What You Must Know

- A spike within the variety of failed trades, operational glitches and extra prices are amongst business fears because the buying and selling course of accelerates.

- The T+1 regime will increase the possibility of failures as a result of the compressed timeframe makes it tougher for consumers and sellers to make sure their funds and securities are prepared.

- The U.S. change additionally means it’s leaving different jurisdictions behind, which is a headache for a lot of funding automobiles working throughout borders.

When U.S. markets reopen subsequent Tuesday after the lengthy weekend, every part will seemingly appear regular. It’s solely after the shut and within the following days that any cracks are anticipated to look.

A spike within the variety of failed trades, operational glitches and extra prices are amongst business fears because the buying and selling course of for American securities accelerates, with the time allowed to finish each transaction halved to a single day.

Spurred on by the unique meme-stock frenzy, the Securities and Trade Fee is pushing the shift to cut back the possibility of one thing going incorrect between when a commerce is executed and when it’s settled. However the change to what’s generally known as T+1 comes with dangers of its personal.

Worldwide traders — who maintain about $27 trillion in American markets — face a system through which the common technique of funding a US commerce takes longer than they really should execute the deal.

Unheralded elements of the buying and selling course of like affirmation (confirming particulars), fixing errors, and recalling securities out on mortgage should occur no less than twice as quick. International funds face a mismatch the place money flowing out and in strikes at a distinct velocity to the belongings they’ve to purchase and promote.

And all of it faces a right away stress check as a number of the world’s main indexes rebalance or reveal deliberate reconstitutions earlier than the tip of this month.

“All arms will probably be on deck,” stated Michele Pitts, Citigroup Inc.’s international head of custody information for securities providers, noting the probability of elevated commerce fails throughout the business. “There will probably be a major uptick in settlement dangers for the primary a number of weeks.”

‘Lot of Nervousness’

Underneath present guidelines, anybody buying a U.S. inventory has two days between hitting the “purchase” button and really having to ship cash for the commerce, whereas the vendor has the identical time to produce the share.

This prolonged settlement interval in such a big and complicated market is what stays from the times when transactions have been handbook, and traders had as much as per week to finish.

That’s been whittled away over time, and new SEC guidelines will slash the settlement time once more on Might 28 to someday. Throughout Wall Road and past, main banks, asset managers and an assortment of specialised service corporations are bracing for the fallout.

At JPMorgan Chase & Co., inside modeling exhibits a couple of quarter of the foreign money trades it processes for shoppers are set to be impacted. Brown Brothers Harriman & Co. is placing shoppers by a “T+1 simulator” to establish these with potential points.

Establishments together with Societe Generale SA, Citi, HSBC Holdings Plc, UBS Asset Administration, Baillie Gifford and extra say they’re both shifting workers, reorganizing shifts or constructing new methods — and in some circumstances all three — in preparation for the change.

“There’s a number of nervousness even simply across the expertise and the precise approach by which settlement will happen,” Amy Hong, head of market construction and strategic partnerships for international banking and markets at Goldman Sachs Group, instructed the Bloomberg Promote-Facet Leaders Discussion board this month.

“There are going to be some mismatches round funding, there are going to be some FX-related points that we’re going to want to work out,” Hong stated.

The world of finance and funding may be famously averse to vary, with doomsayers dependably showing every time new guidelines are proposed. But within the case of T+1, the issues transcend one or two market Cassandras.

Simply 9% of sell-side corporations polled by Coalition Greenwich in April and Might stated they anticipate the T+1 change to go easily, with 38% warning that buy-side managers are unprepared, and 28% believing buying and selling platforms aren’t absolutely prepared. Virtually a fifth anticipate a big disruption with “many or extreme points.”

The consensus view is that commerce failures — when both a vendor doesn’t ship securities or a purchaser fails to provide fee — are about to rise. The query is how massive and protracted that uptick will probably be.

Settlement failures are usually a tiny characteristic of the trendy market, often stemming from technical points or human error. They may end up in regulatory punishment, lack of capital tied up within the commerce, and even — in very uncommon cases when the transaction is massive sufficient — the collapse of events within the deal.

The T+1 regime will increase the possibility of failures as a result of the compressed timeframe dangers making errors extra seemingly, whereas on the identical time lowering the chance to appropriate them. Most crucially, it makes it tougher for consumers and sellers to make sure their funds and securities are prepared.

The $7.5 trillion-a-day foreign-exchange market is a flashpoint of the shift, as a result of foreign money trades usually choose a T+2 foundation. An abroad investor shopping for a US inventory will quickly must both have {dollars} prepared or discover them inside a day in an enviornment the place it will probably take two.

Friday Fears

From its Edinburgh headquarters over 3,200 miles from Wall Road, the £225 billion ($285 billion) funding home Baillie Gifford has relocated two merchants to New York and beefed up its settlement desk to assist the agency keep lively after the 4 p.m. US inventory shut.

