We evaluate the pet insurance coverage trade’s most respected corporations, analysis extensively, and analyze buyer suggestions. Our licensed insurance coverage agent fact-checks the whole lot, and we replace our protection all year long as suppliers change their insurance policies, premiums, payout limits, reimbursements, customer support expertise, and extra. Who’re the very best pet insurance coverage corporations this yr? Let’s discover out.

Finest Pet Insurance coverage Evaluations

The variety of pet insurance coverage corporations to select from is overwhelming. Individuals usually determine to go together with the biggest, most well-known firm, failing to spend the important time wanted to contemplate their choices totally.

Beneath, we spotlight a short snapshot of every main U.S. firm, together with what stands out concerning protection and exclusions, what could sway you to decide on an organization, and any reductions the supplier provides. We encourage you to get quotes and examine charges from a minimum of three corporations and browse our in-depth evaluations of these you have an interest in earlier than signing up.

Corporations are listed in accordance with our rankings adopted by alphabetically.

Pets Finest Assessment

Pets Finest is our greatest general decide for pet insurance coverage as a result of it provides in depth protection at an reasonably priced worth on common in comparison with the competitors. Its plans are fully customizable, so that you pay for the protection you need and what you may afford. There are no higher age limits, so even for those who undertake a senior canine or determine you need protection on your pet after they’re older, you gained’t be restricted in your protection choices.

Pets Finest additionally has some distinctive plans and options. In truth, it’s one of many few pet insurance coverage suppliers to supply an accident-only plan, which might be useful for these wanting a real emergency-only possibility at a cheaper price. Moreover, it gives protection for curable pre-existing circumstances as soon as healed or cured.

Wellness plans are additionally out there by way of Pets Finest as an add-on to your pet insurance coverage coverage. This can be a handy possibility on your family and show you how to funds for routine bills like vaccinations, flea/tick prevention, heartworm testing, and extra. Pets Finest has a lot to supply to suit every pet mother or father’s wants, so it’s price your consideration.

Pets Finest additionally administers insurance policies by way of Farmers Insurance coverage, PEMCO, and Progressive.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your funds and wishes with totally different deductible, reimbursement, and payout choices | Longer than common declare processing averages (7-14 days) |

| Might have possibility for Pets Finest to pay your vet on to keep away from ready for reimbursement | Excludes different/holistic therapies and C-sections |

| Accident-only plan out there | |

| Elective wellness plans out there as an add-on | |

| Shorter than common ready durations (3 days for accidents and 14 days for hip dysplasia) | |

| Persistently among the many lowest costs |

Pets Finest provides the next reductions:

- 5% off for a number of pets

- 5% off for navy members and their households

Use this hyperlink to benefit from the absolute best worth. No promo code is required. You can too go to our devoted Pets Finest reductions web page to study extra.

In-Depth Assessment Of Pets Finest

Fetch Assessment

Fetch is great if you’d like protection for a really younger pet as a result of it provides protection as younger as six weeks outdated. Compared, it’s important to wait till eight weeks with most opponents.

One other distinctive characteristic of Fetch insurance policies is its VirtualVet go to protection. You’ll be able to cowl as much as $1,000 in digital vet visits, whether or not over video chat, name, or textual content.

Fetch provides protection for a number of circumstances generally excluded by different suppliers with out requiring an additional charge. If you’d like a pet insurance coverage coverage with out worrying about add-ons and further charges, Fetch is price your consideration.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your funds and wishes with totally different deductible, reimbursement, and payout choices | Cannot have Fetch pay your vet on to keep away from ready for reimbursement |

| Behavioral therapies, different/holistic therapies, C-sections, sick go to examination charges, and gum illness are included in protection | No accident-only plan out there |

| Elective wellness plans out there as an add-on | Longer than common accident ready interval (15 days) |

Fetch provides the next reductions:

- As much as 10% off for animal shelter adoptees and workers, company profit plans, medical providers pets, strategic companions, navy, veterinary workers, and college students

- 10% off premiums for Walmart customers

- Save $25 or extra whenever you pay quarterly or yearly

- 10% off for AARP members for all times

Use this hyperlink to benefit from the absolute best worth. No promo code is required. Alternatively, name 800-237-1123. You can too go to our devoted Fetch promotion web page to study extra.

In-Depth Assessment Of Fetch

Wholesome Paws Assessment

All of Wholesome Paws’ plans embody limitless payouts. An insurance coverage plan with no cap on payouts means you by no means have to fret about hitting the utmost in your protection payouts, and you’ll at all times count on to be reimbursed for lined prices after you might have met your deductible.

We frequently discover Wholesome Paws to have the bottom costs in comparison with different suppliers’ limitless payout plans. Wholesome Paws helps cut back financial euthanasia as a result of pet mother and father aren’t harassed about the price of a life-saving process that could possibly be restricted by insurance policies with decrease payout limits.

Wholesome Paws additionally has one of many quickest declare processing timelines, averaging solely two days. In comparison with opponents, this can be a speedy turnaround and prevents additional monetary stress one may expertise whereas ready for a declare to be thought-about and paid again.

The corporate is thought for being constant in its choices and never rocking the boat. It hasn’t undergone important turbulence with underwriter adjustments or worth fluctuations as lots of its opponents have.

Customer support is a high precedence for Wholesome Paws, and it has a few of the finest evaluations within the enterprise. Wholesome Paws minimizes clients’ danger of surprising monetary penalties when utilizing pet insurance coverage.

| Professionals | Cons |

|---|---|

| Might have possibility for Wholesome Paws to pay your vet straight and keep away from ready for reimbursement | Restricted customization choices based mostly in your pet’s age |

| Shorter than common CCL surgical procedure ready interval (15 days) | No accident-only plan out there |

| Shorter than common declare processing (2 days) | Not enrolling pets older than 14 years outdated |

| Limitless payouts for all plans | Excludes behavioral therapies, different/holistic therapies, C-sections, examination charges, and gum illness |

| Longer hip dysplasia ready durations than common (12 months) and pets enrolled after age 6 are ineligible for hip dysplasia protection (MD does not have this age limitation) | |

| Longer than common accident ready interval (15 days) |

Use this hyperlink to benefit from the absolute best worth and get a quote on your pet from Wholesome Paws. You can too go to our devoted Wholesome Paws promotion web page to study extra.

In-Depth Assessment Of Wholesome Paws

Embrace Assessment

Embrace has probably the most complete protection for accidents and diseases, together with $1,000 yearly for dental sickness protection. For circumstances that some insurers exclude from their insurance policies, Embrace maintains protection.

There are a number of methods to customise your Embrace plan to suit your funds and protection wants. It’s one of many few insurers providing each a wellness and accident-only plan along with its accident and sickness plans.

Embrace can be an important possibility, because it covers behavioral remedy and coaching identified by a licensed veterinarian for a lined situation. So, suppose your canine is anxious, aggressive, or harmful whenever you depart them. In that case, it might be on account of a behavioral subject which may be lined beneath an Embrace coverage beneath the best circumstances. Behavioral remedy and coaching aren’t generally lined by most pet insurance coverage suppliers.

