by 2.8 proportion factors (pp) in 2023, pushed by weak enterprise sentiment, because the nation’s actual GDP grew marginally by 0.5% final yr. Whereas the slowdown is predicted to proceed in 2024, basic insurance coverage trade development is poised to realize traction from 2025 onwards according to the financial restoration.”

Motor insurance coverage is the chief in South Africa basic insurance coverage, making up 42.6% of the sector when it comes to GWP in 2023. It additionally grew by 4.8% in 2023 regardless of flat automobile gross sales.

As well as, motor insurance coverage development can also be anticipated to be pushed by elevated premium charges attributable to excessive situations of car theft. In accordance with Statistics South Africa, automobile theft incidences elevated to round 98,000 in 2022–23 from round 42,000 in 2021–22.

Furthermore, GlobalData forecasts motor insurance coverage to develop at a CAGR of 4.9% over 2024–28.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

choice for what you are promoting, so we provide a free pattern you can obtain by

submitting the beneath kind

By GlobalData

Ampabathina added: “Rising claims from nat-cat occasions have additionally prompted reinsurers to extend reinsurance charges. This may improve the premium charges of house and building insurance coverage insurance policies, which is able to help property insurance coverage development.”