GlobalData’s findings present that solely 32.6% of UK SMEs at the moment have a usage-based business car coverage, leaving a major alternative for insurers to faucet into the remaining two-thirds of companies. That is an space the place insurtech Flock continues to faucet into with its telematics choices.

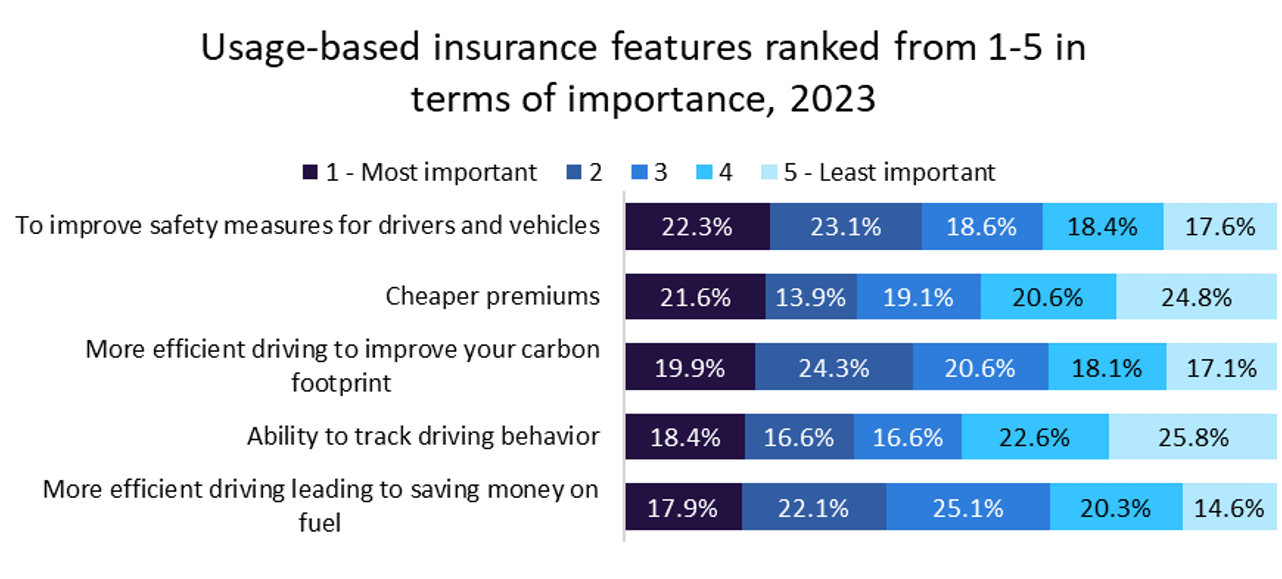

In response to GlobalData’s 2023 UK SME Insurance coverage Survey, 32.6% of SMEs have a usage-based coverage for his or her automobiles, displaying that roughly a 3rd of all SMEs are already utilising the advantages these merchandise present, but there may be nonetheless a possibility on the subject of the remaining two-thirds. GlobalData’s survey appears to be like at SMEs with usage-based business car insurance coverage, highlighting that enhancing security measures for drivers and automobiles is the usage-based characteristic considered most vital to companies (22.3% ranked it first). This means a powerful emphasis on prioritising the protection of drivers and the safety of automobiles. Telematics methods present real-time suggestions on driving behaviour, corresponding to dashing, harsh braking, and acceleration, permitting SMEs to leverage the expertise to watch and analyse driving patterns. Moreover, insurers can supply personalised suggestions to drivers, serving to them to enhance their driving abilities and scale back the chance of accidents.

Flock, an insurtech firm, has partnered with The Acorn Group to launch a brand new UK taxi fleet insurance coverage product that leverages car telemetry information to advertise safer driving practices. This revolutionary product targets medium-sized and huge taxi fleet corporations, together with public rent and personal rent automobiles, with the intention of tapping into the UK taxi fleet insurance coverage panorama. By providing premium rebates as incentives for safer driving practices, the partnership focuses on enhancing fleet security and cost-efficiency over time.

This opens the concept of the gamification of driving, corresponding to offering drivers with scores based mostly on their behaviour, thereby permitting insurers to incentivise protected driving practices by providing reductions or rewards to policyholders who reveal that they will drive responsibly. This method not solely promotes safer roads but in addition aligns to scale back claims and finally decreasing premiums for companies. That is an space that has seen elevated focus given the rising motor premiums lately. Insurers can discover revolutionary pricing fashions that reward protected driving behaviour with decrease premiums, making a compelling worth proposition for SMEs seeking to defend their drivers, automobiles, and funds.

By emphasising the advantages of telematics, selling safer driving practices by incentives, and providing revolutionary pricing fashions, insurers can appeal to a bigger share of SMEs requiring business car insurance coverage. Collaborations such because the one between Flock and The Acorn Group reveal the potential for trade partnerships to drive security enhancements and value financial savings for companies.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we would like you to take advantage of

helpful

resolution for your corporation, so we provide a free pattern which you could obtain by

submitting the beneath kind

By GlobalData