Embrace additionally administers insurance policies by way of Allstate, American Household, Geico, and USAA.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your funds and wishes with totally different deductible, reimbursement, and payout choices | Restricted to accident-only protection for those who enroll your canine after their fifteenth birthday |

| Might have possibility for Embrace to pay your vet on to keep away from ready for reimbursement | C-sections are excluded |

| Elective wellness plans out there as add-on | |

| Shorter than common accident ready interval (2 days) and declare processing (5 days) | |

| Behavioral therapies, different/holistic therapies, examination charges, gum illness, and tooth extractions are included |

Embrace provides the next reductions:

- 10% off (5% off in NY) for a number of pets

- 5% off for navy and veterans (NY and TN excluded)

- 10% off in case your firm or clinic provides Embrace as an worker profit (FL, ND, NY, and TN excluded)

- 5% off in NY for those who pay yearly

- As much as 25% off for eligible USAA clients

- Your deductible robotically goes down $50 annually you don’t obtain a declare fee

Use this hyperlink to benefit from the absolute best worth. No promo code is required. You can too go to our devoted Embrace low cost web page to study extra.

In-Depth Assessment Of Embrace

Figo Assessment

We’ve chosen Figo for the very best worth in pet insurance coverage as a result of it provides in depth protection, low pricing, glorious customer support, and quick declare processing (averages three days). Figo’s plans are customizable, with a number of choices to suit your funds and protection wants, plus two optionally available wellness plans. There are not any higher age limits, and the minimal age to enroll your canine is eight weeks.

Figo provides protection for circumstances typically excluded by different suppliers, comparable to behavioral therapies, different/holistic therapies, and C-sections. It’s additionally one of many solely corporations to supply a 100% reimbursement possibility. Moreover, Figo provides protection for curable pre-existing circumstances freed from therapy and signs after one yr.

Figo has a one-day ready interval for accidents, the shortest size of any firm included on this article. Total, Figo has thorough protection and aggressive pricing, which makes it a superb possibility for pet mother and father.

Figo additionally administers insurance policies by way of Costco.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your funds and wishes with totally different deductible, reimbursement, and payout choices | Cannot have Figo pay your vet on to keep away from ready for reimbursement |

| Elective wellness plans out there as an add-on | No accident-only plan out there |

| Shorter than common accident ready interval (1 day) | |

| Persistently among the many lowest costs | |

| Shorter than common declare processing (3 days) | |

| Behavioral therapies, different/holistic therapies, and C-sections are included in protection | |

| Diminishing deductible for annually a policyholder is declare free, reducing by $50 till it’s $0 |

Figo provides the next reductions:

- 5% off any new Figo pet insurance coverage coverage (unique for Canine Journal readers – use this hyperlink)

- 5% off for a number of pets

- Your deductible robotically goes down $50 annually you don’t obtain a declare fee

Use this hyperlink to benefit from the absolute best worth. No promo code is required. You can too go to our devoted Figo low cost web page to study extra.

In-Depth Assessment Of Figo

Lemonade Pet Insurance coverage Assessment

Lemonade started promoting insurance coverage in 2015 and branched into pet insurance coverage in 2020, providing low costs, which made it interesting to many shoppers. After a few years in enterprise, their costs fall in direction of the mid-range, however the firm continues to be creating loads of buzz with its AI-driven declare course of.

Lemonade’s Synthetic Intelligence (AI) hurries up the reimbursement course of. Most Lemonade claims are processed inside two days, however many are processed inside minutes of submission. Past velocity, one other distinctive factor about Lemonade is that you may bundle your pet insurance coverage coverage together with your Lemonade householders, renters, co-op, or condominium insurance coverage, which could prevent 10%.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your funds and wishes with totally different deductible, reimbursement, and payout choices | Cannot have Lemonade pay your vet on to keep away from ready for reimbursement |

| Elective wellness plans out there as an add-on | No accident-only plan out there |

| Shorter than common ready durations (2 days for accidents and 14 days for hip dysplasia) | Solely out there in 37 states and Washington DC |

| Shorter than common declare processing (2 days) | Breed restrictions based mostly on age |

| Behavioral therapies, different/holistic therapies, examination charges, and gum illness protection can be found for an additional charge |

Lemonade provides the next reductions:

- 10% off for those who bundle together with your renters, householders, auto, condominium, or co-op insurance coverage

- 5% off for a number of pets

- 5% off for those who pay yearly

Use this hyperlink to benefit from the absolute best worth. No promo code is required.

In-Depth Assessment Of Lemonade

Pet Insurance coverage Corporations (All Of Your Choices)

Apart from the insurers listed above, many different opponents exist within the market. The remaining U.S. pet insurance coverage suppliers are listed under and on our devoted pet insurance coverage corporations web page alphabetically. Included are hyperlinks to our in-depth particular person evaluations for those who’d prefer to study extra about an organization.

For those who stay outdoors of the U.S. and wish to find out about your choices, under are pet insurers you may think about.

| AUSTRALIA | Petsy Pet Insurance coverage | RSPCA | Tesco | |

| CANADA | OVMA Pet Well being Insurance coverage | Peppermint | Pets Plus Us | PHI Direct |

| HONG KONG | Blue Cross | OneDegree | PetbleCare | Prudential |

| IRELAND | Allianz | |||

| UNITED KINGDOM | Agria | Itch | Petplan | Waggel |

AKC Pet Insurance coverage Assessment

AKC Pet Insurance coverage is the one supplier to supply protection for pre-existing circumstances after one yr of steady protection. This may be life-changing for purchasers with canines affected by persistent diseases or different pre-existing circumstances. In case your canine has a pre-existing situation, AKC Pet Insurance coverage could possibly be a superb possibility on your family.

| Professionals | Cons |

|---|---|

| No vet data or examination required to enroll | No sickness protection possibility for canines enrolled after age 9 |

| Elective wellness plans out there as add-on | Should buy protection or congenital and hereditary circumstances individually |

| Claims are sometimes paid inside 7 days | Examination charge protection is out there for an extra charge |

| Your pet is roofed after they journey with you within the U.S. or Canada | $3 – $4 month-to-month transaction charge (relying on the state) – highest within the pet insurance coverage house, waived if paid yearly |

| Affords protection for pre-existing circumstances after twelve months of steady pet insurance coverage protection (not in FL and WA) |

AKC provides the next reductions:

- 5% off for a number of pets

- 5% off for canines who cross the AKC Canine Good Citizen check

- 10% off for puppies coming from breeders who take part within the AKC Bred with H.E.A.R.T or AKC Breeder of Benefit packages

