It’s getting uncontrolled, and everyone seems to be annoyed by it. A liked one passes away, and inside days, the GoFundMe marketing campaign exhibits up in your Fb feed…

“Requesting Assist for Funeral – Joe had no Life Insurance coverage :(” It’s unhappy. It’s irritating. It’s awkward. And it pisses lots of people off!

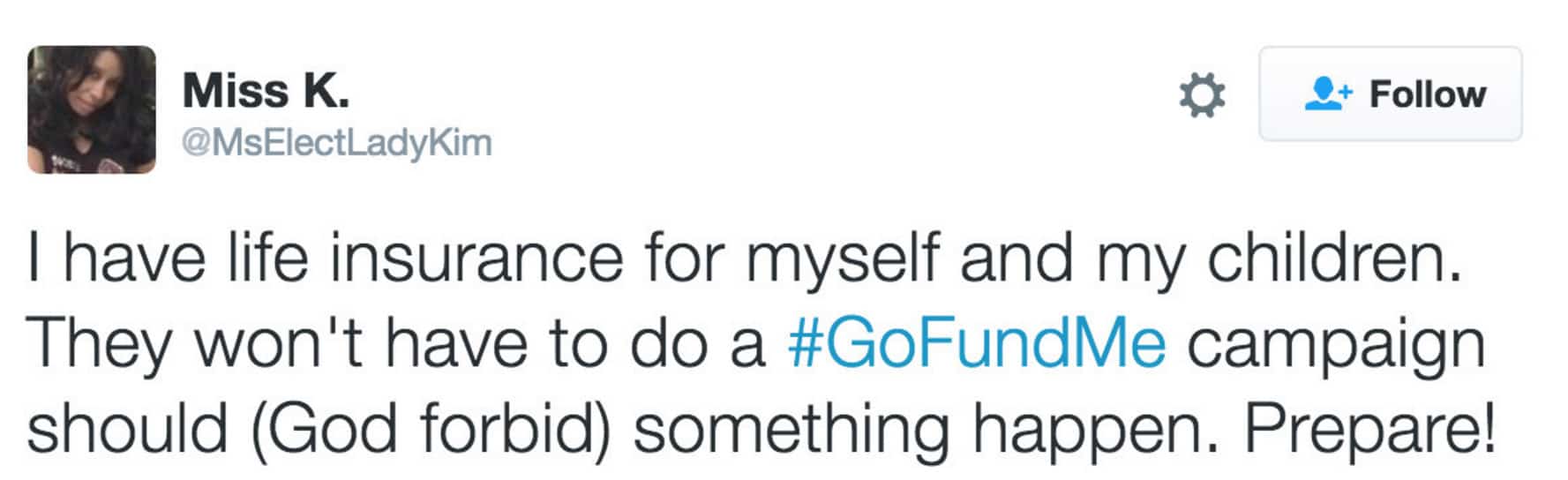

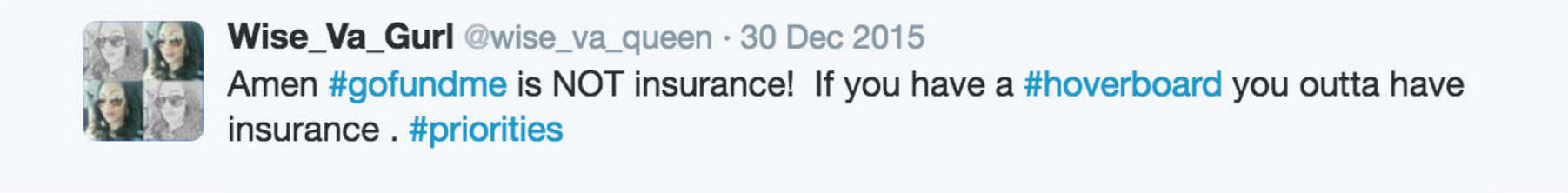

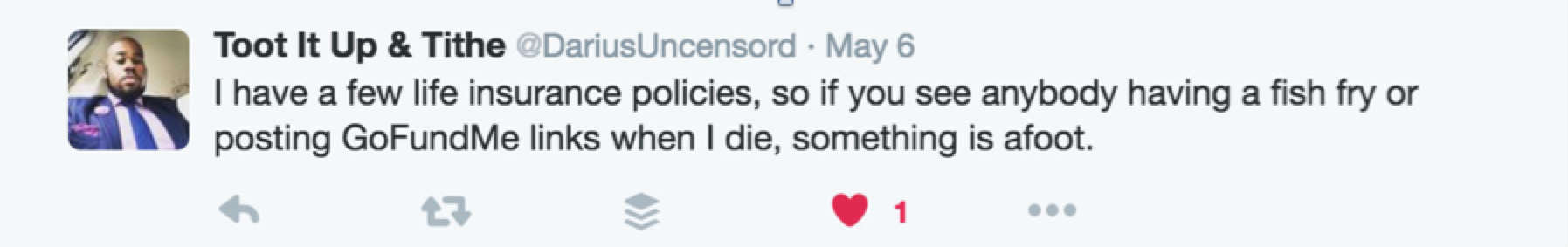

Check out what individuals are saying on Twitter:

Click on right here for extra tweets. A few of these are hilarious!

I say they’re proper! In the event you agree, discover out how one can assist finish these campaigns in 3 straightforward steps.

Welcome to the GoFundMe Insurance coverage Rebel!

The GoFundMe revolt is about powerful love.

