Clue: It is not simply the climate…

The non-admitted insurance coverage market is experiencing a property premium growth, and pure disaster uncovered states are main the cost however are certainly not the one contributors in a tough market.

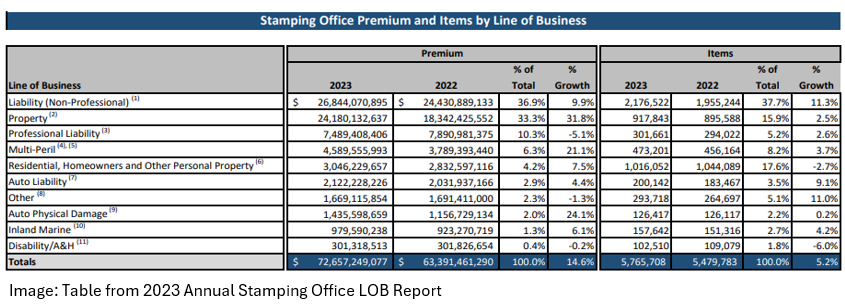

Stamping workplaces throughout the US reported 2023 surplus strains property premiums written progress of 31.8%, or $5.84 billion, far outstripping 2022’s 25.9% enhance. Property now accounts for a 3rd of surplus strains enterprise written throughout the 15 reporting states.

Insureds flip to the excess strains market when customary market insurance coverage availability is tight. It could come as little shock then that pure disaster inclined states which have tussled with capability crunches led the cost when it comes to precise premium added.

“As the usual market’s threat urge for food adjustments, that’s at all times going to drive the stream of sure strains of protection into the excess strains market, and that’s what we’re seeing on the property facet right here, particularly in the case of a number of the harder, riskier property coverages, notably cat uncovered property,” Wholesale & Specialty Insurance coverage Affiliation (WSIA) government director Brady Kelley advised Insurance coverage Enterprise.

Florida, California and Texas might have represented the highest three states when it comes to complete premium, however simply Texas made the highest three for E&S premium share progress. Coastal uncovered North Carolina took the highest spot, whereas Minnesota was third. Simply New York State noticed property premiums written fall.

All however one state noticed surplus strains property premium progress

|

State

|

2023

|

2022

|

Property as a % of complete premium

|

% change from 2022

|

|

Florida

|

$7,169,426,485

|

$5,058,287,251

|

46.50%

|

41.70%

|

|

Texas

|

$5,778,498,526

|

$3,960,589,972

|

39.60%

|

45.90%

|

|

California

|

$3,795,673,668

|

$3,204,131,429

|

22.80%

|

18.50%

|

|

New York

|

$2,363,238,618

|

$2,366,817,444

|

29.20%

|

-0.20%

|

|

Illinois

|

$1,130,269,723

|

$853,472,855

|

28.30%

|

32.40%

|

|

Washington

|

$746,041,474

|

$585,508,452

|

33.10%

|

27.40%

|

|

Pennsylvania

|

$722,069,738

|

$506,264,253

|

26.10%

|

42.60%

|

|

North Carolina

|

$668,095,653

|

$456,273,607

|

33.40%

|

46.40%

|

|

Mississippi

|

$389,744,329

|

$286,278,761

|

41.10%

|

36.10%

|

|

Oregon

|

$343,175,350

|

$260,922,998

|

33.50%

|

31.50%

|

|

Minnesota

|

$338,609,318

|

$236,648,919

|

27.20%

|

43.10%

|

|

Arizona

|

$274,828,133

|

$210,547,869

|

17.90%

|

30.50%

|

|

Utah

|

$207,531,617

|

$165,266,782

|

24.60%

|

25.60%

|

|

Nevada

|

$142,392,450

|

$111,479,870

|

14.70%

|

27.70%

|

|

Idaho

|

$110,537,555

|

$79,935,091

|

33.00%

|

38.30%

|

Supply: Stamping Workplace Premium and Transaction Report – 2023 Annual Report

E&S property premium progress – a confluence of things

Along with extreme climate exposures, insurance coverage professionals pointed to a confluence of things driving the upwards E&S property premium pattern.