In-Depth Assessment Of AKC Pet Insurance coverage

Animalia Pet Insurance coverage Assessment

Animalia is likely one of the latest pet insurance coverage suppliers out there. It’s at the moment solely out there in 39 states. Nonetheless, it’s one of many solely insurers to offer protection for prescription meals and dietary dietary supplements. Animalia is an efficient possibility for individuals who have pets with bilateral circumstances (comparable to hip dysplasia, CCL harm, cataracts, and so forth.) as a result of it has no bilateral exclusions in its coverage.

| Professionals | Cons |

|---|---|

| No lifetime limits on any plan | Pets aren’t eligible for enrollment after fifteenth birthday |

| Reductions out there for multi-pets | No optionally available wellness plan |

| Digital declare submitting | Extra price for dental protection |

| Covers the examination charges for accidents and diseases | 30 day ready interval for most cancers protection |

| Covers digital vet visits, prescription meals, and dietary dietary supplements | Solely out there in 39 states |

| Shorter than common ready durations (5 days for diseases, accidents, cruciate ligament accidents, and hip dysplasia) | Not lined when touring together with your pet outdoors of the U.S. |

| No on-line portal for policyholders |

Animalia provides the next low cost:

Use this hyperlink to benefit from the absolute best worth. No promo code is required.

In-Depth Assessment Of Animalia Pet Insurance coverage

ASPCA Pet Well being Insurance coverage Assessment

ASPCA Pet Well being Insurance coverage has a large identify behind its pet insurance coverage product, which can provide the assurance you want to select them. Their insurance policies are thorough, they usually supply protection for a lot of circumstances usually excluded by different suppliers.

As for pricing, ASPCA Pet Well being Insurance coverage sometimes falls extra within the center, however that may fluctuate based mostly in your pet’s particulars and the plan customizations you select. For instance, an accident-only coverage will probably be inexpensive than an accident and sickness coverage with a $100 deductible, 90% reimbursement, and a $10,000 annual payout restrict.

Elective wellness plans are additionally out there that will help you funds for routine bills, comparable to dental cleanings, annual vet checkups, flea/heartworm prevention, and extra. You’ll be able to modify your protection to suit the price of pet insurance coverage into your funds in some ways.

ASPCA Pet Insurance coverage additionally administers insurance policies by way of Vacationers and Waffle.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your funds and wishes with totally different deductible, reimbursement, and payout choices | Longer than common accident ready interval (14 days) |

| Might have possibility for ASPCA Pet Well being Insurance coverage to pay your vet on to keep away from ready for reimbursement | Longer than common declare processing (15-30 days) |

| Accident-only plan out there | C-sections, gum illness, and tooth extractions are excluded |

| Elective wellness plans out there as add-on | |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (14 days) | |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included |

ASPCA Pet Insurance coverage provides the next low cost:

- 10% off for a number of pets

Use this hyperlink to benefit from the absolute best worth. No promo code is required.

In-Depth Assessment Of ASPCA Pet Insurance coverage

Bivvy Assessment

Bivvy is not offering pet insurance coverage. Present Bivvy insurance policies will finish on their coverage anniversary date (said on the declaration web page). Bivvy will notify you of that non-renewal date and can proceed processing claims that happen and are handled earlier than that date.

CarePlus Assessment

CarePlus is Chewy’s wellness and insurance coverage model providing Trupanion and Lemonade insurance policies. The model continues to be new and present process common adjustments. Nonetheless, the large promoting level of a CarePlus coverage is that 100% of the prescriptions bought by way of Chewy.com are lined by your CarePlus pet insurance coverage plan.

| Professionals | Cons |

|---|---|

| Limitless payouts for all plans | Quotes are usually among the many most costly in comparison with opponents |

| Might have possibility for Trupanion to pay your vet on to keep away from ready for reimbursement | Should improve plans to have protection for examination charges, behavioral therapies, and bodily and rehab therapies |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (14 or 30 days) | Solely out there in 42 states at the moment |

| Elective wellness plan out there as a stand-alone plan | |

| Accident-only plan out there | |

| Declare processing averages 3-7 days however usually paid in 24 hours | |

| 100% of prescriptions lined when bought by way of Chewy.com | |

| Covers your pet in the event that they journey outdoors the U.S. with you |

In-Depth Assessment Of CarePlus By Chewy Pet Insurance coverage

Companion Defend Assessment

Companion Defend provides a really distinctive coverage. Pricing isn’t based mostly on breed, it has no ready durations, and its base plan consists of an annual wellness examination. Nonetheless, it’s essential to use an in-network vet to get claims reimbursed and solely not too long ago adopted pets from certainly one of their taking part shelter companions can join.

| Professionals | Cons |

|---|---|

| Premiums don’t enhance on account of your pet getting old | Lifetime payout limits |

| No ready durations | No details about annual payout limits |

| No higher age limits | Utilizing an out-of-network vet might be expensive |

| Good in-network advantages | Rigid coverage choices |

| Multi-pet low cost as much as 15% | Strict prior approval necessities |

| Free annual wellness examination (with in-network vet) | No wellness plans out there |

| Protection for different and holistic care | Doesn’t cowl your pet in the event that they journey outdoors the U.S. with you |

In-Depth Assessment Of Companion Defend

Hartville Assessment

Hartville provides comparable merchandise to ASPCA Pet Well being Insurance coverage with the identical protection, exclusions, and so forth. Insurance policies are complete, and you’ll select from optionally available wellness plans. The largest grievance from clients is that reimbursements are decrease than they anticipated.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your funds and wishes with totally different deductible, reimbursement, and payout choices | Low reimbursements reported by clients |

| Might have possibility for Hartville to pay your vet on to keep away from ready for reimbursement | Longer than common accident ready interval (14 days) |

| Pet is roofed after they journey with you within the U.S., Guam, Puerto Rico, U.S. Virgin Islands, and Canada | Longer than common declare processing (15-30 days) |

| Accident-only plan out there | C-sections, gum illness, and tooth extractions are excluded |

| Elective wellness plans out there as add-on | |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (14 days) | |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included |

Hartville provides the next low cost:

- 10% off for a number of pets

In-Depth Assessment Of Hartville

ManyPets Assessment

ManyPets is a number one pet insurance coverage supplier within the U.Ok. and Sweden and has branched into the U.S. market. One distinctive characteristic offered is grief counseling upon the loss of life of a pet. No different firm provides this. Moreover, a household plan covers as much as three pets beneath one annual restrict.

| Professionals | Cons |

|---|---|

| No transaction or one-time charges | Not enrolling pets older than 14 years outdated |

| Pets enrolled after 6 aren’t eligible for hip dysplasia protection | |

| Not out there in all 50 states |

In-Depth Assessment Of ManyPets

MetLife Assessment

MetLife has a wholesome pet incentive, which lowers the deductible by $50 every coverage yr you don’t obtain a declare reimbursement. In case your coverage restrict is $5,000 or extra and you’ve got an unused quantity of $1,000 or extra on the finish of the coverage interval, MetLife will enhance your coverage restrict by $500 at no additional price whenever you renew.

| Professionals | Cons |

|---|---|

| Elective wellness plans out there as add-on | Doesn’t cowl therapy, providers, or provides offered outdoors the U.S. |

| 80% of claims are processed inside 10 days | |

| Diminishing deductible |

MetLife provides the next reductions:

- 10% off for vets, shelter personnel, and so forth.

