In a context of ongoing disruption, insurers are being known as to reinvent themselves. So as to rework on an operational degree, insurers want to maneuver from complexity to simplicity. This alone is a frightening process. Composable structure helps insurers to simplify this complexity at each step of the insurance coverage value-chain, typically utilizing processes already at their disposal. Under are 5 sensible composable structure use instances.

1. Coverage administration – from advanced organizational constructions to agile and built-in ecosystems

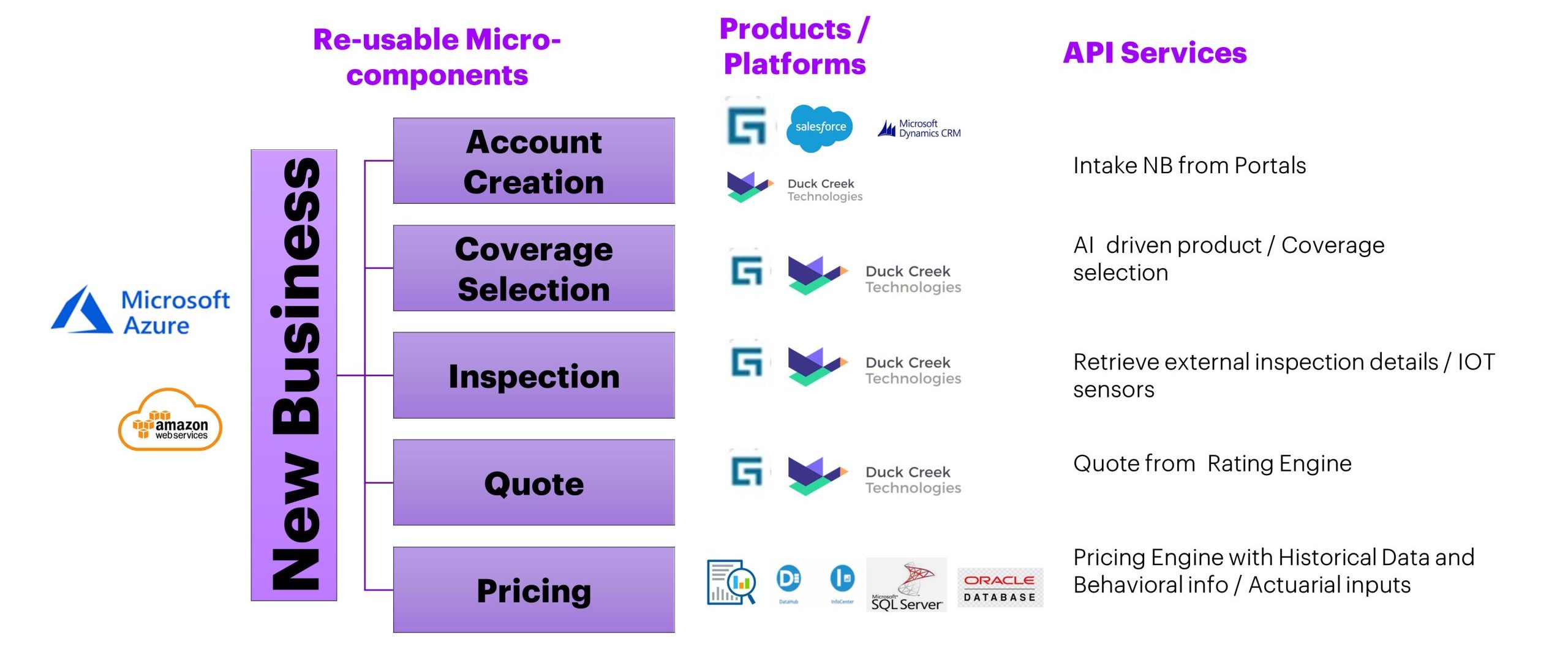

Lots of the providers for brand spanking new insurance coverage protection functions will be unbundled. This can allow insurers to consumption functions from digital portals and an AI-based product/protection choice engine. This could additionally assist them set up a pre-qualification engine based mostly on information from varied distributors like distance to coast, CLUE reporting, threat inspection utilizing IOT sensors (Surveillance Programs, Sensible Residence home equipment, Sensible Metering, and many others.), in addition to externalized ranking and pricing engines. This assists in distributing growth, integration, and testing efforts in addition to uptaking new enterprise coverage functions at a a lot quicker tempo. Breaking down processes into a number of sub-processes helps customers devour them at completely different factors of the coverage transaction timeline resembling when making a financial endorsement, or throughout renewals.

