Nonetheless, not all improvements are equal and nor do they comply with a relentless upward pattern. As an alternative, their evolution takes the type of an S-shaped curve that displays their typical lifecycle from early emergence to accelerating adoption, earlier than lastly stabilizing and reaching maturity.

Figuring out the place a selected innovation is on this journey, particularly these which are within the rising and accelerating phases, is important for understanding their present degree of adoption and the probably future trajectory and impression they’ll have.

20+ improvements will form the insurance coverage business

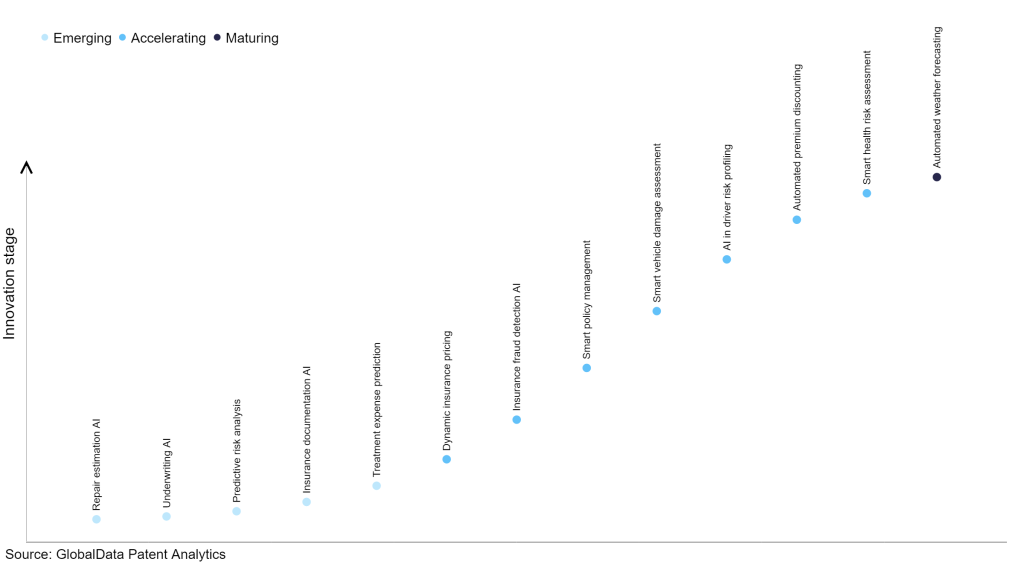

In response to GlobalData’s Know-how Foresights, which plots the S-curve for the insurance coverage business utilizing innovation depth fashions constructed on over 70,000 patents, there are 20+ innovation areas that can form the way forward for the business.

Throughout the rising innovation stage, underwriting AI, predictive danger evaluation, and insurance coverage documentation AI are disruptive applied sciences which are within the early phases of utility and needs to be tracked intently. Insurance coverage fraud detection AI, good coverage administration, and good car harm evaluation are a number of the accelerating innovation areas, the place adoption has been steadily growing. Amongst maturing innovation areas is automated climate forecasting, which is now properly established within the business.

Innovation S-curve for synthetic intelligence within the insurance coverage business

Sensible car harm evaluation is a key innovation space in synthetic intelligence

Sensible car harm evaluation refers to using superior AI applied sciences reminiscent of picture processing, laptop imaginative and prescient, and machine studying to robotically assess and estimate the restore price of broken automobiles. By analyzing pictures of the broken car, each exterior and inner harm will be detected and inferred by insurers, permitting for a extra correct estimation of restore prices. This know-how goals to streamline and automate the method of car harm claims, thereby decreasing guide effort and bettering the effectivity of insurers.

GlobalData’s evaluation additionally uncovers the businesses on the forefront of every innovation space and assesses the potential attain and impression of their patenting exercise throughout completely different purposes and geographies. In response to GlobalData, there are 150+ corporations, spanning know-how distributors, established insurance coverage corporations, and up-and-coming start-ups engaged within the growth and utility of good car harm evaluation.

Key gamers in good car harm evaluation – a disruptive innovation within the insurance coverage business

‘Software range’ measures the variety of purposes recognized for every patent. It broadly splits corporations into both ‘area of interest’ or ‘diversified’ innovators.

‘Geographic attain’ refers back to the variety of nations every patent is registered in. It displays the breadth of geographic utility meant, starting from ‘world’ to ‘native’.

Patent volumes associated to good car harm evaluation

Supply: GlobalData Patent Analytics

State Farm Mutual Vehicle Insurance coverage is without doubt one of the main patent filers in good car harm evaluation. The corporate filed patents associated to machine studying and deep studying picture processing strategies for robotically estimating the harm degree, restore time, and restore price for automobiles concerned in an accident. Cox Enterprises, Alibaba Group, and Ping An Insurance coverage (Group) are a number of the different key patent filers within the good car harm evaluation house.

When it comes to utility range, Theator held the highest place, whereas Curiteva and Clearlake Capital stood in second and third positions, respectively. By way of geographic attain, Alphabet leads the pack, adopted by Pictometry Worldwide and Clearlake Capital.

To additional perceive the important thing themes and applied sciences disrupting the insurance coverage business, entry GlobalData’s newest thematic analysis report on Synthetic Intelligence (AI) in Insurance coverage.

From

The gold commonplace of enterprise intelligence.

Mixing knowledgeable data with cutting-edge know-how, GlobalData’s unrivalled proprietary knowledge will allow you to decode what’s taking place in your market. You may make higher knowledgeable choices and acquire a future-proof benefit over your opponents.