Rising reinsurance prices was chief amongst these for Bob McNamee, Jimcor VP of business binding authority.

“There are a number of various factors, the largest one in all probability being that reinsurance prices are rising, which finally ends up leading to greater premiums and price to the top client,” McNamee stated. “That may considerably enhance pricing and all indications are that as we transfer into 2025 that may stabilize, but it surely’s nonetheless impacting the 2024 premiums fairly considerably.”

Reinsurance charges have continued to harden since 2018 following the triple-threat hit of hurricanes Harvey, Irma and Maria (HIM).

In Hurricane Ian’s devastating wake, 2023 noticed carriers scramble to acquire reinsurance amid price hikes and tightening. For some, US property reinsurance charges rose as a lot as 50% in July 1, 2023 renewals, based on Gallagher Re. The pattern echoed into Jan. 1, 2024 for beforehand disaster hit property, however charges reportedly started to accept others.

Development challenges and constructing valuations affect

An uptick in constructing valuations has additional added to a premium swell, McNamee and different insurance coverage professionals stated. Additionally piling on upwards stress, rising development prices and labor shortages have left some buildings going with out updates, leaving them topic to greater property insurance coverage charges.

Hit by extreme climate and buildings claims value challenges, property capability throughout each London and the home markets has shrunk amid heightened demand, culminating in worth hikes.

Admitted carriers have introduced in stricter underwriting necessities and in circumstances shied away from sure areas. This has pushed property enterprise into the excess strains market.

“Customary carriers proceed to drag out of assorted courses and are implementing firmer underwriting necessities – comparable to wiring sorts and restricted geographical areas – which is pushing extra enterprise into the E&S strains market,” stated Wealthy Gobler, SVP, Western United States, Burns & Wilcox. “On account of these tightened necessities, every provider is proscribed to what they’ll write, creating much less capability.”

E&S provide and demand dynamics

Surplus strains property capability warning and provide and demand dynamics even have a job to play. E&S carriers have been burned earlier than and this has boosted worth will increase.

“E&S carriers are elevating charges considerably on account of elevated quantity of submissions and unprofitable leads to property over the previous five-plus years, with excessive development prices being a significant component,” Gobler stated.

With many E&S carriers reducing again on sure courses, Gobler famous that these which can be prepared to cite will “possible get the charges they need”.

The typical line measurement within the E&S market shrank final 12 months, with extra insurance policies required to realize the identical “and even decrease” limits than in 2022, RPS nationwide property president Wes Robinson stated.

Extra competitors might push pricing and premiums again down, but it surely has but to emerge, insurance coverage sources stated.

“We haven’t seen [significant entrances into the market] and in case you add provide, it’s finally going to place stress on the value,” stated Doug Davis, SVP massive property division, Skyward Specialty. “We haven’t seen that however that doesn’t imply that markets which have had one good 12 months out of say six [won’t] say that now’s a great time to go and develop. When you’ve got sufficient markets doing that, then finally there’ll be some stress in the marketplace as a complete.”

General, surplus strains premium written grew 14.6% in 2023 following a record-setting 2022. Residential, owners’ and different private property noticed progress of seven.5%. WSIA’s Kelley stated this was not “typical”, with disaster inclined states like Florida and California pushing up premium figures additional than within the prior 12 months.

Kelley was buoyant on continued wholesale and specialty progress into 2024 and past.

“Whereas the supplemental nature of our business actually creates cyclical ebbs and flows, our members comprise an business targeted on integrity, service, innovation, monetary stability, and entry to markets that may customise options for probably the most advanced insurance coverage dangers,” Kelley stated. “That strategy to enterprise goes to proceed to create alternative, for my part, for the wholesale and specialty market.”

Obtained a view on surplus strains progress? Drop a remark beneath.

Associated Tales

Sustain with the most recent information and occasions

Be a part of our mailing record, it’s free!