- For navy, veterans, first responders, and healthcare staff

In-Depth Assessment Of MetLife

Nationwide Assessment

Nationwide is the solely pet insurance coverage supplier we evaluate that gives unique pet insurance coverage and canine and cat insurance coverage. When you’ve got a rabbit, chook, reptile, ferret, or one other small mammal, think about insurance coverage by way of Nationwide.

Like canine or cat insurance coverage, unique pet insurance coverage covers surprising visits to the vet which might be topic to the insurance coverage plan you select. Relying in your alternatives, this will likely embody accidents, diseases, the loss of life of your pet, and extra.

Nationwide can be the one firm we evaluate to supply a conventional pet insurance coverage product and a profit schedule-style plan much like a wellness plan with financial protection limits per situation/therapy. Suppose you’re already acquainted with Nationwide’s insurance coverage merchandise in different areas of your life. In that case, it might be price contemplating sticking with them, however it’s additionally price getting a number of quotes from others.

| Professionals | Cons |

|---|---|

| Elective wellness plan out there as add-on | Cannot have Nationwide pay your vet on to keep away from ready for reimbursement |

| Shorter than common hip dysplasia ready interval (14 days) | Restricted to accident-only protection for pets 10 and older |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included in protection | Longer than common ready durations (14 days for accidents and 12 months for CCL surgical procedure) |

| Shorter than common declare processing (4 days) | C-sections, gum illness, and tooth extractions are excluded |

| One of many solely pet medical insurance corporations to supply unique pet insurance coverage |

Nationwide Pet Insurance coverage provides the next reductions:

- 5% off for 2-3 pets lined

- 10% off for 4 or extra pets lined

Use this hyperlink to benefit from the absolute best worth. No promo code is required.

In-Depth Assessment Of Nationwide

Odie Assessment

Odie requires add-ons for primary protection that opponents embody of their insurance policies robotically. Plan customization choices are restricted. Accident-only plans can be found, and you’ll add a wellness plan onto your insurance coverage coverage. Wishbone Pet Insurance coverage can be managed by Odie.

| Professionals | Cons |

|---|---|

| Common premium pricing is commonly decrease than different suppliers | Should pay additional for workplace visits, prescription medicine, rehab, acupuncture, and chiropractic care protection |

| No age restrictions and protection begins as early as 7 weeks | Behavioral circumstances are excluded |

| Declare processing averages 4-5 enterprise days | No limitless payout limits |

| Elective wellness plans out there as add-on | Bilateral circumstances are excluded |

| Your pet is roofed after they journey with you within the U.S., Canada, or Puerto Rico |

In search of an Odie Pet Insurance coverage promo code? Click on right here for the very best deal we may discover.

In-Depth Assessment Of Odie

Paw Defend Assessment

Paw Defend administers Embrace pet insurance coverage insurance policies. The one distinction is that Paw Defend provides a credit score line known as Paytient that you should utilize with 0% curiosity to pay the vet payments upfront as an alternative of paying out of pocket. Clients have entry to $2,000 to assist pay their vet payments till they’ve the money to repay the debt.

| Professionals | Cons |

|---|---|

| No per-incident limits on their claims as they use an annual deductible | $25 enrollment charge |

| No lifetime restrict | Solely covers enrolled pets age 14 and youthful for accidents and diseases (accident solely could also be out there for ages 15+) |

| Elective wellness plans out there as add-on (not out there in RI) | If one leg has a CCL (ACL) harm previous to enrollment, the opposite leg is not going to be lined even when there are not any prior points; it’s thought-about a pre-existing situation |

| Pays claims inside 10-15 days on common | Pricing for combined breeds typically varies between Embrace and Paw Defend |

| Covers your pet in the event that they journey outdoors the U.S. with you | |

| Eligible to use for a digital Paytient Visa card to pay for vet payments |

Paw Defend has the next reductions:

- 10% off (5% off in NY) for a number of pets

- 5% off for navy and veterans (NY and TN excluded)

No promo code is required. Use this hyperlink to benefit from the absolute best worth.

In-Depth Assessment Of Paw Defend

Petco Assessment

Petco administers Nationwide pet insurance coverage insurance policies. The one distinction is that Petco provides reductions and financial savings on veterinary providers out there by way of Petco’s community of hospitals and clinics. For those who stay close to certainly one of Petco’s amenities and suppose you might benefit from their vet providers, then Petco’s pet insurance coverage by way of Nationwide may show you how to get reductions on vet care.

| Professionals | Cons |

|---|---|

| Elective wellness plan out there as add-on | Longer than common ready durations (14 days for accidents and 12 months for CCL surgical procedure) |

| Shorter than common hip dysplasia ready interval (14 days) | C-sections, gum illness, and tooth extractions are excluded |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included in protection | Pets older than 10 are ineligible for sickness enrollment |

| Shorter than common declare processing (4 days) | |

| Unique pet insurance coverage out there | |

| Reductions out there by way of Petco vet providers |

In-Depth Assessment Of Petco

PetPartners Assessment

PetPartners provides comparable merchandise to AKC Pet Insurance coverage with the identical protection, exclusions, and so forth. Insurance policies are complete, and you’ll select from optionally available wellness plans. Like AKC Pet Insurance coverage, you obtain protection for pre-existing circumstances after one yr of steady protection.

| Professionals | Cons |

|---|---|

| No vet data or examination required to enroll | No sickness protection possibility for canines enrolled after age 9 |

| Elective wellness plans out there as add-on | Should buy protection or congenital and hereditary circumstances individually |

| Claims are sometimes paid inside 7 days | Examination charge protection is out there for an extra charge |

| Your pet is roofed after they journey with you within the U.S. or Canada | $3 – $4 month-to-month transaction charge (relying on the state) – highest within the pet insurance coverage house, waived if paid yearly |

| Affords protection for pre-existing circumstances after twelve months of steady pet insurance coverage protection (not in FL and WA) |

PetPartners provides the next low cost:

- 5% off for a number of pets

In-Depth Assessment Of PetPartners

Prudent Pet Assessment

Prudent Pet has spectacular protection however is costlier than its opponents. Declare processing buyer suggestions is sporadic, with some saying it’s quick and others saying it’s sluggish. Nonetheless, it’s displaying some promise for being newer to the pet insurance coverage trade.

| Professionals | Cons |

|---|---|

| No lifetime payout limits on any plans | Premiums have been considerably larger than common after we ran quotes |

| No higher age limits | Longer than common accident ready interval (5 days) |

| 60% of claims are processed inside 1 day | If there’s a knee harm previous to enrollment or through the ready interval, they gained’t cowl the second leg if an harm happens (thought-about bilateral situation) |

| Your pet is roofed after they journey with you within the U.S., Canada, Puerto Rico, and different U.S. territories | No cellular app |

| Competitively priced wellness plans | $2 transaction charge |

Prudent Pet provides reductions to navy and veterinarians and their workers.

