By Max Dorfman, Analysis Author, Triple-I

2023 was one other yr with high-risk local weather and weather-related challenges, with 2024 positioned to pose its personal challenges.

Certainly, 2023 was the warmest yr for the globe since 1850 — when these information have been first made. The temperature in 2023 was over two levels Celsius above the 20th Century common, with the ten warmest years in recorded historical past occurring from 2014-2023. Report-setting temperatures hit areas throughout Canada, the southern United States, Central America, South America, Africa, Europe, Asia, in addition to components of the Atlantic Ocean, the Indian Ocean, and South Pacific Ocean.

These shifts in international climate – mixed with altering inhabitants and different dynamics – have performed a robust position within the threat of disasters.

Prices are excessive

In america, Allianz estimates, excessive climate occasions now price the nation $150 billion a yr, making these perils “key threats” for organizations. Nonetheless, bigger corporations are main a response to those dangers by remodeling their enterprise fashions to low carbon, whereas additionally creating new and improved plans to reply to local weather occasions. Allianz notes that supply-chain resilience is an important space of focus for the approaching yr.

“Though this yr’s Allianz Danger Barometer outcomes on local weather change present that reputational, reporting, and authorized dangers are considered lesser threats by companies,” mentioned Denise De Bilio, ESG Director, Danger Consulting, Allianz Business, “many of those challenges are interlinked.”

Based on Allianz, publicity stays highest for utility, vitality, and industrial sectors. Final yr’s wildfires in Canada restricted oil and fuel output to three.7 % of nationwide manufacturing. Water shortage is now additionally thought of to be a menace.

Promising developments

As Triple-I reported in late 2023, regardless of all the priority concerning local weather threat, sure weather-related disasters really declined prior to now yr. This consists of U.S. wildfire, which noticed its lowest frequency and severity prior to now twenty years, regardless of catastrophic losses in Washington State, Hawaii, Louisiana, and elsewhere, in response to a Triple-I Points Temporary. California – a state typically thought of synonymous with wildfire – final yr skilled its third gentle fireplace season in a row.

Householders insurance coverage charges in California, as elsewhere in america, have been rising. A few of this development is because of wildfires and building within the wildland-urban interface, which put elevated quantities of high-priced property in danger. Based on Cal Hearth, 5 of the biggest wildfires within the state’s historical past have occurred since 2017.

A lot of California’s downside, nevertheless, is said to a 1988 measure – Proposition 103 – that severely constrains insurers’ means to profitably insure property within the state. Late in 2023, California Insurance coverage Commissioner Ricardo Lara introduced a bundle of govt actions geared toward addressing a number of the challenges included in Proposition 103.

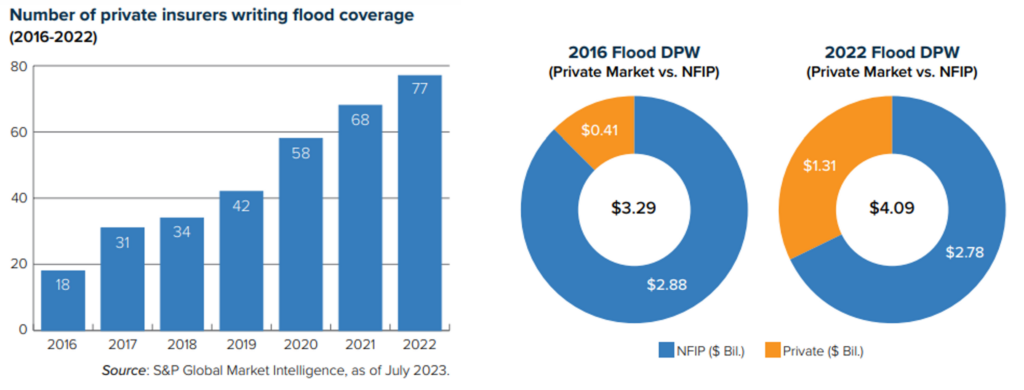

Flood stays a extreme and rising peril in america. Whereas the federal authorities stays the primary supply of insurance coverage protection by way of FEMA’s Nationwide Flood Insurance coverage Program (NFIP), the personal insurance coverage market is more and more stepping as much as assume extra of the danger. As Triple-I has reported, between 2016 and 2022, the entire flood market grew 24 % – from $3.29 billion in direct premiums written to $4.09 billion – with 77 personal corporations writing 32.1 % of the enterprise. Because the charts beneath clarify, personal insurers are accounting for a much bigger piece of a rising pie.

This is a vital improvement, because the rising private-sector involvement in flood can fairly be anticipated to consequence, over time, in higher availability and affordability of flood insurance coverage because the peril will increase and NFIP – by way of elevated reliance on risk-based pricing – spreads the price of protection extra pretty amongst property homeowners. Traditionally, the system typically sponsored protection for higher-risk houses, to the detriment of lower-risk property homeowners. With NFIP premium charges rising to extra precisely mirror the danger assumed, personal insurers – armed with more and more subtle information and analytical instruments – are higher geared up than ever to determine alternatives to write down extra enterprise.

A lot but to be achieved

Rising consciousness and motion to deal with climate-related threat is promising, however the disaster is way from over. In a number of U.S. states, insurance coverage affordability and even availability are being affected, and far of the dialog round this matter confuses trigger with impact. Rising insurance coverage charges and constrained underwriting capability is a consequence of the danger surroundings – not a reason for it.

Funding in mitigation and resilience is critical, and it will require collective accountability from the person and group ranges up by way of all ranges of presidency. It’ll require public-private partnerships and applicable alignment of funding incentives for all co-beneficiaries.

Be taught Extra:

Triple-I Points Temporary: Flood

Triple-I Points Temporary: Wildfire

FEMA Reauthorization Session Highlights Significance of Danger Switch and Discount

Miami-Dade, Fla., Sees Flood Insurance coverage Fee Cuts, Due to Resilience Funding

Milwaukee District Eyes Increasing Nature-Primarily based Flood-Mitigation Plan

Attacking the Danger Disaster: Roadmap to Funding in Flood Resilience

It’s Not an “Insurance coverage Disaster” — It’s a Danger Disaster