What You Must Know

- he $250 billion closed-end fund trade is now the scene of probably the most dramatic energy struggles in finance.

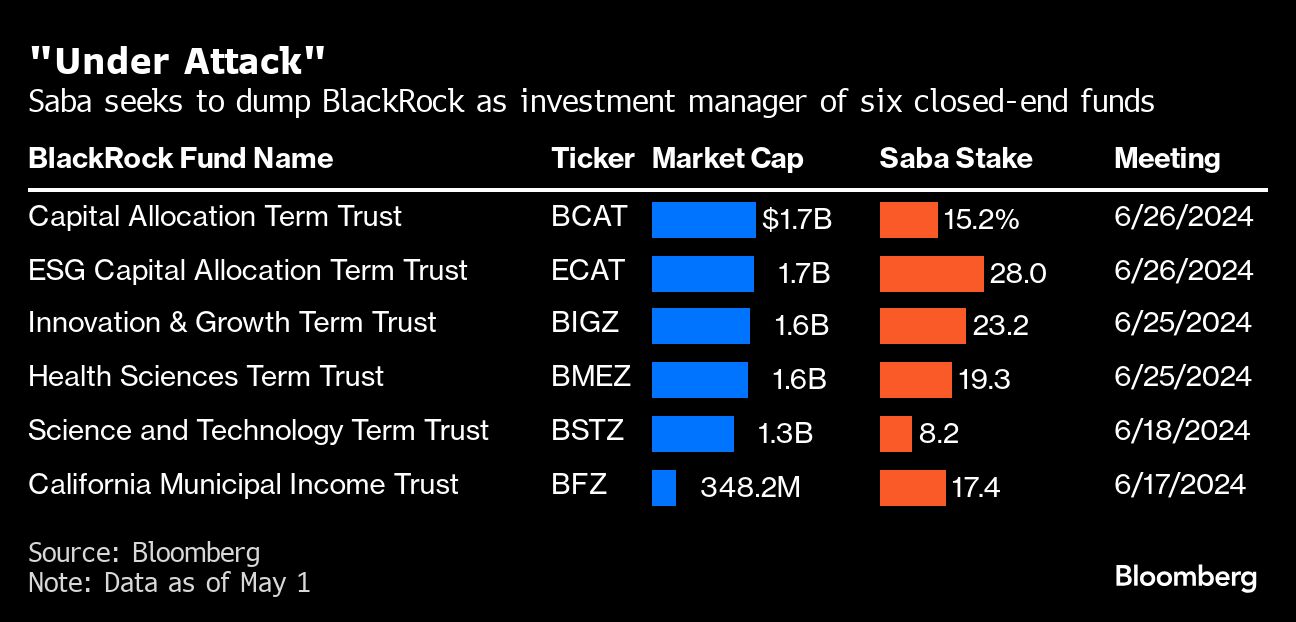

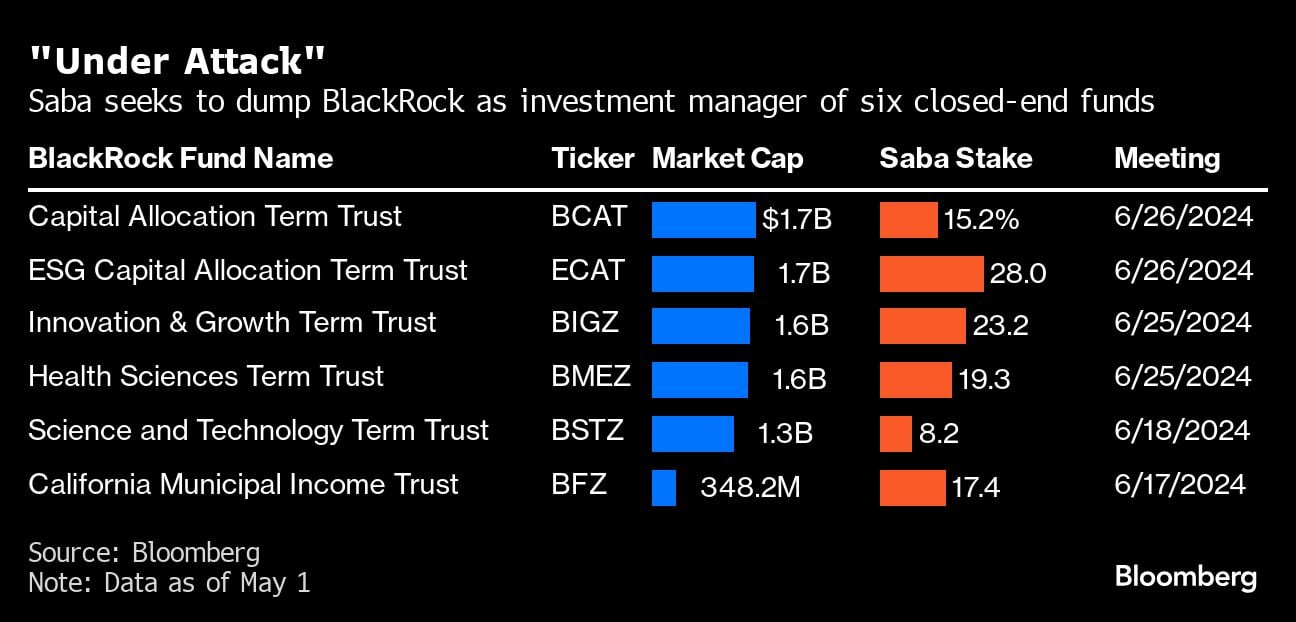

- Final month, Saba Capital Administration launched a frenetic bid to have buyers take away BlackRock as supervisor of six funds overseeing about $10 billion in belongings.

- BlackRock is warning buyers that Saba may radically alter the composition of the funds ought to it win management, exposing shareholders to better danger.

Just a few days in the past, BlackRock Inc. despatched an uncommon message to hundreds of shoppers. It contained not one of the formulaic language or inscrutable wonderful print sometimes packed into these kinds of statements. No, this was a name to arms.

“Your fund is underneath assault,” the headline screamed in daring print.

The attacker: Boaz Weinstein, the sharp-elbowed Wall Avenue cash supervisor who says worth distortions in funds run by BlackRock and others are dishonest buyers out of billions of {dollars}, they usually must be eradicated.

This has changed into one thing of a campaign for Weinstein. Final month, his hedge fund, Saba Capital Administration, launched a frenetic bid to have buyers take away BlackRock as supervisor of six funds overseeing about $10 billion in belongings.

Boaz Weinstein, founder and chief funding officer of Saba Capital Administration Which is what triggered the observe BlackRock despatched to shoppers. “If Saba have been to succeed, it might search to nominate itself as funding advisor” and essentially disrupt the funds’ goals and methods, “all to counterpoint itself.”

The ongoing feud has turned the $250 billion closed-end fund trade, a usually sleepy Wall Avenue backwater, into the scene of probably the most dramatic energy struggles in finance — one which’s coming to a head at shareholder conferences subsequent month.