In-Depth Assessment Of Prudent Pet

Pumpkin Assessment

Pumpkin is the primary pet insurance coverage producer to incorporate beneath a worldwide pharmaceutical big. It has many plan customizations and protection for circumstances usually excluded by opponents. Pumpkin has complete protection, however know-how must catch up and get a cellular app for customers to file claims.

| Professionals | Cons |

|---|---|

| 90% reimbursement for all plans | Value quotes are usually costlier than most opponents however this can be on account of solely providing 90% |

| Elective wellness plan out there as add-on | $2/month transaction charge |

| Your pet is roofed after they journey with you within the U.S., Canada, Puerto Rico, Guam, and U.S. Virgin Islands | Longer than common accident and sickness ready durations (14 days) |

| No higher age limits | No app |

| Excludes routine dental procedures |

In-Depth Assessment Of Pumpkin

Spot Assessment

Spot Pet Insurance coverage was based in 2019 and provides some ways to customise your plan. You’ll be able to select an accident-only coverage or accident and sickness coverage, add on a wellness plan, and modify your deductible, reimbursement, and payout choices. These choices present a variety of the way to assist match Spot into your funds.

Spot additionally has comparatively quick 14-day ready durations for CCL surgical procedure and hip dysplasia in comparison with many different pet insurance coverage suppliers. So if both of those circumstances considerations your canine, Spot could also be price contemplating.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your funds and wishes with totally different deductible, reimbursement, and payout choices | Cannot have Spot pay your vet on to keep away from ready for reimbursement |

| Accident-only plan out there | Longer than common accident ready interval (14 days) |

| Elective wellness plans out there as add-on | Longer than common declare processing (10-14 days) |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (14 days) | C-sections, gum illness, and tooth extractions are excluded |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included |

Spot provides the next low cost:

- 10% multi-pet low cost whenever you use this hyperlink.

- 10% off for eligible Purina clients

- As much as 20% off for eligible AAA clients

Use this hyperlink to benefit from the absolute best worth. No promo code is required.

In-Depth Assessment Of Spot

Toto Assessment

Toto has extra limitations for its pet insurance coverage insurance policies than different insurers. Nonetheless, it is likely one of the solely suppliers to supply Ultimate Respects protection, which reimburses a portion of cash for the price of an post-mortem, cremation, and urns. Lastly, Toto could change your premium, reimbursement price, annual deductible, and coverage phrases and circumstances at renewal.

| Professionals | Cons |

|---|---|

| No lifetime or per-incident payout limits for accident or sickness plans | Longer than common sickness ready interval (14 days) |

| Elective wellness plan out there as add-on | 180-day ready interval for IVDD and CCL accidents |

| Your pet is roofed after they journey with you within the U.S., Canada, and different U.S. territories | Protection is restricted to accidents just for pets over 9 years outdated at enrollment |

| Ultimate Respect protection is out there for pets enrolled earlier than their fifth birthday | Bilateral circumstances excluded |

| No cellular app | |

| No limitless payout restrict possibility |

In-Depth Assessment Of Toto

Trupanion Assessment

Certainly one of Trupanion’s most talked about options is Trupanion’s Vet Direct Pay, which eliminates the declare processing wait time. Many different pet insurance coverage corporations supply a vet direct pay possibility. Nonetheless, Trupanion’s Vet Direct Pay is the one possibility that enables fee throughout checkout. If Trupanion’s Vet Direct Pay isn’t out there at your vet’s workplace, you may name to ask about it or converse together with your vet about them setting it up.

Trupanion can be a superb alternative for breeds with a previous harm or ailment to at least one aspect of their physique however not the opposite. This pet can be thought-about predisposed to a bilateral situation, however many Trupanion insurance policies have no bilateral exclusions. A bilateral situation is any situation or illness that would have an effect on either side of the physique. Examples embody hip dysplasia, CCL accidents, cataracts, and extra. Most pet insurance coverage suppliers exclude bilateral protection as a result of if one thing occurs on one aspect of the physique, there’s a stable probability it may additionally occur to the opposite over time. Nonetheless, Trupanion is keen to take this danger.

Lastly, Trupanion is often chosen by breeders due to its Breeder Help Program. This system’s major focus is the Go House Day Supply, which lets breeders present consumers with a proposal for Trupanion enrollment with out ready durations. This implies a pet mother or father can decide up their pet from the breeder and get pet insurance coverage instantly with none ready durations. Moreover, Trupanion insurance policies cowl breeding-related well being circumstances, one other perk for breeders.

Trupanion additionally administers insurance policies by way of Geico and State Farm.

| Professionals | Cons |

|---|---|

| 90% reimbursement with limitless payouts for all plans | No accident-only plan out there |

| Might have possibility for Trupanion to pay your vet on to keep away from ready for reimbursement | Pets older than 14 are ineligible for enrollment |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (30 days) | Longer than common sickness ready interval (30 days) |

| Shorter than common declare processing averages (2 days) | Persistently among the many most costly |

| Behavioral therapies, C-sections, and tooth extractions are included in protection | Examination charges are excluded |

Use this hyperlink to benefit from the absolute best worth and get a quote on your pet from Trupanion. You can too go to our devoted Trupanion promotions web page to study extra.

In-Depth Assessment Of Trupanion

Wagmo Assessment

Wagmo has per-incident deductibles and lifelong payout limits, so this could possibly be a superb possibility on your pet for those who’re nervous about persistent circumstances. Nonetheless, for those who anticipate requiring a lifetime payout past $100,000, then assess different choices.

| Professionals | Cons |

|---|---|

| Declare reimbursement averages 1 day for wellness and 3-5 enterprise days for accidents and diseases, after the declare is authorised | No limitless payout possibility |

| Elective wellness plan out there as add-on | Per-incident deductible and lifelong payout limits |

| Longer than common accident ready interval (15 days) | |

| Pets older than 15 are ineligible for enrollment | |

| 30-day ready interval for most cancers therapy | |

| Hip dysplasia isn’t lined for pets older than 6 |

In-Depth Assessment Of Wagmo

24Petprotect Assessment

24Petprotect gives accident and sickness plans in addition to accident-only insurance coverage insurance policies to assist provide your protection and funds wants. There are additionally a number of deductible, payout, and reimbursement choices that will help you get the plan you want.

| Professionals | Cons |

|---|---|

| Elective wellness plan out there as add-on | $2 transaction charge (waived if paying yearly) |

| Covers curable pre-existing circumstances which might be freed from signs and therapy for 180 days | No limitless payout possibility |

| Your pet is roofed after they journey with you within the U.S., Canada, Guam, Puerto Rico, and U.S. Virgin Islands | Longer than common accident ready interval (14 days) |

| Larger premiums in comparison with others | |

In-Depth Assessment Of 24Petprotect

Price And Protection Comparisons

We’ve compiled a few comparability tables that handle price and protection points:

For those who’re uncertain the place to begin, you need to if it’s worthwhile having pet insurance coverage. It addresses widespread questions comparable to how pet insurance coverage works, what it covers, statistics, whether or not it’s price it for everybody, and extra.

