Retirement is the most costly “buy” most American households will ever make, with a price ticket for a lot of coming in at over $1 million. With regards to constructing environment friendly portfolios for retirees, there are a selection of various issues and views amongst monetary advisors.

To raised perceive the advisor view, Prudential’s Advertising Insights & Analytics group fielded a survey of 13 questions amongst 198 monetary advisors in December 2023.

Our survey signifies monetary advisors, particularly those that observe experience in retirement earnings planning, are clearly and centered on constructing (and utilizing) portfolios particularly designed for retirees. These portfolios typically leverage totally different asset lessons than these utilized in extra accumulation-focused methods.

These outcomes typically counsel advisors more and more ought to concentrate on the frameworks that exist to develop environment friendly retirement earnings portfolios or associate with asset managers which have particular experience on this area.

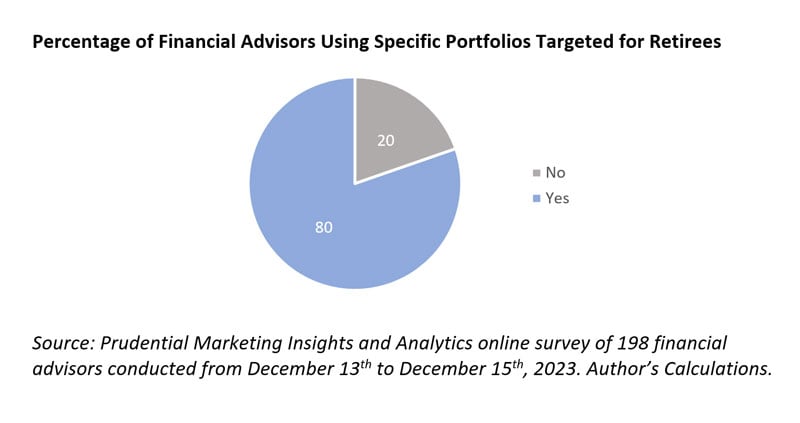

1. Monetary advisors use particular portfolios for retirees.

One survey query requested: “Do you construct, or use, a separate set of portfolios particularly focused in direction of retiree shoppers?” Eighty % of respondents stated sure.

Use of retiree-specific portfolios was greater amongst those that have been considerably or very educated about retirement earnings planning. In distinction, solely 58% of advisors who stated they weren’t very educated about retirement earnings planning used retiree-specific portfolios.

This means as experience in retirement earnings planning will increase, these numbers might additional improve.

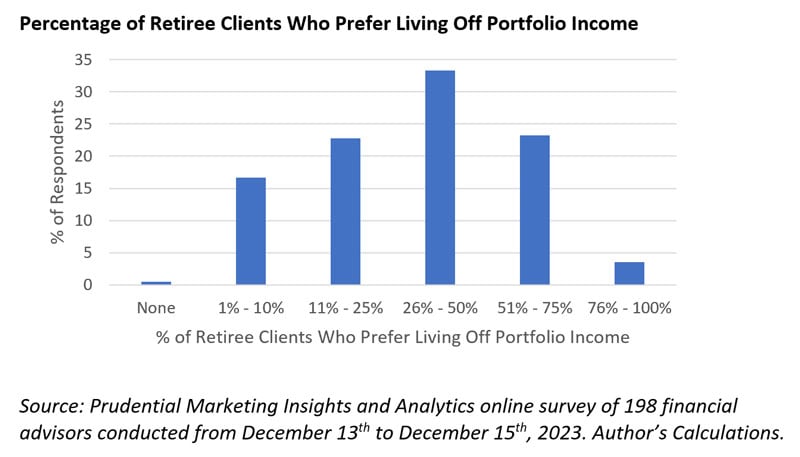

2. Retired shoppers choose to dwell off portfolio earnings.

One other query requested: “… Roughly what % of your retiree shoppers choose dwelling off portfolio earnings?” Whereas there may be clearly a variety of responses, general it seems about 50% of retiree shoppers choose to dwell off of earnings.

This means advisors have to be able to constructing portfolios which have an earnings focus. These portfolios will be very totally different than the extra conventional perspective utilizing imply variance optimization (MVO), which focuses on whole return (a mix of earnings return and value return).

3. Views on utilizing asset lessons in retirement portfolios range notably.

The query requested: “Ignoring danger tolerance, what function do you assume the next asset lessons ought to play in portfolios for retirees (versus non-retirees)?”

The graphic consists of the proportion of respondents who thought allocations needs to be considerably greater or a lot greater. Monetary advisor respondents have been most all in favour of allocation to long-term bonds, U.S. large-cap equities, and Treasury inflation-protected securities.