Weinstein says BlackRock isn’t solely trapping shareholders in underperforming merchandise, but in addition failing to satisfy fundamental governance requirements by stymieing his efforts to elect new administrators.

BlackRock factors to Weinstein’s personal monitor file, the place he took over a closed-end fund that had beforehand invested in floating-rate loans and put a few of its cash into crypto publicity and SPACs.

Either side vow they’ve the ethical excessive floor.

“We have to present there’s a price to illegally entrenching themselves to guard their administration charges whereas doing horrible issues to shareholders,” Weinstein stated in an interview, including that a lot of BlackRock’s closed-end funds have monitor file of “horrible efficiency.”

Weinstein’s transfer — echoing among the most audacious company raids of the Nineteen Eighties — is the most recent escalation in a multiyear marketing campaign concentrating on closed-end funds buying and selling nicely under the worth of their underlying belongings.

The 50-year-old hedge fund boss at the moment has about $6 billion invested within the merchandise, utilizing his stakes in dozens of funds to press cash managers to purchase again shares close to their full market worth (often known as a young) or flip their funds into open-ended automobiles, which might produce an identical outcome.

In recent times he’s taken on the likes of Eaton Vance, Franklin Templeton and Voya Monetary, convincing managers to tender, successful board seats and even prompting them to resign from their function as fund adviser.

Weinstein notes that if Saba have been to win the proxy battles, it wouldn’t essentially imply the hedge fund would assume administration of the funds. That will be as much as the boards, however Saba has stated it could “stand prepared” to help and will provide to do the job.

In mid-2021, Saba took over the $600 million Voya Prime Charge Belief, now often known as the Saba Capital Earnings & Alternatives Fund (ticker BRW) and altered its funding mandate after getting shareholder approval.

