Wall Road acquired a actuality examine on Tuesday, with hotter-than-estimated inflation knowledge triggering a slide in each shares and bonds.

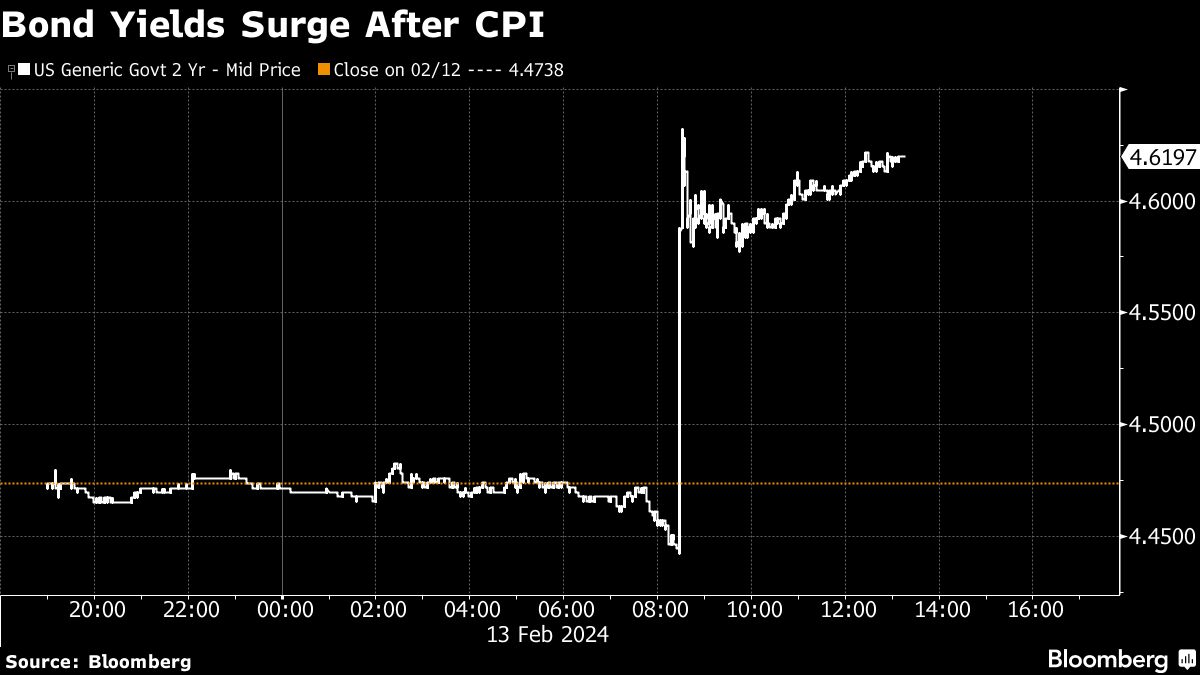

Equities moved away from their all-time highs after the core shopper worth index topped estimates and climbed probably the most in eight months. Treasuries bought off, with two-year yields hitting the best since earlier than the December central financial institution “pivot.”

Swap merchants all however deserted expectations for a Fed reduce earlier than July. And a measure of perceived danger within the U.S. investment-grade company bond market soared — with three issuers getting sidelined.

