What You Have to Know

- Some shoppers may have protection to remain in power at age 90.

- Some might have tight budgets and extra versatile protection length wants.

- The creator suggests serving to shoppers weigh the prices and the advantages rigorously.

Everlasting life insurance coverage is available in many types. Too typically, nonetheless, shoppers are introduced as if solely two varieties exist: “assured” and “non-guaranteed.”

Whether or not intentional or not, framing the selection this fashion creates a false dichotomy and too typically leads shoppers towards options that don’t greatest meet their wants. In my expertise, probably the most profitable producers take a unique strategy.

The very first thing they acknowledge is that every one merchandise have ensures, and all merchandise have dangers. It doesn’t serve anybody to fake in any other case.

For instance, a product introduced because the “assured” possibility might include the chance of limiting a consumer’s skill to regulate their premium funding sooner or later, or with the chance that the fee is considerably larger than alternate options. However, a product introduced as “non-guaranteed” may really assure protection for many years whereas offering compelling money worth development potential relative to the “assured” various.

The second factor profitable producers do is preserve it easy, however not too easy. Whereas “assured” vs. “non-guaranteed” is actually catchy, it oversimplifies the dialog. An alternate strategy is acknowledging that tradeoffs are required in life insurance coverage product choice, simply as in every other monetary resolution. Advisors can do that by asking a extra neutral and open-ended query: “What’s the very best use of your cash?”

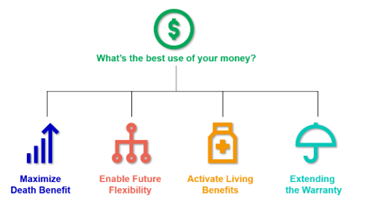

When the necessity is everlasting loss of life profit safety, there are sometimes 4 totally different priorities that must be balanced: maximizing the loss of life profit, enabling future flexibility, activating residing advantages, and eventually, what I name “extending the guarantee.” This final one will get on the “assured” query in additional impartial phrases {that a} consumer can simply perceive. Simply as with a automobile or a TV set, a life insurance coverage purchaser has the choice to take a “producer’s guarantee” — i.e., the fundamental no-lapse assure — or they will “lengthen the guarantee” and buy an extended no-lapse assure. Presenting it this fashion helps the consumer perceive that this strategy has each a value and a profit — one which needs to be balanced in opposition to different wants.

At this level, the advisor has a significantly better understanding of what’s really necessary to the consumer, and this will result in presenting two decisions which have totally different no-lapse ensures. For instance, possibility A may provide a 20% decrease premium with a no-lapse assure to age 90, whereas possibility B has a lifetime no-lapse assure however is costlier. On this state of affairs, the advisor should deal with a really actual consumer concern: “What if the coverage underperforms the illustration and I outlive life expectancy?”

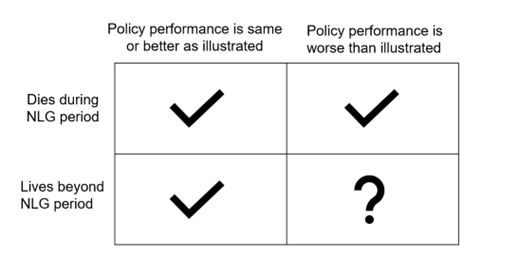

This results in the third factor profitable advisors do: they present how “assure” length doesn’t essentially imply “protection” length. The simplest means to do that is to attract a easy two-by-two grid to map out 4 doable outcomes. In three of the 4, “Choice A” would be the clear favourite. Within the different one, the higher resolution will rely on how lengthy the consumer lives and the way a lot worse the illustrated efficiency is.

Displaying a grid like this has three advantages. First, it eliminates a false assumption that life insurance coverage protection doesn’t essentially disappear after the no-lapse assure interval. Second, it helps the consumer see that the hostile consequence shouldn’t be the one doable consequence. And, lastly, it helps present that there could also be hostile situations that can nonetheless preserve protection in power properly past the producer’s guarantee. Advisors can then get inventive in addressing hostile situations via totally different illustration designs.