Following a pair of tender gives, the fund has returned an annualized 4.1%, greater than triple its high-yield bond benchmark, based on knowledge compiled by Bloomberg. It ranked third of twenty-two peer funds in 2022, 14th in 2023 and second-to-last this yr by means of April, based on Morningstar Inc. knowledge, which compares the product to US financial institution mortgage closed-end funds.

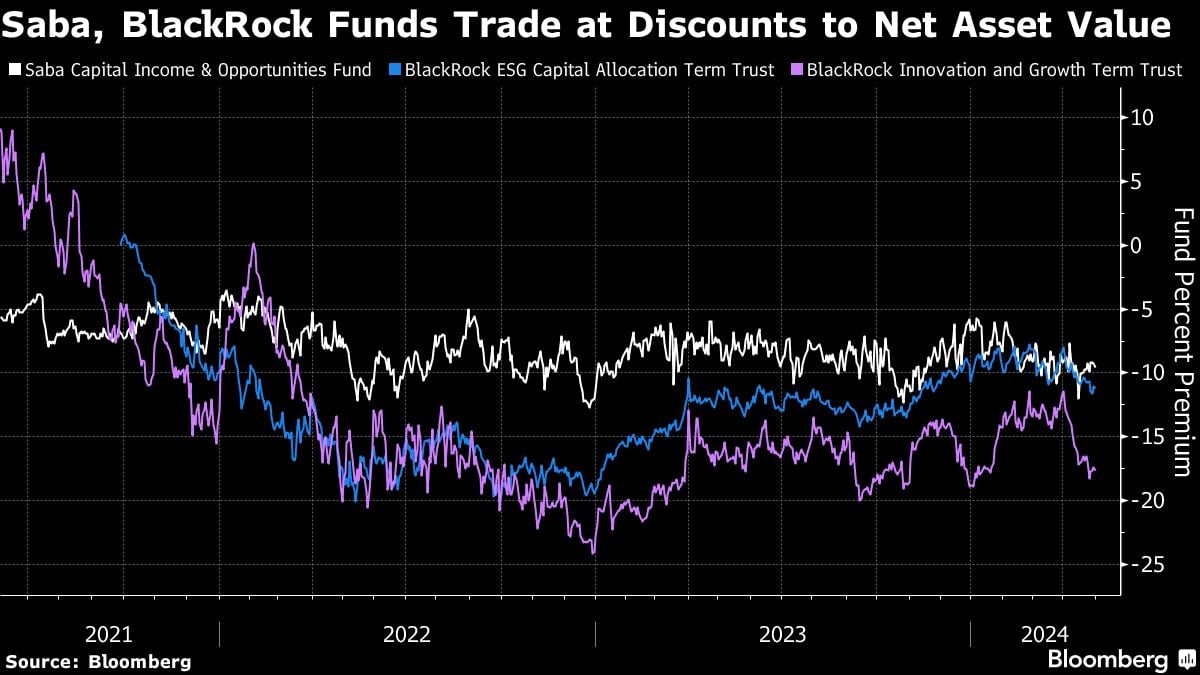

By comparability, the $1.6 billion BlackRock Innovation & Development Time period Belief (ticker BIGZ) has misplaced an annualized 23% over the identical interval, whereas the $1.7 billion BlackRock ESG Capital Allocation Time period Belief (ticker ECAT) has gained an annualized 0.8% since its September 2021 inception.

BIGZ ranked both first or second in its Morningstar class of solely two funds over the interval; ECAT ranked sixth in 2022, second in 2023 and eighth this yr by means of April in its group of 11 funds.

BlackRock is fast to level out that BIGZ and ECAT returned 19% and 32%, respectively, final yr as markets rebounded broadly, and that it manages closed-end funds in the identical Morningstar peer group as BRW which have had increased returns than the Saba fund lately.

Nonetheless, BIGZ and ECAT proceed to commerce considerably under their so-called web asset worth, or NAV. BIGZ is at the moment at a 17% low cost, whereas ECAT trades at a ten% low cost, based on knowledge compiled by Bloomberg. Saba’s BRW is at an 8.3% low cost.

BlackRock is warning buyers that Saba may radically alter the composition of the funds ought to it win management, exposing shareholders to better danger.

After Saba took over BRW, it started including every part from crypto publicity to SPACs to different closed-end funds Weinstein is campaigning towards. BlackRock says Saba’s ways don’t have anything to do with serving to buyers apart from himself and his hedge fund shoppers.