Monetary advisors contemplating going out on their very own are weighing a number of paths to independence whereas dealing with a number of challenges in doing so, in line with a brand new Charles Schwab examine.

“The trail to independence is alive and properly — and, because the examine exhibits, is evolving in new, attention-grabbing methods. There are extra selections than ever as monetary advisors search independence,” mentioned Jon Beatty, chief working officer of Schwab Advisor Companies, in an interview with ThinkAdvisor.

“A flourishing ecosystem system has sprung up round advisors over the previous 30 years — with custodians enjoying a vital function, together with fintech gamers, outsourcing companions, pay-for-service organizations and enterprise companies that arrange platforms for advisors to hitch,” Beatty defined.

This implies there’s “extra complexity than ever, so help for advisors with the method [of going independent] is extra important than ever,” he famous.

Advisors should resolve what providers to supply, the consumer demographic they wish to serve, what know-how to make use of, which custodians to work with, and the way they’ll pay for the change, amongst different selections, the report factors out.

The examine is predicated on responses collected in March and April from 200 monetary advisors — 158 of whom have been then working for a broker-dealer and contemplating a transfer to independence over the subsequent three years, and 42 of whom had joined an RIA and gone impartial over the previous 4 years.

Listed here are 10 important findings from the Schwab Advisor Companies Supported Independence Research. Click on on the photographs, which come from Schwab’s report, to enlarge.

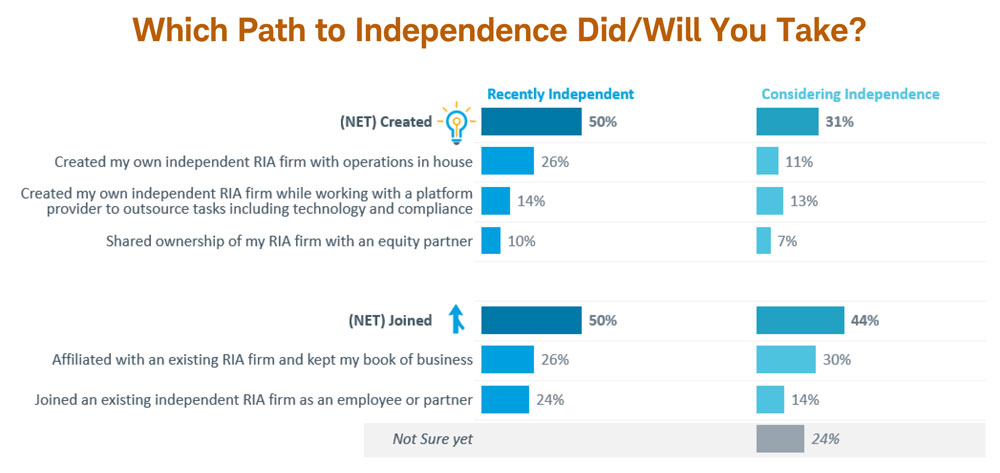

1. Advisors take totally different paths to independence.

Advisors presently contemplating independence usually tend to be part of or affiliate with an current registered funding advisor (44%) than create their very own agency (31%), whereas 24% are uncertain which path they’ll take, the examine discovered.

In distinction, just lately impartial advisors have been equally prone to have shaped their very own RIA agency as they have been to have joined or affiliated with an current RIA.

Among the many advisors Schwab interviewed one-on-one, the extra risk-averse have been extra prone to lean towards becoming a member of a agency, in line with the examine, which discovered advisors contemplating independence expressed fear concerning the monetary results of beginning their very own enterprise.

