What You Must Know

- Labor analysts included a puzzling asset comparability desk within the remaining fiduciary customary replace packet.

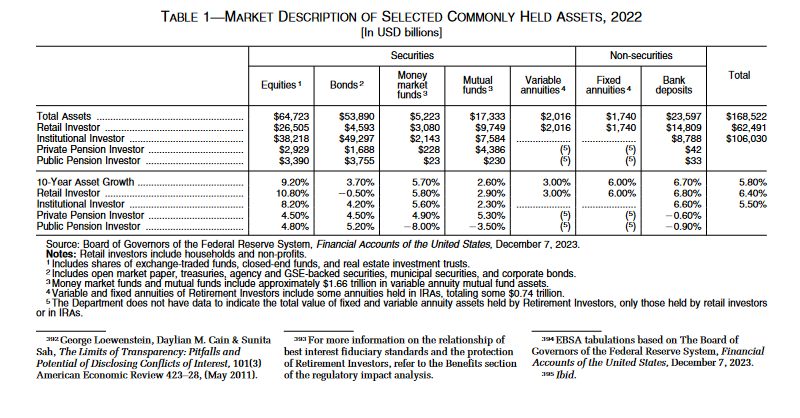

- The desk exhibits fastened annuity property rising twice as quick as mutual fund property.

- The numbers look unusual to some annuity professionals as a result of the analysts used Fed asset totals, not funding yield knowledge.

Labor Division regulation analysts not too long ago shocked the U.S. fastened annuity group.

The division set robust new retirement account rollover recommendation fiduciary customary necessities.

The division additionally reported that, as of 2022, 10-year asset progress had been 6% for fastened annuities, 3% for variable annuities and simply 2.9% for mutual funds.

Shares ranked first, with 10-year asset progress of 10.8%, however humble financial institution deposits ranked second, with 10-year progress of 6.8%.

Retail traders’ mutual fund property had a progress fee of two.9%, whereas bonds had a detrimental progress fee, a lower of 0.5%.

Credit score: U.S. Division of Labor’s funding recommendation fiduciary remaining rule packet.

Credit score: U.S. Division of Labor’s funding recommendation fiduciary remaining rule packet.Annuity professionals requested one another and ThinkAdvisor: How may fastened annuity property develop sooner than mutual fund property?

The reply: Labor Division analysts used completely different sorts of knowledge than retail funding advisors normally use when monitoring product efficiency.

Retail comparisons: Funding advisors who assist shoppers examine the efficiency of varied forms of investments typically present tables or charts that concentrate on how a lot the worth of a sure asset class has elevated or decreased as a result of market shifts.

For shares, they could use the S&P 500 inventory index or an analogous inventory index.

The DOL desk: Labor Division fiduciary regulation influence analysts included the retirement asset snapshot desk to present customers a tough thought of what sorts of property retail traders are utilizing and the way the asset totals are altering.

As a substitute of utilizing the sorts of funding index figures that usually present up in information reviews or funding advisor shows, the division analysts pulled knowledge from the Federal Reserve System’s Monetary Accounts of america reviews.

The Fed publishes the monetary accounts reviews, that are often known as the Z.1 reviews, each three months. The version the Labor Division influence analysts used was printed Dec. 7.