GlobalData surveying has discovered {that a} important majority of brokers can not identify a best-in-class insurer for sustainability and environmental, social, and governance (ESG) initiatives. Concurrently, analysis from Aviva signifies that ESG concerns are gaining traction amongst brokers.

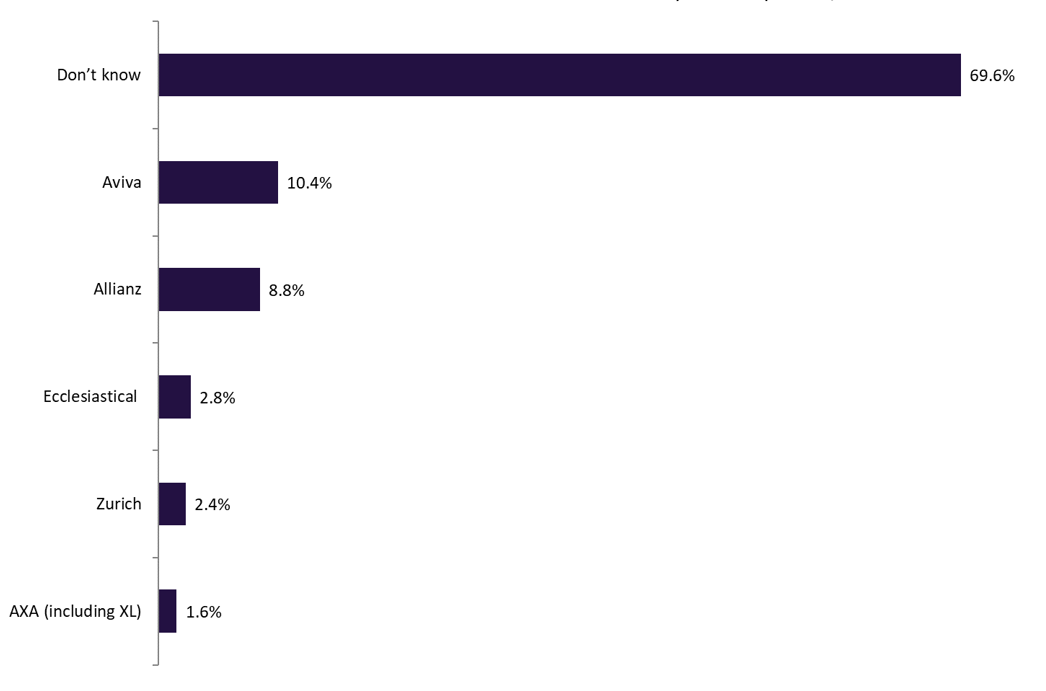

In accordance with GlobalData’s 2024 UK Industrial Insurance coverage Dealer Survey, 69.6% of brokers admitted to being unaware of any insurer that may very well be categorized as greatest in school by way of sustainability and ESG practices. This means that some brokers might not prioritise or recognise the significance of this problem. Regardless of this, Aviva (10.4%), Allianz (8.8%), and Ecclesiastical (2.8%) have emerged as frontrunners on this class.

In the meantime, 2024 analysis from Aviva underscores the rising emphasis on ESG amongst brokers. The research noticed that the variety of brokers actively pursuing sustainability targets has doubled over two years. Moreover, the analysis discovered that 4 out of 5 brokers are dedicated to enhancing the sustainability of their very own operations, in addition to these of their purchasers. Furthermore, whereas solely 35% of brokers presently have a concrete plan or are within the means of attaining net-zero emissions in 2024, this determine marks a rise from 17% in 2022 and 27% in 2023, indicating a optimistic pattern within the trade’s method to sustainability.

It’s crucial for brokers to not solely focus on ESG elements but in addition to be well-informed in regards to the insurers which are main the way in which in these areas. Brokers’ partnerships with insurers are a mirrored image of their very own values and might have important implications for his or her status and the belief positioned in them by purchasers. Brokers should align themselves with insurers that aren’t solely greatest in school by way of sustainability and ESG practices but in addition share the same ethos and dedication to those ideas. For insurers, there’s a urgent want to speak their sustainability and ESG achievements extra successfully. By doing so, insurers can place themselves as most well-liked companions for brokers which are more and more centered on these important points. Insurers have to recognise that their ESG efficiency can considerably affect their enchantment to brokers and, by extension, to their finish purchasers. Subsequently, a concerted effort to focus on their sustainability credentials can function a aggressive benefit in an trade that’s progressively prioritising ESG concerns.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

useful

determination for your online business, so we provide a free pattern which you can obtain by

submitting the beneath type

By GlobalData