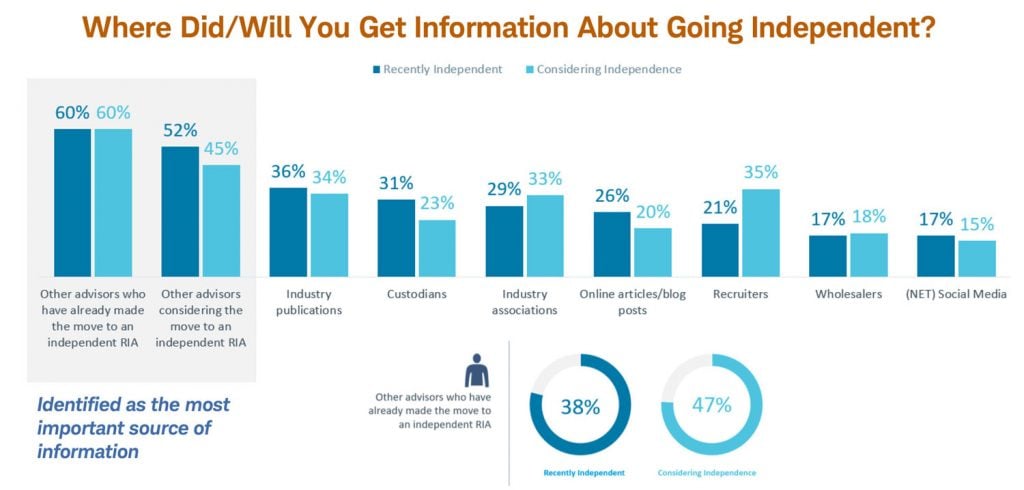

2. They flip to friends for help.

The survey discovered that 60% of advisors contemplating independence are most probably to hunt recommendation from friends who beforehand made the transition, whereas 45% mentioned they’d seek the advice of with different advisors weighing independence.

Practically half, or 47%, cited advisors who’ve already gone impartial as essentially the most useful data sources.

Findings have been comparable for newly impartial advisors, with 60% saying they turned to those that had already transitioned and 38% indicating these advisors have been their finest data supply.

“These are very very reassuring findings,” mentioned Beatty. “Typically, advisors contemplating this [move] attain out to friends, so there’s a virtuous ecosystem that ought to convey much more advisors into independence.”

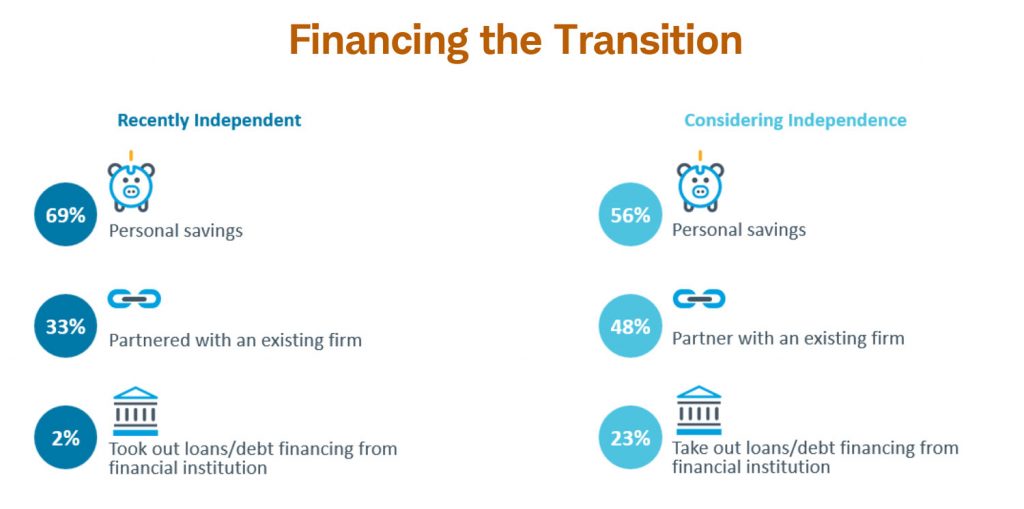

3. They see alternative ways to pay for it.

Going impartial will be expensive, whether or not an advisor establishes their very own RIA agency or transfer their enterprise to an current RIA, Schwab famous.

The advisors polled indicated they have been or are most probably to make use of their private financial savings to help the transition, with 69% of just lately impartial and 56% of contemplating advisors citing this technique as their most popular route.

