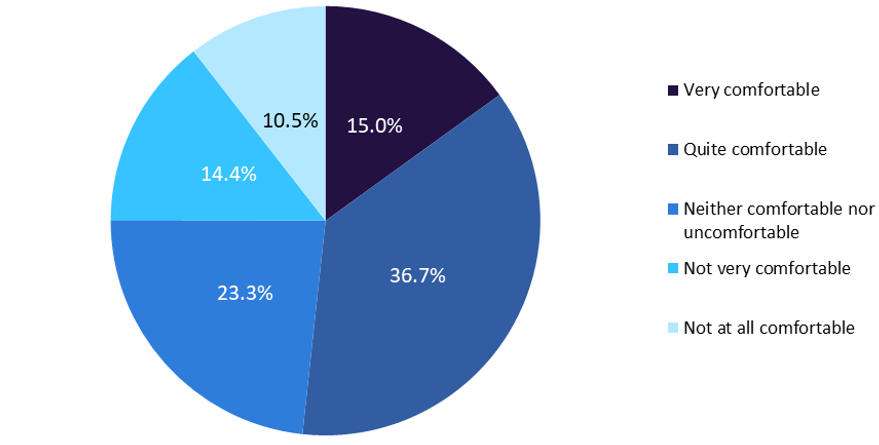

Synthetic intelligence (AI) is altering the insurance coverage sector by enhancing accuracy and effectivity throughout the worth chain, serving to enhance the analysis of insurance coverage wants. But small and medium-sized enterprises (SMEs) present an impediment to insurers within the adoption of this know-how, in keeping with GlobalData’s 2023 UK SME Insurance coverage Survey. Nearly 1 / 4 of SMEs responding to our survey reported that they weren’t very comfy or under no circumstances comfy with having AI assess their insurance coverage wants.

Based mostly on the identical survey, the next are the highest three causes SMEs oppose utilizing AI to find out insurance coverage wants: 56.1% favor human experience and recommendation, 37.3% don’t belief AI, and 36.2% consider AI shouldn’t be superior sufficient to carry out the exercise. For insurers that wish to combine AI into their operations, overcoming these obstacles is essential. Moreover, 25.6% of SMEs expressed concern about how AI will use their private or company information, which is in step with common issues about information safety and privateness. Notably, in keeping with AXA, threat related to AI and information is among the many high ten issues for each UK consultants and most people. Moreover, 16.9% of respondents acknowledged that they don’t perceive AI, which makes them against its software to insurance coverage.

Quite the opposite, 51.7% of SMEs say they’d really feel very or fairly comfy utilizing AI to satisfy their insurance coverage wants (23.3% have been neither comfy nor uncomfortable). They acknowledged the benefits of AI, with 45.8% keen to make use of AI for sooner processing occasions and 38.1% for extra correct estimations of ranges of canopy (and thus premiums). Despite the fact that AI remains to be comparatively new to the insurance coverage sector, its integration into sure key areas of the worth chain is progressing rapidly.

To navigate the deterrents recognized by GlobalData’s survey, it’s important to extend AI safety and belief. Considerations about cybersecurity are rising as AI develops rapidly. Test Level Analysis has reported that there could possibly be an 8% enhance in world cyberattacks because of elevated developments in using AI for cybercrimes. By making investments in strong cybersecurity measures and information dealing with practices, insurers can cope with this problem. They need to make it clear that they’re dedicated to defending delicate information and will present particulars on the safety protocols and functions of AI. Insurers ought to try to coach shoppers on the advantages of AI assessing their insurance coverage wants. This contains emphasising that AI enhances human experience moderately than replaces it. Clients’ apprehension might be alleviated, and belief might be fostered by highlighting the pace and accuracy AI brings to the method. Insurance coverage corporations can efficiently incorporate AI into their operations and supply extra correct and environment friendly insurance coverage assessments by addressing issues and showcasing the know-how’s benefits.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

useful

choice for your corporation, so we provide a free pattern you can obtain by

submitting the under type

By GlobalData