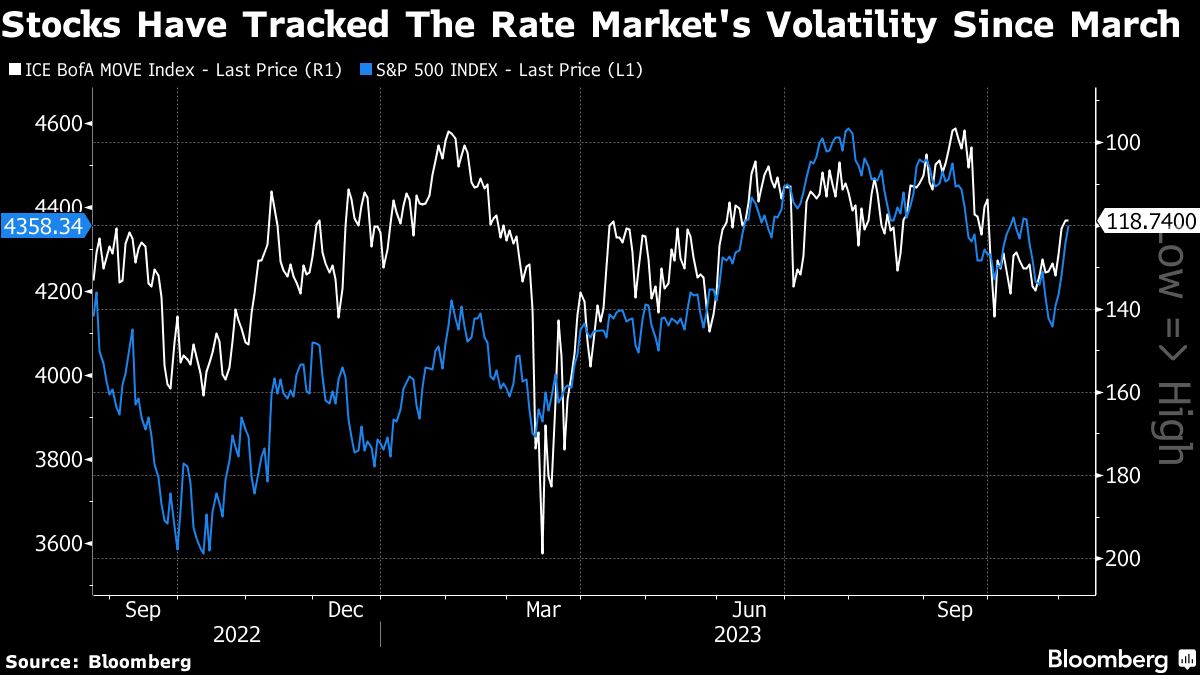

Shares prolonged their November rally as Treasury volatility abated, with merchants wanting previous disappointing consumer-sentiment information and the Federal Reserve’s efforts to downplay the market’s dovish bid.

The S&P 500 hit the important thing 4,400 mark, seen by some chartists as a resistance stage that might pave the way in which for extra features, if crossed. The gauge climbed over 1% and was on observe for a seven-week excessive.

The Nasdaq 100 rose 2% as Microsoft Corp. climbed towards a document and Nvidia Corp. rallied for an eighth straight day. Ten-year yields had been little modified, following a surge triggered by a weak 30-year bond sale and Jerome Powell’s “sterner” tone on coverage.

“Calm within the Treasury market” is what a sustained market rally would require, mentioned Tom Essaye, a former Merrill Lynch dealer who based The Sevens Report publication. “Brief, sharp declines are not any extra helpful for shares than quick, sharp rises.”

Wall Avenue continued to control the most recent remarks from U.S. officers, with Fed Financial institution of Atlanta President Raphael Bostic saying policymakers can return inflation to their aim with out the necessity to hike additional.

His San Francisco counterpart Mary Daly mentioned the U.S. central financial institution might must hike its benchmark lending fee once more if progress on inflation stalls whereas the economic system roars forward. Information Friday confirmed client long-term inflation expectations hit a 12-year excessive, whereas financial considerations weighed on sentiment.

Merchants ought to count on the Fed to focus on its dedication to the two% inflation goal, however the rise in long-run inflation expectations point out shoppers should not satisfied the Fed can fulfill its inflation mandate, based on Jeffrey Roach, chief economist for LPL Monetary.

“The buyer is feeling stretched between the dual pains of inflation and better rates of interest, making them much less optimistic about their present and future financial prospects,” mentioned Damian McIntyre, portfolio supervisor and head of multi asset options at Federated Hermes.

Emotional Reactions

Traders have softened their emotional reactions to information in latest weeks, with considerably much less volatility, and we count on the identical with the potential for a authorities shutdown subsequent week if a spending deal just isn’t struck,” based on Mark Hackett, chief of funding analysis at Nationwide.

“Traditionally, shutdowns have been quick in length and restricted in financial or market affect,” he famous.

The warning that pervaded fairness markets previously three months has now switched to “year-end greed” on expectations of a decline in US bond yields, based on Financial institution of America Corp.’s Michael Hartnett.

International shares recorded inflows of $8.8 billion within the week by means of Nov. 8, based on the notice citing EPFR International information. Nonetheless, money stays the asset class of selection, Hartnett mentioned. About $77.7 billion went into cash market funds within the week, setting them up for document annual inflows of $1.4 trillion.