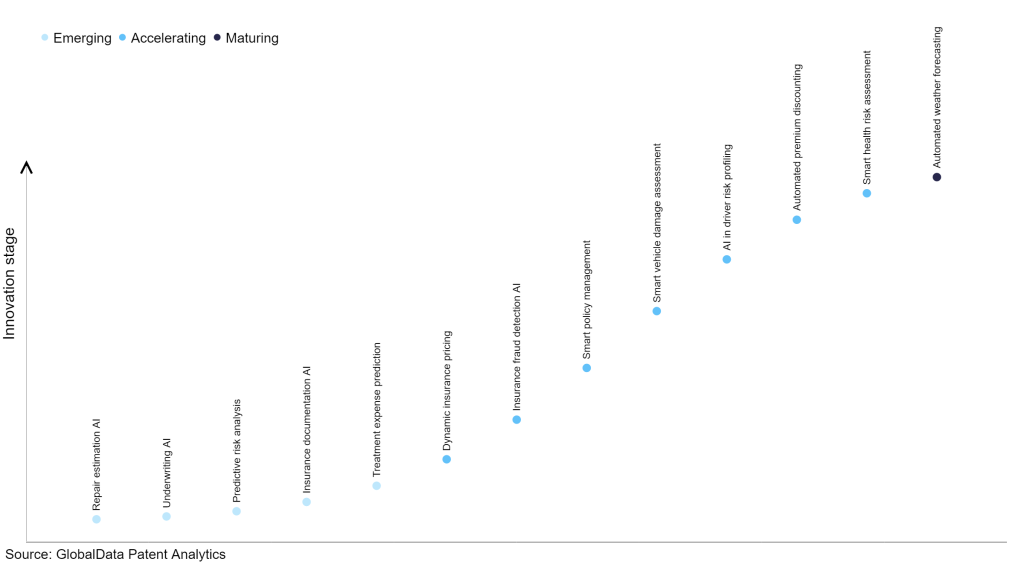

Nonetheless, not all improvements are equal and nor do they observe a continuing upward development. As an alternative, their evolution takes the type of an S-shaped curve that displays their typical lifecycle from early emergence to accelerating adoption, earlier than lastly stabilizing and reaching maturity.

Figuring out the place a selected innovation is on this journey, particularly these which are within the rising and accelerating phases, is important for understanding their present stage of adoption and the doubtless future trajectory and influence they’ll have.

20+ improvements will form the insurance coverage business

In accordance with GlobalData’s Know-how Foresights, which plots the S-curve for the insurance coverage business utilizing innovation depth fashions constructed on over 70,000 patents, there are 20+ innovation areas that can form the way forward for the business.

Throughout the rising innovation stage, underwriting AI, predictive threat evaluation, and insurance coverage documentation AI are disruptive applied sciences which are within the early phases of software and must be tracked intently. Insurance coverage fraud detection AI, good coverage administration, and good car harm evaluation are among the accelerating innovation areas, the place adoption has been steadily growing. Amongst maturing innovation areas is automated climate forecasting, which is now nicely established within the business.

Innovation S-curve for synthetic intelligence within the insurance coverage business

Sensible coverage administration is a key innovation space in synthetic intelligence

Sensible coverage administration refers to using superior applied sciences, akin to machine studying and picture processing, to automate and optimize numerous points of insurance coverage coverage administration. It entails the coaching and use of machine studying fashions to research information, akin to pictures and textual content, to make knowledgeable selections and carry out duties associated to insurance coverage insurance policies. These applied sciences allow environment friendly underwriting processes, correct willpower of harm to property, verification of car odometer mileage, submission of insurance coverage claims, technology of insurance coverage information and insurance policies, processing of picture information for car harm evaluation, and depiction of car data in augmented actuality.

GlobalData’s evaluation additionally uncovers the businesses on the forefront of every innovation space and assesses the potential attain and influence of their patenting exercise throughout completely different functions and geographies. In accordance with GlobalData, there are 50+ corporations, spanning expertise distributors, established insurance coverage corporations, and up-and-coming start-ups engaged within the growth and software of good coverage administration.

Key gamers in good coverage administration – a disruptive innovation within the insurance coverage business

‘Software variety’ measures the variety of functions recognized for every patent. It broadly splits corporations into both ‘area of interest’ or ‘diversified’ innovators.

‘Geographic attain’ refers back to the variety of nations every patent is registered in. It displays the breadth of geographic software meant, starting from ‘world’ to ‘native’.

Patent volumes associated to good coverage administration

Supply: GlobalData Patent Analytics

Ping An Insurance coverage (Group) is likely one of the high patent filers in AI-driven applied sciences for good coverage administration. The corporate makes use of superior AI applied sciences akin to deep studying, information mining, biometric identification, and pure language processing to automate and enhance the effectivity of the complete coverage administration system, from threat evaluation and coverage underwriting to proof verification and claims processing.

Among the different main innovators within the good coverage administration area embrace Clearlake Capital, State Farm Mutual Car Insurance coverage, and Taikang Insurance coverage.

By way of software variety, Clearlake Capital held the highest place, whereas Curiteva and Capital One Monetary stood in second and third positions, respectively. By way of geographic attain, Clearlake Capital leads the pack, adopted by Paperclip and Visa.

To additional perceive the important thing themes and applied sciences disrupting the insurance coverage business, entry GlobalData’s newest thematic analysis report on Artificial Intelligence (AI) in Insurance coverage.

From

The gold customary of enterprise intelligence.

Mixing knowledgeable data with cutting-edge expertise, GlobalData’s unrivalled proprietary information will allow you to decode what’s occurring in your market. You may make higher knowledgeable selections and achieve a future-proof benefit over your opponents.