A rally that’s pushed U.S. shares to a brand new document this yr will stall if firm earnings disappoint, based on two of Wall Avenue’s most bearish strategists.

Morgan Stanley and JPMorgan Chase & Co. are rising involved because the outlook for earnings has been weakening even because the S&P 500 reaches contemporary highs. Fairness positive aspects over the previous 5 months have been pushed by simpler monetary situations and better valuations reasonably than enhancing fundamentals, based on Morgan Stanley’s Michael Wilson.

“Additional a number of enlargement within the U.S. is probably going depending on an upward inflection in earnings expectations,” a staff led by Wilson wrote in a notice. “It’s onerous to justify the upper index-level valuations primarily based on fundamentals alone, on condition that 2024 and 2025 earnings forecasts have barely budged over this time interval.”

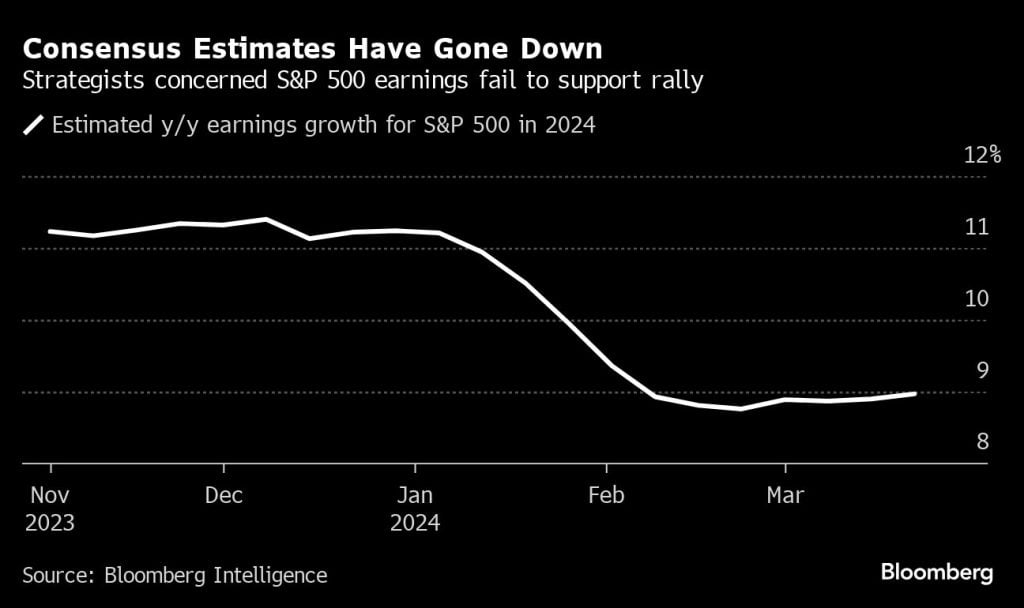

Based on information compiled by Bloomberg Intelligence, consensus earnings estimates have been revised decrease over the previous 5 months, with analysts at the moment anticipating earnings-per-share to develop about 9% this yr versus 11% initially of November. However whereas revenue estimates have been falling, U.S. shares have continued to rally amid optimism about potential charge cuts and developments in synthetic intelligence, with a stronger-than-expected fourth-quarter outcomes season additionally serving to.

“Our concern is that revenue progress may underwhelm, for numerous causes,” a staff led by Matejka wrote in a notice. “If the earnings acceleration fails to materialize, this might act as a constraint.”