What You Must Know

- Shares are heading into the second half having gained about 15% this yr.

- The S&P 500 has adopted up a constructive first-half return with a mean second-half acquire of 6%.

- Softening within the measure of inflation favored by the Fed highlights a slowing financial system that’s upping the chance of a coverage error by the central financial institution, Mohamed El-Erian mentioned.

Wall Avenue’s enthusiasm light within the last stretch of a stable quarter for shares that noticed the market hitting a number of all-time highs.

The S&P 500 was little modified after gaining virtually 1% earlier Friday. The Nasdaq 100 additionally misplaced steam after briefly surpassing 20,000 amid volatility in massive techs.

Treasury yields pushed increased, reversing a drop within the rapid aftermath of inflation knowledge that bolstered bets on Federal Reserve charge cuts.

Merchants saved a detailed eye on information relating to the U.S. presidential race, whereas remaining cautious forward of Sunday’s elections in France.

JPMorgan Chase & Co.’s Marko Kolanovic says the S&P 500 will falter in coming months within the face of mounting headwinds, from a slowing financial system to downward earnings revisions. The gauge is poised to plunge to 4,200 by year-end, a roughly 23% drop from Thursday’s shut, he mentioned.

“There’s a clear disconnect within the large run-up in U.S. fairness valuations and the enterprise cycle,” the strategist wrote, including that the S&P 500’s 15% year-to-date acquire isn’t justified, given waning progress projections.

The S&P 500 fluctuated after briefly topping 5,500 earlier Friday. Nvidia Corp. swung between good points and losses. Nike Inc. tumbled 20% on a disappointing outlook. Treasury 10-year yields rose six foundation factors to 4.35%.

Shares are heading into the second half having gained about 15% this yr. Traditionally, a powerful first half tends to be adopted by above-average second-half returns, in line with Adam Turnquist at LPL Monetary.

“Whereas elevated valuations, overbought situations, and underwhelming market breadth level to a possible pause forward, seasonal developments recommend momentum may proceed within the second half,” he famous.

The S&P 500 has adopted up a constructive first-half return with a mean second-half acquire of 6%, Turnquist added. Moreover, when first-half good points had been 10% or increased, the index posted common good points of seven.7% within the second half, with 83% of occurrences producing constructive outcomes.

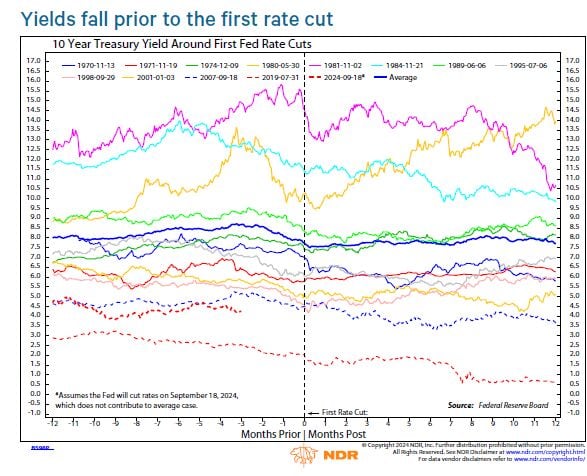

Supply: Ned Davis Analysis

Supply: Ned Davis AnalysisThe U.S. presidential election and its aftermath guarantees buyers massive market swings within the second half of the yr, says Goldman Sachs Group Inc.’s Scott Rubner.

The worldwide markets division managing director and tactical specialist has been accurately bullish on US shares in Might and June, however after July 17 he’s modeling a correction within the inventory market — this often means a couple of 10% drop for equities.

“I might be trying to trim publicity up right here submit July 4th,” Rubner wrote in a word to purchasers Friday.

Earlier within the session, merchants saved a detailed eye on financial knowledge.