Free Pet Insurance coverage Quotes

Our protection comparability is comparatively simple, however pricing comparisons can get difficult. Why? Pricing quotes are distinctive as a result of they’re based mostly on a pet’s age, breed, geographic location, the supplier and plan you choose, and a number of other different components.

Because of this, we encourage you to get quotes from a number of corporations earlier than deciding on a pet insurance coverage supplier. We’ve made this simple for you by making a free quote kind that pulls quotes from high pet insurance coverage corporations whenever you fill out your pet’s particulars. You’ll be able to higher perceive the protection wanted by getting into your pet’s particular traits.

What Are The Completely different Sorts Of Pet Insurance coverage Plans?

There are two pet insurance coverage: accident-only and accident and sickness. Some corporations additionally supply an optionally available wellness plan for an additional cost, however it isn’t an insurance coverage product. Since a number of pet insurance coverage suppliers supply wellness plans throughout enrollment, we included them to make sure you know the complete vary of choices throughout new enrollment.

What Do Accident-Solely Pet Insurance coverage Plans Cowl?

An accident-only plan solely covers vet payments related to an accident, comparable to torn ligaments, damaged bones, international physique ingestion, poisoning, accidents, chew wounds, and extra. Sicknesses are excluded from this protection. An accident-only pet insurance coverage plan is often inexpensive than an accident and sickness one because it covers fewer bills. Nonetheless, just some corporations supply this coverage sort.

What Do Accident & Sickness Pet Insurance coverage Plans Cowl?

That is the commonest and standard sort of pet insurance coverage plan. It covers accidents (like damaged bones, international physique ingestion, and different gadgets lined in accident-only plans) and sickness-related circumstances (like most cancers, allergy symptoms, urinary tract infections, arthritis, pores and skin infections, ear infections, and extra). The sort of coverage is extra complete than an accident-only one.

What Do Wellness Plans Cowl?

Wellness protection is bought as an add-on or a standalone product and comes with an incremental charge. Sometimes, this program covers issues that happen throughout an annual examination, comparable to vaccination, flea/tick/heartworm therapy, enamel cleansing, and spay/neuter procedures. A wellness plan is a monetary software to assist cowl the prices related to preventative measures that help your canine’s general well being and forestall diseases the place potential. Common vet visits, particularly ones lined with a wellness plan, additionally encourage house owners to be extra proactive with their pet’s well being. Wellness plans will not be pet insurance coverage as they don’t cowl prices related to accidents or diseases.

| Plan Sort/Want | Accident-Solely | Accident & Sickness (hottest) |

Wellness |

|---|---|---|---|

| Damage-related circumstances (damaged bones, international physique ingestion, poisoning, chew wounds, and so forth.) | | ||

| Illness-related circumstances (allergy symptoms, urinary tract infections, arthritis, most cancers, ear infections, and so forth.) | | | |

| Preventative measures (annual exams, vaccination, flea/tick/heartworm prevention, enamel cleansing, spay/neuter procedures, and so forth.) | | | |

| Price | $ | $$ | $$$* |

What Does Pet Insurance coverage Cowl?

Pet insurance coverage protection varies based mostly on the coverage sort and the corporate you select. The vast majority of accident and sickness pet insurance coverage cowl the next gadgets when deemed medically vital. Nonetheless, this protection could have limitations, so please test your coverage.

Our specialists have put collectively a complete information to what pet insurance coverage covers. You’ll additionally discover price and reimbursement examples, standards to contemplate, options to pet insurance coverage, wellness plans, and extra.

| Coated | Excluded |

|---|---|

| Blood assessments | Boarding |

| Most cancers (chemo & radiation) | Cremation & burial prices |

| CAT scans | Elective procedures (e.g., declawing, ear cropping, spaying/neutering, tail docking, and so forth.) |

| Persistent circumstances | Meals & dietary supplements |

| Congenital circumstances | Grooming |

| Emergency care | Pre-existing circumstances* |

| Euthanasia | Being pregnant & breeding |

| Hereditary circumstances | Vaccines |

| MRIs | |

| Non-routine dental therapy | |

| Prescription medicines | |

| Rehabilitation | |

| Specialised exams & care | |

| Surgical procedure & hospitalization | |

| Ultrasounds | |

| X-rays |

Did You Know?

U.S. pet insurers used to drop sick pets or exclude persistent and hereditary circumstances in insurance policies. Happily, this isn’t the case at the moment.

