What You Must Know

- Some purchasers have the self-discipline to lock money away in abnormal investments.

- The portfolio might crash on the worst time.

- The necessity for care might come sooner than anticipated.

Ought to my consumer Bob self-fund the long-term care threat or choose a hybrid long-term care coverage? He’s 67 and does have some well being points.

Since he’s an engineer and an accountant, and he’s pursuing his doctorate in AI, I positively anticipated insightful questions from him.

Positive sufficient, Bob despatched this thought-provoking electronic mail: “Utilizing the $6,500 profit for 4 years and assuming the assured fee, my most profit is $563,053. If I make investments the one-time premium at 5.59% for 20 years in a high-grade bond, I can get the identical quantity.”

My Preliminary Ideas

As long-term care advisors, we all know that in an ideal world — with an correct crystal ball to foretell the longer term — it could be nice if a consumer might predict when they are going to want care.

Sadly, we can’t rely upon that occuring.

The way in which I see it, the “self-funding” technique is inclined to 3 huge dangers:

- A lower-than-expected fee of return.

- Larger-than-expected tax charges at declare time.

- The shortcoming to realize the 20 years of wanted development to construct the ‘LTC self-fund’ account.

Any one of many three outcomes — or perhaps a mixture — and the self-funding technique could also be insufficient.

That would depart our purchasers with the monetary dilemma of methods to pay the excessive care prices, which may vary from roughly $60,000 a 12 months for dwelling care to over $108,000 for nursing dwelling care.

My Subsequent Step

To handle Bob’s inquiry and take a more in-depth have a look at the self-funding threat, I consulted Zack Derryberry, Hybrid LTC Director at ACSIA Companions.

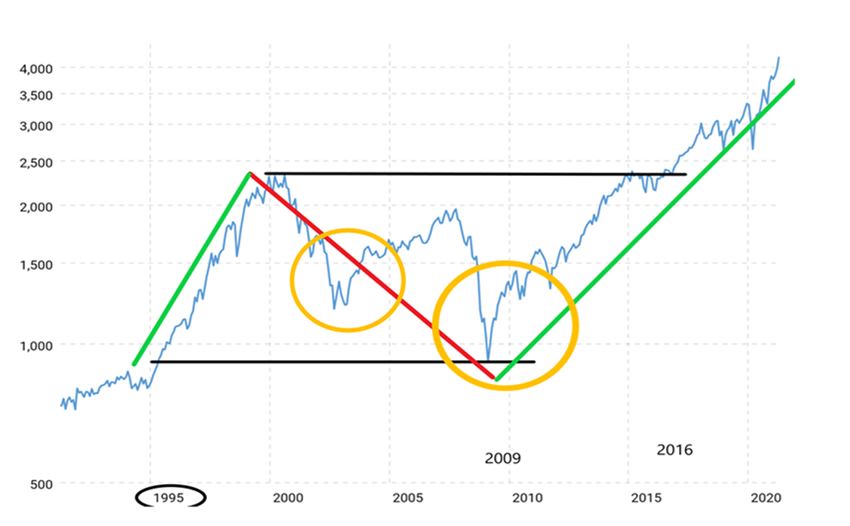

We checked out market efficiency beginning in 1995 and the way it could have labored for a consumer if the consumer had began self-funding 29 years in the past.

Zack offered this chart to elucidate a key threat of utilizing investments to fund LTC bills — lack of management over timing.

We used Joan as our instance.

- In 1995, at age 65, she decides to make use of investments to self-fund her future LTC prices.

- From 1995 to 2000, her technique seems to be prudent. The S&P 500 (the blue line on the left facet of the chart) soars, growing her portfolio (the inexperienced line on the left).

- Nevertheless, the last decade of 2000 to 2010, with pure market functioning, brings volatility.

- Sadly, Joan experiences two LTC occasions (orange circles).

The primary LTC occasion is at age 73, and the second LTC occasion is at age 79.

Takeaway: Joan seemed nice for 5 years.

Nevertheless, as a result of her planning is delicate to the market, she now has far much less financial savings than anticipated to cowl prices.

And, in 2009, when she wanted care at age 79, she had solely about the identical sum of money she had in 1995, attributable to market downturns (the purple line.)

Shoppers like Bob who hope to fund their LTC prices with a portfolio of fixed-rate bonds can also face the forms of funding threat related to bonds, corresponding to default threat, name threat and asset-liability matching issues.

The Dangers of Timing

Zack explains, “Since you may’t predict once you’ll undergo a change in well being which leads to struggling long-term care bills, a interval of market decline might depart you inclined to inadequate funding for LTC expense.”

This sort of monetary shortfall defeats the aim of self-funding.

The fluctuating worth of your consumer’s accounts — a standard market incidence — and a scarcity of management over the timing of a long-term care occasion — might depart your consumer ill-prepared and even in monetary issue.