Partnering with an current agency, which 33% of just lately impartial and 48% of contemplating advisors cited, is the second most-favored choice, which Schwab known as unsurprising as this selection helps cut back startup prices for these with much less monetary flexibility.

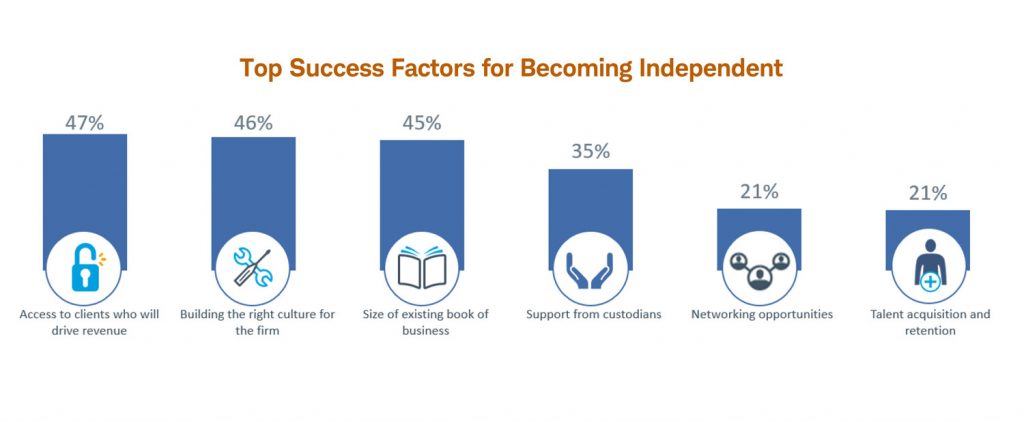

4. The three C’s of success are shoppers, tradition and custodians.

Apart from cash and recommendation, advisors want to contemplate different components that can assist them achieve going impartial.

Forty-seven % of each advisors who just lately grew to become impartial and people contemplating it cited entry to shoppers who will drive income as a key issue to attain that success, the examine discovered.

Constructing the best tradition for the agency additionally ranked excessive, as did the advisor’s current enterprise measurement. And over a 3rd cited help from custodians as an essential success issue.

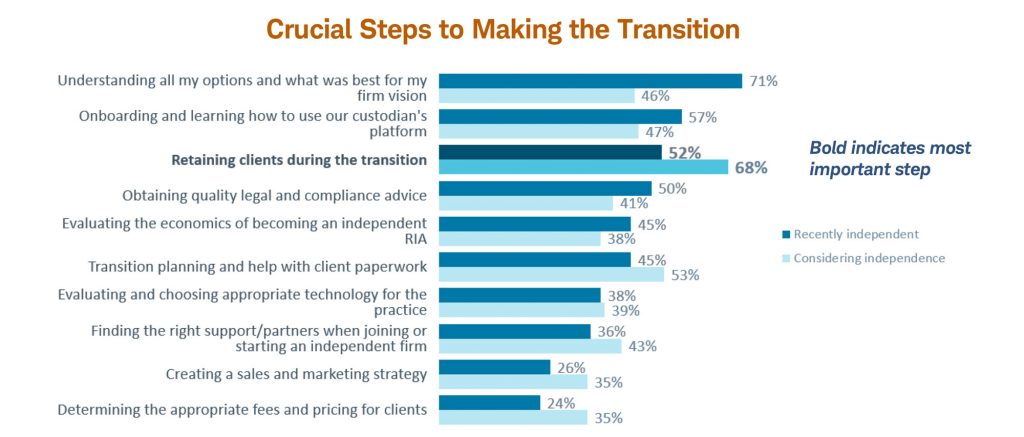

5. A very powerful steps to independence won’t be what advisors count on.

Advisors contemplating the transfer and people who’ve made it already differed in the important thing steps they took, or plan to take, to transition to independence.

Amongst these serious about going impartial, 68% cited consumer retention and 53% named transition planning and consumer paperwork because the most probably steps they are going to soak up changing into an impartial advisor.