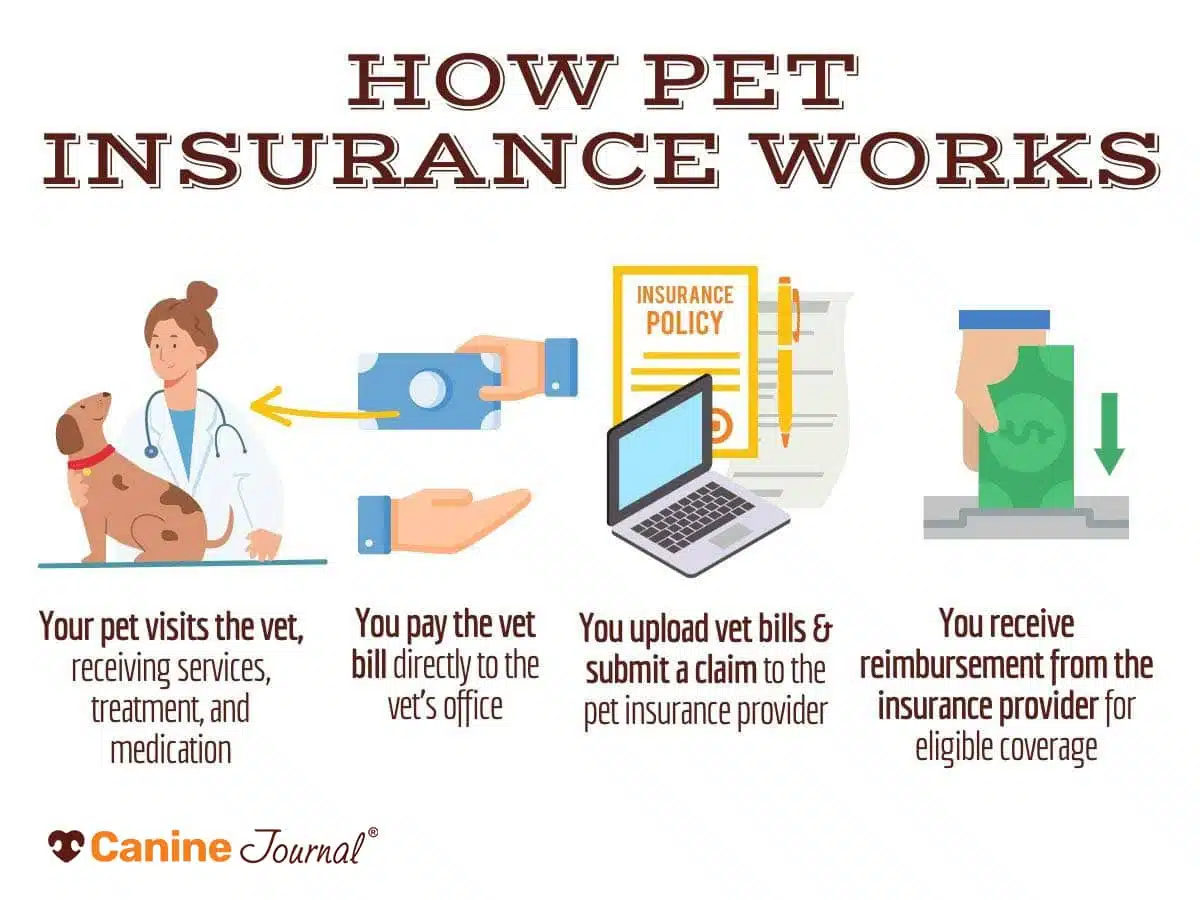

How Does Pet Insurance coverage Work?

- Go to the vet and pay your invoice on the time of service.

- Ship a accomplished declare kind and an itemized receipt to your insurance coverage firm. Some corporations require a signature out of your vet, so it’s smart to take a printed copy of your declare kind to your go to.

- As soon as the declare is authorised, the insurance coverage firm will ship your reimbursement* by way of your chosen fee technique (test, direct deposit, and so forth.).

*The reimbursement timeline can fluctuate from a couple of minutes to some weeks, relying on the complexity of your declare and the promised processing time. The reimbursement quantity is determined by your coverage particulars, together with deductible, annual payout, reimbursement proportion, protection, and exclusions.

Pet Insurance coverage Declare Instance

Let’s stroll by way of an instance to higher perceive the way it works.

Suppose your coverage has the next protection:

- $250 annual deductible

- 80% reimbursement

- $5,000 payout restrict

In that case, you’re answerable for the next:

- Any unplanned vet payments associated to lined gadgets as much as $250,

- 20% of the full vet invoice as much as $5,000, after which

- 100% above the $5,000 payout restrict.

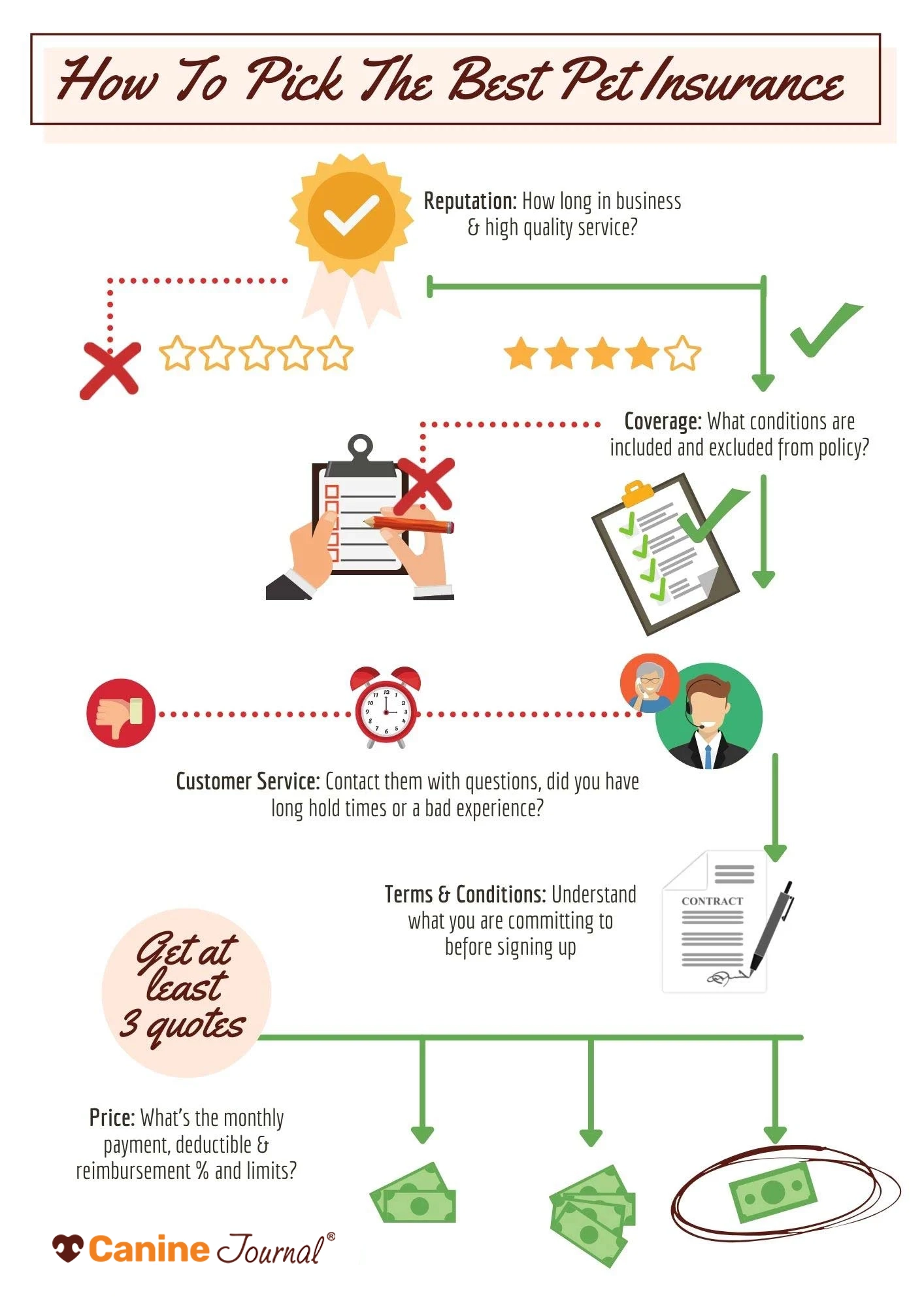

How To Select The Finest Pet Insurance coverage For You

How can one determine with so many pet insurance coverage corporations to select from? Because of this it’s essential to take the time to contemplate your choices rigorously. By understanding the important thing concerns and committing to the analysis, it’s possible you’ll discover a supplier that matches your breed and well being considerations.

It’s smart to think about any diseases your canine’s breed could also be predisposed to. For instance, suppose your pet is predisposed to hip dysplasia. In that case, you’ll wish to make sure you’re happy with the phrases related to hip dysplasia protection. Some corporations add extra ready durations to hip dysplasia or think about it a bilateral situation, thus excluding it from protection as a pre-existing situation. Moreover, think about a dialog together with your vet about any potential circumstances they’d advocate masking based mostly on the breed or combine.