2. Billing administration – from guide to automated and customized invoicing

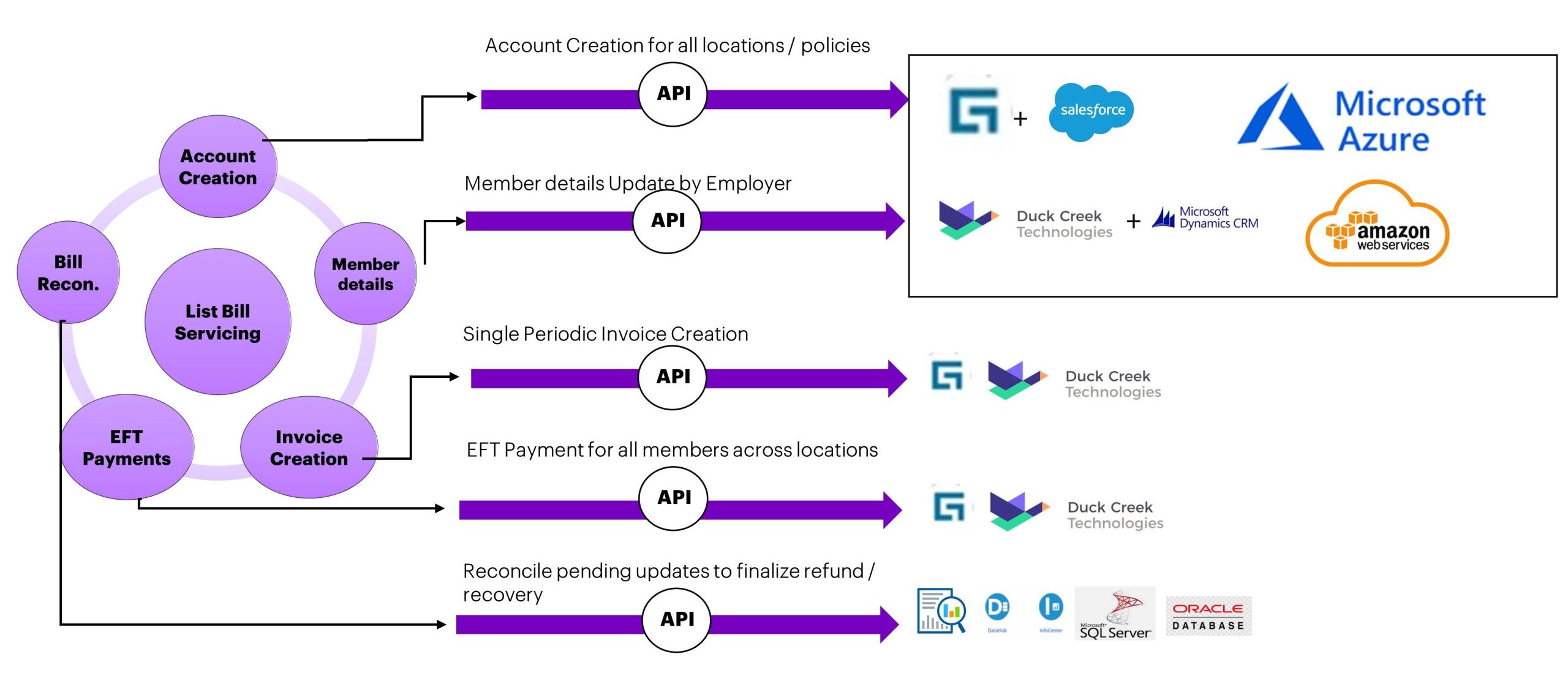

Within the case of billing administration, a listing invoice service breakdown can be utilized to assist construct re-usable features resembling account creation and member element updates. An bill is generated for transactions throughout a number of policyholders or brokers, at particular frequency and EFT funds are accomplished for various coverage members throughout areas. Restoration and refund transactions will be triggered based mostly on audit duties accomplished on the finish of the coverage 12 months. Many of those particular person providers are re-usable for normal audits for industrial strains as effectively.