It’s like telling your 32-year-old son with no job who received’t transfer out of your own home and sits round in your sofa taking part in video video games bare consuming Cheetos, that he has 3 months to both transfer out or begin paying lease. Guess what. He’ll get his ass off the sofa and begin on the lookout for a job!

… Robust love.

What occurs each time individuals see these campaigns get funded? They subconsciously resolve that planning for demise simply isn’t that necessary as a result of another person can bail my household out. And on goes the cycle.

Wish to assist cease GoFundMe life insurance coverage campaigns? Cease contributing to them.

Take the “Fund” out of “GoFundMe”, and we’ll finish the cycle.

RELATED: 5 Crucial Ideas You Should Know Earlier than Shopping for Life Insurance coverage

When You Ought to Name BS on a GoFundMe Marketing campaign (and once you shouldn’t)

Some GoFundMe campaigns have their place – you realize them once you see them. We’re not right here to cease campaigns elevating $20,000 for that surgical procedure that your medical health insurance didn’t cowl. We’re right here to struggle for this noble concept:

Go Fund Me Campaigns must be used for bills that accountable individuals by no means noticed coming.

May a accountable particular person presumably foresee and plan for an sudden demise? You guess.

So if Joe is a wholesome, 50-year-old and instantly dies of a coronary heart assault or will get hit by a automotive, whether or not he’s single with no dependents, or married with 3 youngsters…we shouldn’t see a GoFundMe marketing campaign.

Why? He was wholesome. Meaning he *may have* certified for life insurance coverage!

So if Joe was a middle-income American, he ought to’ve deliberate forward, and it shouldn’t be our burden to bail his household out as a result of he mismanaged his cash. However Joe’s “center revenue” instance brings up an excellent level.

What About Individuals Who Can’t Afford Life Insurance coverage?

“What if they honestly didn’t have the means to place any cash away or purchase life insurance coverage?” To begin with, I do know the place your coronary heart is with this assertion and I recognize that. However severely, have you learnt how a lot it prices for only a $100,000 time period coverage? In the event you’re below 50 and wholesome, usually below $20 bucks per thirty days!

You’ll must be the decide of the way you reply to the GoFundMe requests from low-income households.

In the event that they’re struggling simply to make ends meet and pay for the necessities – meals, clothes, housing, and so forth., then I can see sympathizing and serving to a household out who really couldn’t have “saved up” or purchased life insurance coverage to stop the necessity for a GoFundMe marketing campaign.

But when I can image Joe’s spouse writing the GoFundMe request on her iPad whereas sipping a White Chocolate Mocha at Starbucks, you be the decide of whether or not or not you need to contribute, however hell no, I’m not serving to!

RELATED: Verify Pattern Life Insurance coverage Charges by Age (No Private Information Required)

Enter your ZIP code under to view corporations which have low cost insurance coverage charges.

Secured with SHA-256 Encryption

Wish to Assist Finish Irresponsible GoFundMe Insurance coverage Requests?

We are able to finish these requests in 3 straightforward steps:

1. Make the Pledge – see under

2. Cease contributing to GoFundMe insurance coverage campaigns

3. Share the Rebel

As a substitute of GoFundMe, Purchase Life Insurance coverage

It begins with you. You’ve bought to get YOUR monetary geese in a row to guarantee YOUR household received’t be requesting crowdsourced funds on YOUR behalf. That might imply it’s good to spend a bit much less and save extra. That might imply it’s good to look into shopping for some life insurance coverage.

That might imply speaking to your family members about your needs upon your demise.

Make a pledge that no GoFundMe marketing campaign shall be used upon your demise, and share it on Fb, Twitter, Snapchat, and so forth.

“I vow that no GoFundMe marketing campaign shall be arrange upon my demise, nor will I set one up for my relations. #gofundmerebellion”

Listed below are a couple of fast shareable concepts:

GoFundMe will not be life insurance coverage! #gofundmerebellion

Two Fast Bulletins: 1) I’m not contributing to GOFUNDME campaigns 2) Life insurance coverage is tremendous low cost – Now go do the fitting factor! #gofundmerebellion

LIMRA, a life insurance coverage analysis affiliation, says that folks overestimate the price of life insurance coverage by over 3 occasions! It’s reasonably priced individuals. Don’t depend on GOFUNDME! #gofundmerebellion

Go Fund Me Campaigns must be used for bills that accountable individuals by no means noticed coming. #gofundmerebellion

Final Ideas on GoFundMe For Life Insurance coverage

So in the event you’re a middle-income American, please cease with the Go Fund Me requests. It makes your family and friends uncomfortable.

Nobody ought to have to consider the best way Joe mismanaged his cash and may have purchased life insurance coverage, however didn’t.

Enter your ZIP code under to view corporations which have low cost insurance coverage charges.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance coverage Agent

Jimmy McMillan is an entrepreneur and the founding father of HeartLifeInsurance.com, an impartial life insurance coverage brokerage. His firm makes a speciality of life insurance coverage for individuals with coronary heart issues. He is aware of personally how troublesome it’s to safe well being and life insurance coverage after a coronary heart assault.

Jimmy is a licensed insurance coverage agent from coast to coast who has been featured on ValientCEO and the podcast…

Licensed Life Insurance coverage Agent

Editorial Tips: We’re a free on-line useful resource for anybody desirous about studying extra about insurance coverage. Our objective is to be an goal, third-party useful resource for every little thing insurance coverage associated. We replace our website repeatedly, and all content material is reviewed by insurance coverage specialists.