After you might have an inventory of your must-haves, you’re able to slim down your listing of choices.

- Your largest concern as a pet mother or father must be the fame of the pet insurance coverage supplier. Have you ever heard of them? Do household and pals use them? What has their expertise been after they’ve needed to file a declare? Getting a pet insurance coverage coverage is simply helpful if it covers what you count on it to cowl and for those who can afford the month-to-month premium. Keep in mind, though the month-to-month price is essential, it’s not probably the most essential issue when selecting insurance coverage. The entire level of any insurance coverage coverage is making certain you might have the protection to pay for in any other case unaffordable payments in emergencies.

- Resolve what sort of protection you need on your canine and which extra perks could also be negotiable to decrease your prices. For those who’d prefer to study extra about what a few of the generally referenced phrases in pet insurance coverage imply, try our terminology 101 part that breaks the lingo down into layperson’s phrases for you.

- Receive quotes from a minimum of three corporations to get an thought of how a lot your month-to-month premium will probably be. Pricing varies drastically, and simply because an organization expenses you extra doesn’t imply the protection is extra thorough.

- Don’t hesitate to contact potential suppliers with any questions earlier than signing up. And pay shut consideration to that have — it might mirror customer support high quality down the street.

- Contemplate the declare reimbursement course of, together with the way it works, the common processing timeline, and whether or not there’s an possibility for the corporate to pay the vet straight. If an organization takes longer than you may watch for reimbursement, it’s possible you’ll wish to search different choices.

Choosing a pet insurance coverage plan is a private alternative, and nobody is aware of what your canine wants higher than you. Take the time to make an knowledgeable choice, and understand it’ll be well worth the added safety in the long term.

Incessantly Requested Questions

Listed below are some questions we’ve acquired from our readers concerning pet insurance coverage. Don’t see yours? Ask us within the feedback.

Can I Go To Any Vet With Pet Insurance coverage?

Most pet insurance coverage corporations will let you select any licensed vet on your pet’s well being care wants. We all know one firm, Companion Defend, that’s the exception to this rule. Companion Defend claims to cowl extra of the associated fee inside its authorised community of vets. Whereas they will let you use an out-of-network vet, it might price you extra money.

What Are The Disadvantages Of Pet Insurance coverage?

Though we really feel that pet insurance coverage is effective and value it for many, listed below are 4 cons to pay attention to:

- Routine preventative exams and related bills aren’t included in your pet insurance coverage coverage. You will need to buy a wellness plan at an incremental price to cowl these.

- You’ll nonetheless have out-of-pocket bills, together with your deductible and any quantity that surpasses your payout restrict. Additionally, you will be answerable for masking the steadiness of the reimbursement quantity (i.e., for those who selected an 80% plan and your supplier agrees to cowl your declare, you’ll nonetheless owe 20%).

- Most pet insurance coverage suppliers exclude pre-existing circumstances from protection, and you might be answerable for related prices.

- In contrast to human well being care, most pet insurance coverage corporations require you to pay vet bills upfront and watch for reimbursement. Some corporations supply a vet direct pay possibility as a substitute for this commonplace reimbursement mannequin. Nonetheless, it’s essential to work together with your vet to make sure that is in place earlier than you start therapy.

What Ought to I Ask Earlier than Shopping for Pet Insurance coverage?

These are questions we advocate asking your supplier earlier than you join.

- Can I select my vet?

- What are the ready durations?

- What’s excluded from protection?

- Are there additional charges for protection associated to examination charges, prescription medicine, or different gadgets?

- Are you able to present me an instance of how a declare is dealt with?

- What is going to I be answerable for paying?

- What occurs if I purchase a coverage after my pet will get sick or damage?

- Are there any limits on advantages (per-incident, annual, or lifetime)?

- How briskly will my declare be processed and repaid?

Is It Price Making A Pet Insurance coverage Declare?

When you’ve got a pet insurance coverage coverage, it’s nearly at all times price it to make a pet insurance coverage declare. Suppliers have made submitting claims moderately easy. Even when you understand you gained’t get reimbursed as a result of you might have but to hit your deductible, the declare will go towards your deductible. It might not be price submitting a declare in case your coverage has any limits (per coverage interval or per situation) and you’ve got already hit the utmost.

Are New Corporations Eligible To Win Classes?

No. Traditionally, new corporations have entered the pet insurance coverage house by providing low costs to achieve market share. Nonetheless, after a while within the enterprise with extra paid claims, these corporations have a tendency to extend charges to enhance their profitability. This hurts you, the shopper, as a result of this causes their premiums to extend considerably — and for those who visited your vet or submitted a declare, your pet now has a pre-existing situation. So, for those who want to change suppliers to discover a extra aggressive price, that situation is unlikely to be lined. Finally, you could have been higher off beginning with a special, extra well-established firm.

Due to these points, we’ve determined solely to incorporate pet insurance coverage corporations in our high spots with a minimum of 5 full years of nationwide expertise. This method offers corporations time to determine a constant pricing system and fame, supplying you with and our group a greater thought of what to anticipate.

Our specialists will nonetheless cowl new entrants (topic to reader demand) and produce you the whole lot we will discover on these corporations in our evaluations as a result of we would like you to know all of the out there choices. Additional, we added a “Finest Newcomer” class to our rankings to offer a advice amongst new entrants within the pet insurance coverage house. We additionally think about whether or not an organization is new to the insurance coverage trade or simply the pet insurance coverage sector.

Finest Pet Insurance coverage Suppliers By Worth And Wants

We additionally evaluate suppliers based mostly on worth and particular wants. Head to our finest pet insurance coverage by worth and wishes article to see suppliers ranked based mostly on younger pets, protection, worth, vet direct pay, pre-existing situation protection, and extra.

Why Belief Canine Journal?

Choosing the proper pet insurance coverage coverage on your pet is a private choice. That’s why we worth your belief in us to offer all the target info you want to make an knowledgeable alternative.

Canine Journal has been masking the subject of pet insurance coverage since 2012, properly earlier than different conglomerates found the rising reputation of well being look after our pets. A lot of our authors have private expertise with pet insurance coverage, together with Kimberly Alt, who has been Canine Journal’s go-to writer for pet insurance coverage for over a decade, having written about almost each potential aspect associated to pet insurance coverage. Kimberly is aware of the topic so properly that she will reply a breadth and depth of pet insurance coverage questions instantly. And on the uncommon event she doesn’t know the reply off the highest of her head, she will discover it inside minutes on account of her in depth listing of sources.

Kimberly additionally consulted with Michelle Schenker, Canine Journal’s in-house licensed insurance coverage agent, for added experience, to make sure accuracy, and provides Canine Journal the authority to write down about and help readers in buying insurance policies legally.

Here’s a fast comparability desk displaying what we provide in comparison with the competitors.

Tagged With: Comparability, Reviewed By Insurance coverage Agent