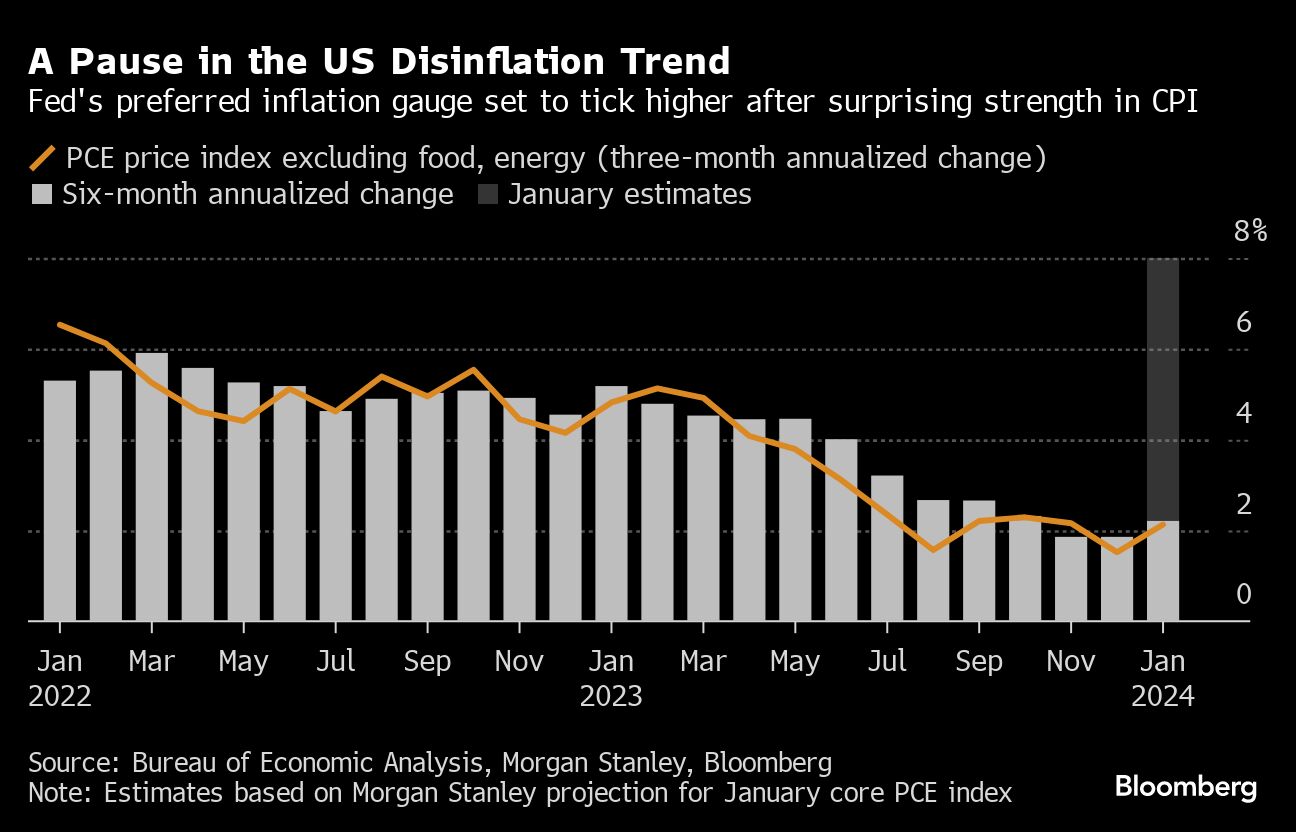

The CPI knowledge got here as a disappointment for buyers after a current downdraft in worth pressures that helped construct expectations for fee cuts this yr. The numbers additionally gave credence to the wait-and-see strategy highlighted by Jerome Powell and a refrain of Fed audio system.

“If Powell and different Fed members hadn’t already thrown chilly water on the prospects for a March fee reduce a couple of weeks in the past, right this moment’s CPI report may need performed that,” stated Jason Satisfaction at Glenmede. “Proof of still-sticky providers inflation is probably going to provide the Fed pause earlier than slicing charges too rapidly.”

Satisfaction says fee cuts are doubtless nonetheless on the desk for this yr, however they could start later than the market could also be anticipating.

The S&P 500 fell under 5,000, heading for its worst CPI day since September 2022. Fee-sensitive shares like homebuilders and banks sank, whereas Microsoft Corp. led losses in megacaps.

U.S. 10-year yields climbed 10 foundation factors to 4.28% — set for the best since November. The greenback rose and gold fell under $2,000.

“Whereas the door for a March reduce had already been successfully shut given the current Fed commentary and the roles reviews, the Fed has now locked the door and misplaced the important thing,” stated Greg Wilensky at Janus Henderson Buyers.

A lot of the unanticipated improve in CPI was concentrated in what seems like a “noisy soar” in House owners’ Equal Hire (OER) — a shelter worth indicator, based on Tiffany Wilding at Pacific Funding Administration Co. Whereas that may doubtless revert, the main points have been in step with the Fed having a “final mile downside” — and never slicing charges till midyear or later, she added.

Swap contracts referencing Fed coverage conferences — which as just lately as mid-January totally priced in a fee reduce in Might and 175 foundation factors of easing by the top of the yr — have been roiled. The chances of a Might reduce dropped to about 36% from about 64% earlier than the inflation knowledge, with fewer than 100 foundation factors anticipated this yr.

Fed officers are being confirmed proper of their “take it sluggish” strategy, based on Russell Value at Ameriprise. He says the primary fee reduce might come as early as June — but it surely might simply be July with no materials enchancment in near-term inflation traits.

The January CPI report is a reminder that inflation is a tough, not-well-understood downside that doesn’t transfer in a straight line, based on Chris Zaccarelli at Impartial Advisor Alliance.

“Bonds are too costly if inflation continues to be an issue and the inventory market can’t hold rallying if charges are going to be higher-for-longer — particularly if the belief that the Fed is totally performed elevating charges is inaccurate,” he added.

Previous to Tuesday’s knowledge, strategists at Citigroup Inc. famous that what was lacking was merchants hedging the chance of a really transient easing cycle adopted by fee will increase shortly thereafter.

If inflation proves to be sticky, the talk in regards to the Fed’s so-called impartial fee — which balances provide and demand — might resurface and spark the Treasury yield curve to steepen, they stated.