3. Reworking claims with composability – from rigid to dynamic claims options

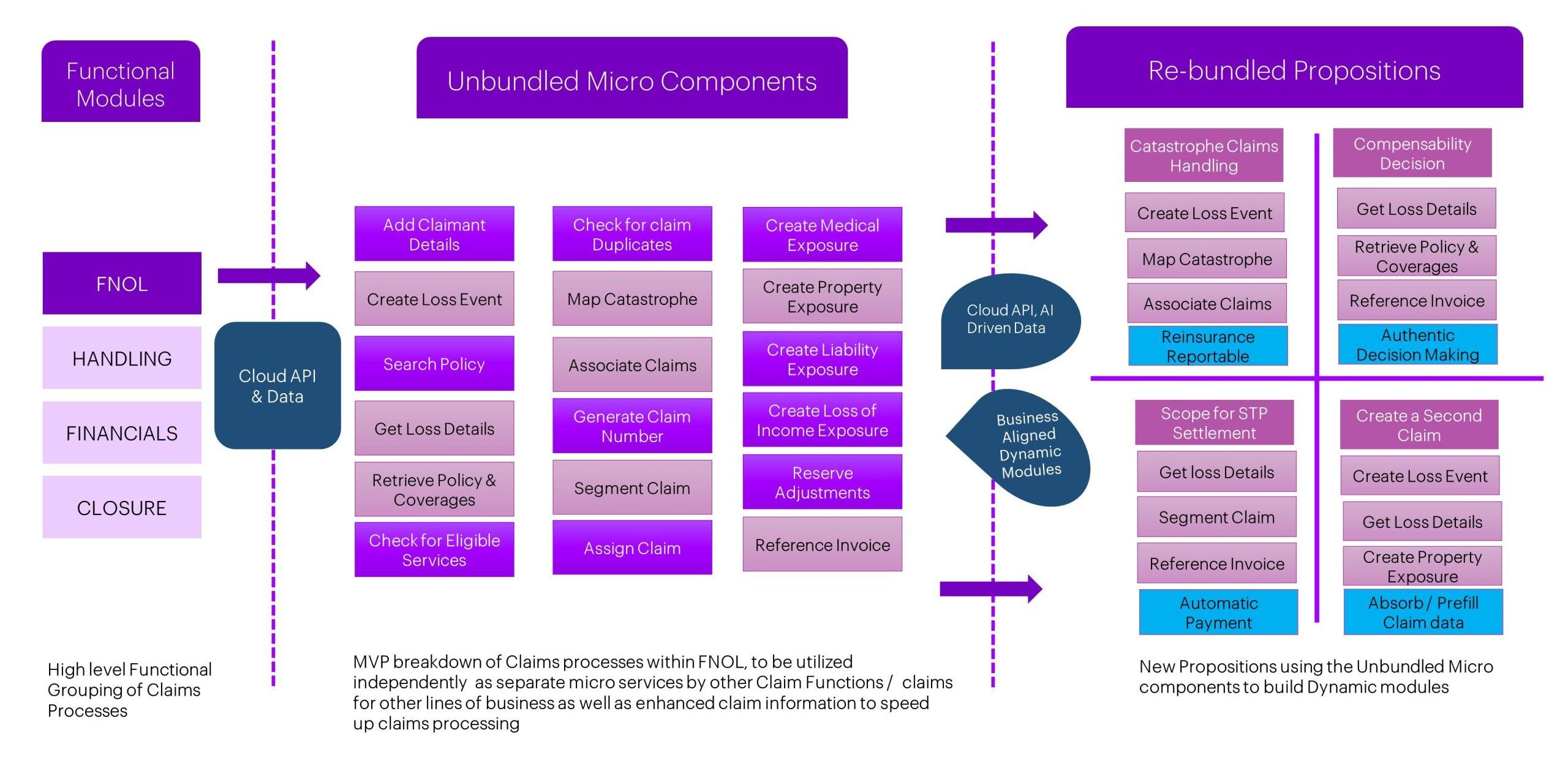

Claims processing has 4 excessive degree modules: First Discover of Loss (FNOL), Dealing with, Financials and Declare Closure. The FNOL course of has micro degree providers that may be unbundled as particular person software programming interface (API) providers to inside and exterior programs and listed as unbundled micro parts. In a composability enterprise mannequin, these unbundled parts will be rebundled to construct dynamic modules.

4. Straight-Via Processing (STP) in Claims – from time-intensive overview processes to API-led auto-approval

Straight-Via Processing (STP) claims check with excessive quantity, low worth claims which will be paid immediately with no detailed adjudication course of. On this case, completely different APIs are used for the next processes: ranging from a base of declare consumption; coverage search and retrieval; attaching a declare bill by pushing invoices which have car or declare quantity mechanically; verifying protection for the particular particulars within the bill; and seeing if the bill quantity is lower than the STP threshold (say $350) outlined by an insurance coverage firm. Based mostly on the result of all these API processes, declare funds will be auto authorized and the quantity is paid to the insured immediately. These will be utilized for car ‘glass solely’ claims, in addition to low-cost medical accidents.

5. Monolith simplification – from massive scale legacy infrastructure to a modular, agile method

In present conversations with purchasers, we’re recommending the simplification of monolith constructions for the efficient implementation of a composable structure. This refers back to the technique of incrementally dismantling the present infrastructure and rebuilding it in a manner that’s extra environment friendly. Monolith simplification helps to minimise threat when a shopper has an energetic monolith software which is supporting the enterprise and repeatedly present process enhancements.

As soon as we decide that composable design will be utilized, we method it in three phases – perceive the problem, consider the motion wanted, and implement the answer. Following this preliminary method, an additional element guidelines will be created to categorise monolith experiences.

Get in contact to find how it may be used to streamline and develop your insurance coverage enterprise for Whole Enterprise Reinvention.