Due to the T+1 shift and a 6 p.m. deadline at CLS Group (a platform on the middle of the market that settles over $6 trillion of foreign money transactions on daily basis), that can grow to be an important interval for asset managers in search of {dollars} to fund their U.S. trades.

Nevertheless it additionally falls across the begin of what are generally known as the witching hours in foreign-exchange circles due to the well-known lack of liquidity.

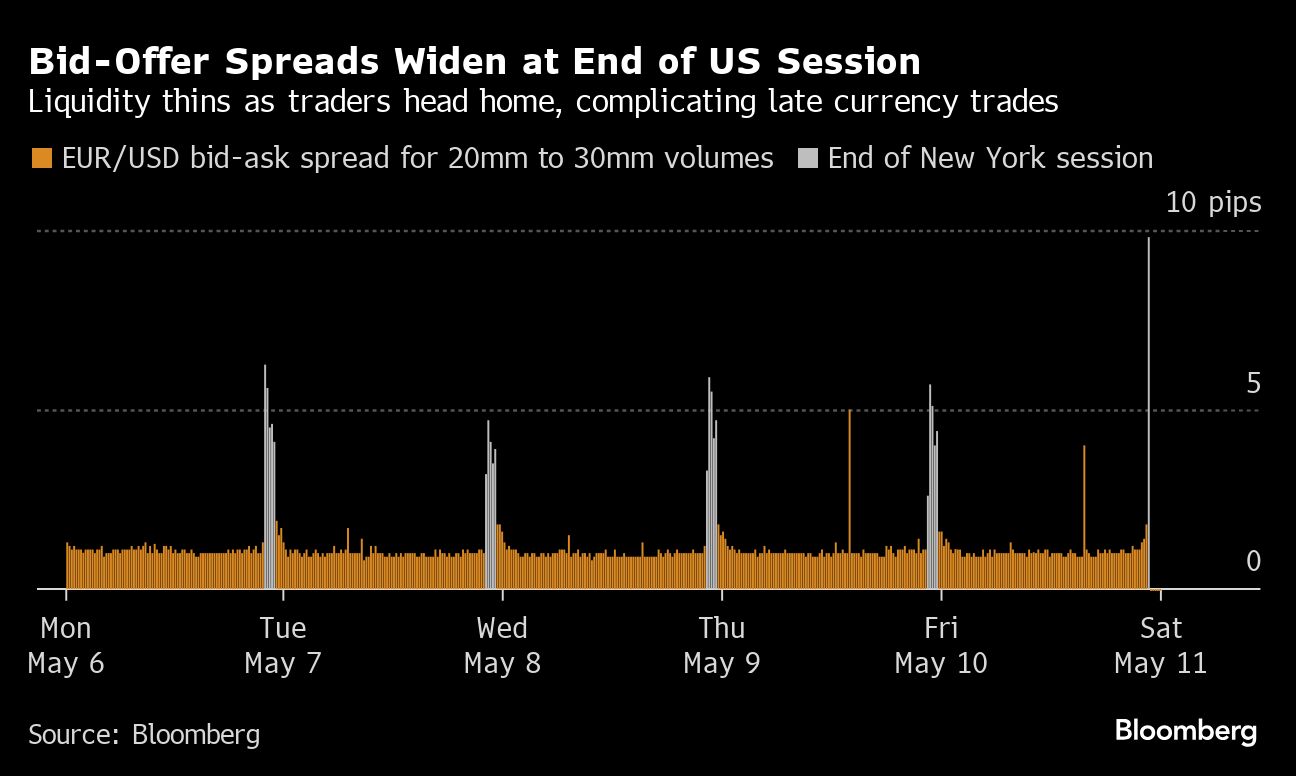

“In the event you have a look at the bid-offer spreads, they’re usually tight all through the day and whenever you get to the 5 p.m. to about 8 p.m. Japanese, they only widen out,” stated Brendan Burke, a managing director at BBH. “It’s so simple as there’s much less liquidity out there as a result of the banks aren’t staffed.”

Baillie Gifford has lobbied US regulators to get banks to increase their foreign-exchange buying and selling hours and to proceed offering liquidity till no less than 6 p.m. in New York, 5 days per week. Since shifting its workers in January, the agency has been buying and selling as if T+1 was already in drive to make sure every part goes easily, based on Adam Conn, head of buying and selling.

“It’s about attempting to mitigate the extra working threat which is falling on asset managers,” stated Conn. There’ll solely be a “very brief window” after the US market near resolve issues, he stated.

Friday afternoon is rising as a selected space of concern, as a result of foreign money markets shut on weekends, which means liquidity is often at its lowest simply earlier than the US joins Europe and Asia in clocking off. JPMorgan’s Brijen Puri, head of world FX providers, stated “neither the buyside or sellside actually is aware of what’s going to occur” in these intervals following the change.

“As soon as there’s extra information about what’s taking place in that point zone, that’s when banks in addition to asset managers could determine on offering extra protection,” Puri stated. “Like you might have an evening desk, you might have a Friday night desk.”